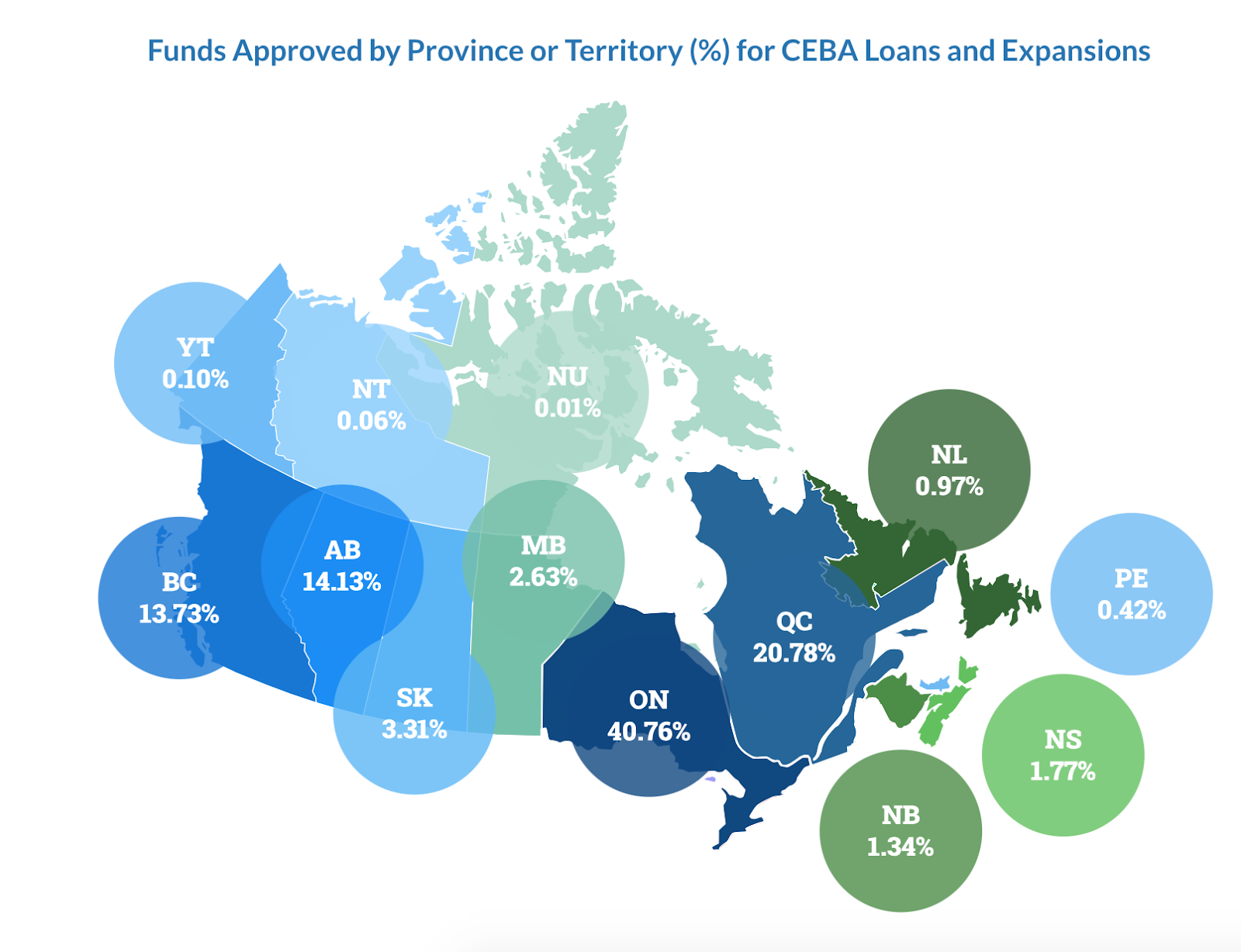

Many Canadian businesses needed a little help during the pandemic, and nearly $50 billion of assistance was provided across the country via the Canada Emergency Business Account (CEBA) program. Businesses that benefitted from funding via this program are now facing the task of repayment – and the government has once again updated their deadlines. So here’s what you need to know if you were a CEBA recipient:

A Quick Refresher on CEBA

CEBA enabled over 200 financial institutions across the country to offer up to $60,000 in interest free loans to small businesses and non-profits. The initial loan amount had a maximum of $40,000, and eligible loan holders were later offered a $20,000 loan expansion. Applications to the program ended in June 2021.

The program always included the stipulation that certain CEBA borrowers could receive partial loan forgiveness if they repaid their loan funds by a certain date, but the government has repeatedly extended this repayment deadline. It now stands at January 18th 2024, or March 28th 2024 for those pursuing refinancing.

Source: Government of Canada, 2022

Loan Forgiveness Terms

For qualifying borrowers, partial loan forgiveness can amount to up to 33% of the total amount borrowed. It’s calculated as:

- 25% of the initial borrowed amount (so if you borrowed $40,000 in the first wave of CEBA, $10,000 would be forgiven)

- Plus 50% of the remaining funds if you accessed CEBA expansion funds (so if you borrowed a further $20,000, another $10,000 would be forgiven)

This means a business that borrowed $60,000 via the program can have $20,000 waived if they meet the repayment terms (the waived amount is then counted as taxable income). As this is such a significant amount, many businesses have been scrambling to meet the repayment deadline in order to lessen their overall debt load.

