Business Financing in Canada: How to Fund Your Business with a Merchant Cash Advance

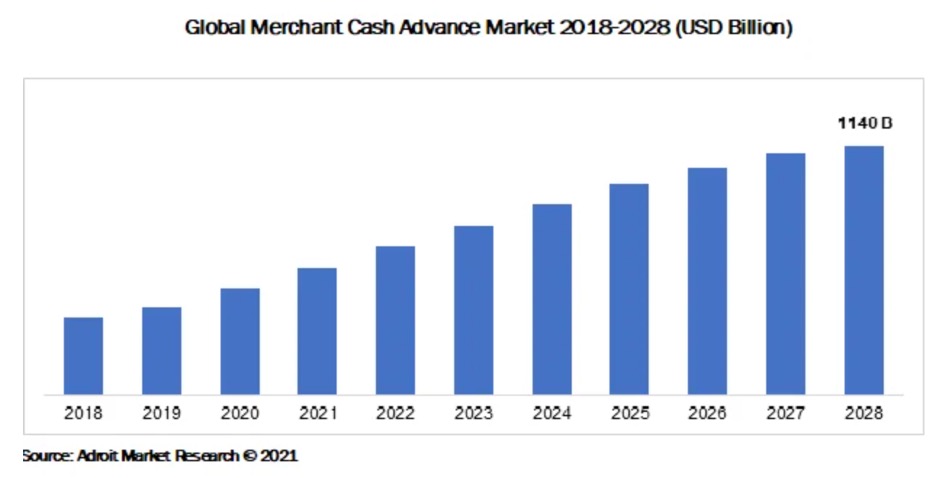

Canada is home to over 1.3 million businesses, two thirds of which are small. It should be no surprise then that there are a multitude of financing options for small businesses. But not every solution will fit every company; here we're going to take an in-depth look at funding options for small businesses, focusing specifically on merchant cash advances and how they compare to other options. With this information, you will be able to make an informed decision about the right financing solution for your business.

What is a Merchant Cash Advance?

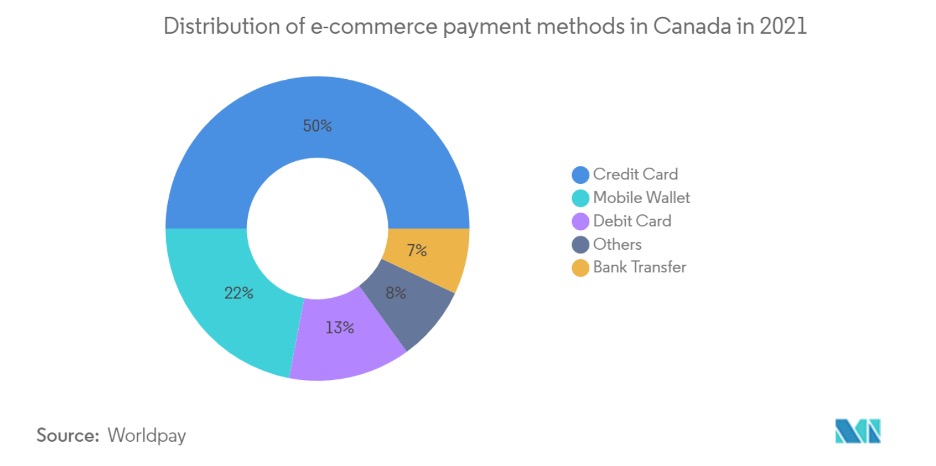

A merchant cash advance (MCA) is technically not a loan; rather it is a cash advance based on a business's anticipated future sales. In this respect, MCAs work best for businesses with a known income stream, received directly from consumers.

How Does a Merchant Cash Advance Work?

Merchant cash advances are actually much simpler than some other types of business financing. Here's how they work: let's say you are a small business owner and need some extra funds - for whatever reason. The process goes as follows:

Step 1. Choose Your Financing

As a small business owner, you have several business funding options. But crucially, you expect to be paid for your goods or services from your customers, via credit card transactions, over the next few months. You intend to keep running your business as normal and making sales, you just need some extra cash now. This puts you in the ideal situation for a merchant cash advance.

Step 2. Apply and Receive Funds

Now you are in a position to consider different merchant cash advance providers and find one that works for you. We go into this in more detail below, but for now let's just say you have found a good lender and have completed the application process.

The lender will look at your expected revenue from future sales, and calculate how much they are willing to advance you (advance amount), what percentage fee they will charge (factor rate) based on their perception of risk, and over what time period you need to repay the money (repayment period). Once this has been agreed and your application approved, your business receives its cash advance very quickly via direct deposit of a lump sum into your business bank account

Step 3. Repayment

Repayments are then automatically deducted from your daily, weekly or monthly credit card sales. This is done in concert between your lender and your credit card processor, meaning you do not have to do any calculations or manage repayments yourself. They happen automatically every time you receive a card payment. The repayment amount is calculated as a fixed percentage of sales, rather than as a set sum, so how quickly you pay off the advance depends on how many sales you make.

Step 4. Repeat

Once your cash advance has been paid off in full, the slate is wiped clean, and you are able to borrow more money via a merchant cash advance again in the future - either from the same lender or a different one. One benefit of using the same lender time and again is that as they get to know your business, the amount of funding you qualify for will grow, and you'll pay a cheaper percentage. The application process also becomes easier over time.