Source: Government of Canada, 2022

The Impending CEBA Repayment Deadline

There are three scenarios that businesses can face when January 18th hits, each with different financial implications:

Scenario 1: CEBA Loan Repayment Completed by January 18th

If your business has repaid its CEBA loan (minus the amount covered by the potential debt forgiveness) by January 18th 2024, it will qualify for the partial loan forgiveness, and will in addition have paid zero interest on the funds that were borrowed. This is the ideal scenario.

Scenario 2: Refinancing Application Submitted by January 18th

Some businesses, aware of the January deadline but unable to repay their funds by then, will apply for refinancing of their CEBA loan with the financial institution that granted it. As refinancing applications take some time to process, there is a grace period of a few months to prevent those pursuing this route from being too heavily penalized.

The application for refinancing must be submitted by January 18th 2024; interest on the borrowed funds will then start to accrue at a rate of 5% per annum from January 19th. Interest is charged on the entirety of the borrowed amount. However, partial loan forgiveness is still an option, as long as the loan funds (minus the amount covered under the forgiveness clause) are repaid to CEBA by March 28th 2024. The interest that has accrued over these few months must also be paid by this date.

Scenario 3: CEBA Loan Deadlines in January and March Missed

The third scenario is that a business does not repay its CEBA loan or apply to refinance it by January 18th. In this case, the opportunity for partial loan forgiveness is totally lost, and the entirety of the CEBA funds must be repaid in full. The initial interest-free terms convert on January 19th 2024 to a three year non-amortizing loan with 5% interest, and the repayment deadline for all of the funds and interest becomes December 31st 2026.

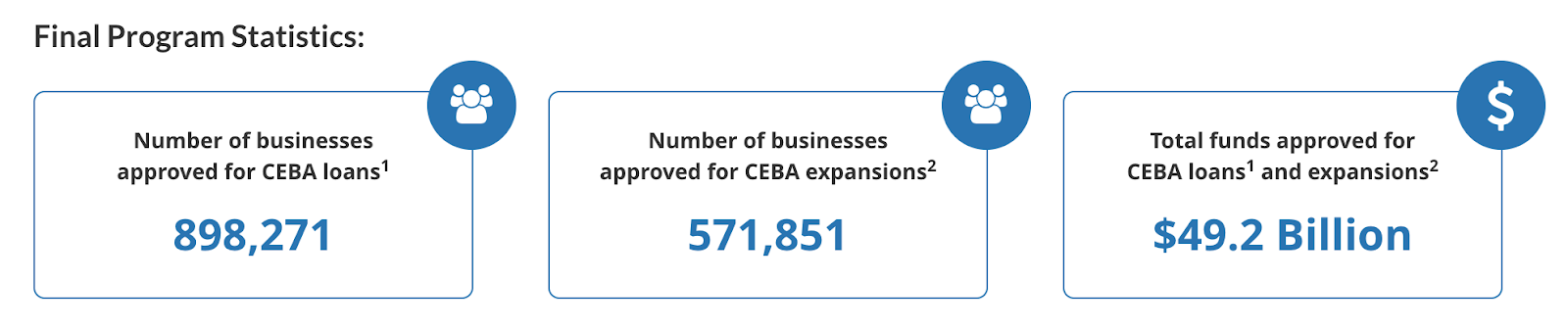

Comparing the Cost of Each Scenario

As of May 2023, only 21% of businesses that received CEBA funds had fully repaid them; the low rate of repayment is in fact one of the reasons the government has extended the repayment deadline again. As tough economic times persist, many of the affected businesses simply do not have the capital on hand to repay their loans in full by this January; as such, refinancing is by far the more viable and affordable option.

Let’s look at an example to illustrate, based on the maximum amount of borrowing available under CEBA:

| Scenario 1 | Scenario 2 | Scenario 3 | |

| Amount Borrowed | $60,000 | $60,000 | $60,000 |

| CEBA Repayment Deadline | January 18th 2024 | March 28th 2024 | December 31st 2026 |

| Interest Charged | 0% | 5% from Jan 19 2024 to Mar 28 2024Interest from Mar 28 onwards dependent on refinancing agreement | 5% from Jan 19 2024 to Dec 31 2026 |

| Loan Forgiveness Amount | $20,000 | $20,000 | $0 |

| Total Amount Repaid | $40,000 | $47,000* | $69,000 |

*Based on transferring CEBA balance on Mar 28 2024 to a standard small business loan with an average interest rate of 6.5% and a five year term.

Of course, the overall cost of refinancing your CEBA loan will depend heavily on the type of instrument you use to refinance it; different debt products have different interest rates and terms. But almost every business financing option will be cheaper than losing $20,000 in loan forgiveness.

Refinancing Can Save You Thousands

Thousands of businesses could lose thousands of dollars in loan forgiveness if they don’t either repay or restructure their debt by January 18th. Don’t be caught out; to find out more about possible refinancing options, read our article on “Alternative Financing Solutions for Small Businesses” or take a look at our “Ultimate Guide to Business Funding”. And connect with one of BizFund’s experts for specialized help.