Key Terminology

When looking at any merchant cash advance option, you'll see the following common phrases:

Holdback

The holdback is the amount held back from each credit card transaction in order to repay the advance. This is calculated via an agreed upon percentage, rather than a fixed dollar sum. Holdbacks will automatically happen until the advance is paid back in full.

The holdback amount depends on how much your advance was, how long you have to repay the advance, and how much your receivables are. Typical holdback rates range from 10%-20%. So, if you receive a card payment of $100 and your holdback rate is 10%, $10 will automatically go to your lender and $90 to you.

Repayment Amount

The repayment amount is the total amount you need to repay the lender. This is effectively the sum of all of the holdback amounts over the life of the agreement.

Factor Rate

Merchant cash advances do not have interest rates in the way that other forms of funding do. Instead, a merchant cash advance has a fixed fee, calculated as a percentage of the amount borrowed. This fee is expressed as a factor rate. So, for example, a business may agree to pay a fee of $0.20 for every $1.00 borrowed. This equates to a factor rate of 1.2.

How Much Does a Merchant Cash Advance Cost?

As mentioned above, merchant cash advances are a little different from other types of business financing, so it's worth understanding how they are priced and how this compares to other funding options.

Interest Rate vs. Factor Rate

As a business owner, when you compare different loans, you'll primarily be comparing interest rates. You'll also need to take into account loan fees, and then calculate how much each loan will set you back over the life of the loan. The longer you take to repay, the more you'll pay in interest, as interest compounds.

But with a merchant cash advance, the fee for your funding is instead expressed as a factor rate, which is a percentage calculated at the start of the financing agreement, and remains fixed. The amount you pay for your financing does not change or compound, no matter how long your repayment takes.

Factor rates are generally somewhere between 1.07 and 1.35, depending on the size and stability of the business, the volume and value of transactions, and other lender-specific factors.

Merchant Cash Advance Calculator

To understand the price of a merchant cash advance, you simply need to multiply the amount you borrow by the factor rate.

For example, if you were to borrow $10,000 at a factor rate of 1.20, you would be required to repay: $10,000 x 1.2 = $12,000.

Merchant cash advances do not have any other fees to account for.

How Do I Obtain a Merchant Cash Advance?

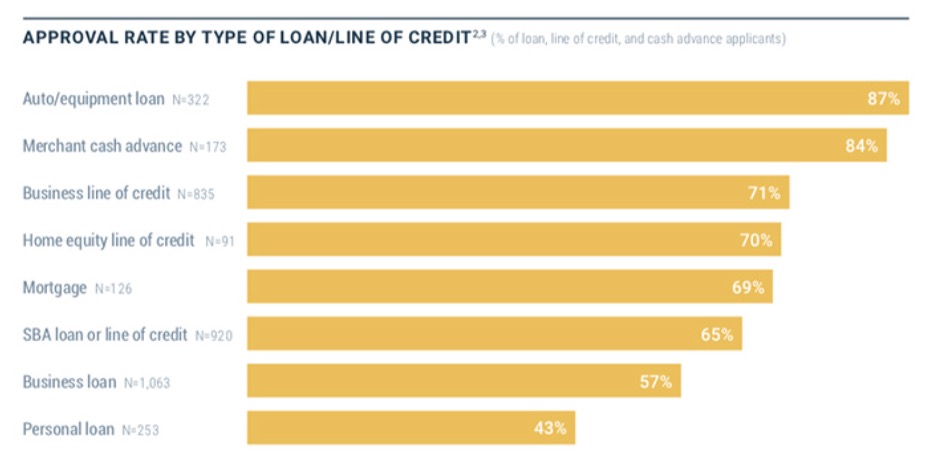

Only 22% of small business loan applications to banks are approved, and the average bank loan application requires 32 articles of information. These are just two of the reasons small businesses choose to apply for a merchant cash advance rather than a traditional loan - they are both easier to qualify for and easier to apply for. That doesn't mean that every business is eligible though!

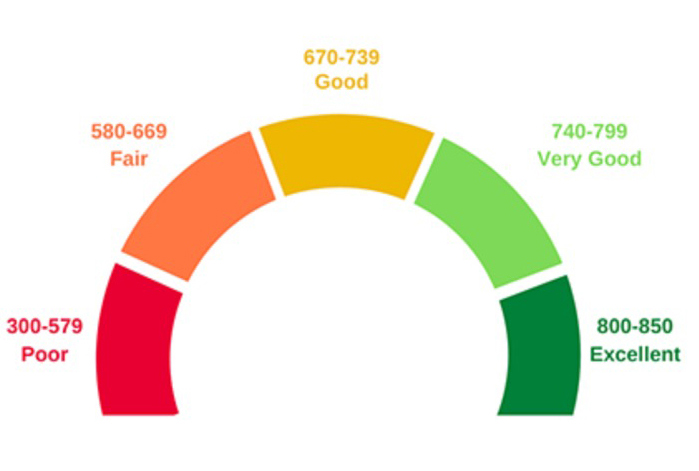

Credit Requirements

There are no strict credit score requirements with merchant cash advances, as approval is usually based on expected revenue from future sales. This means those with bad credit scores are more likely to obtain business funding with an MCA than with other financing types. However, as MCAs are unsecured, there are some instances where a lender may want to do a credit check, and low credit scores or serious issues with other lenders may impact approval.

It's important to note that an MCA does not help a small business build a credit profile, as technically it's not a loan, and repayments are not reported to credit bureaus. It can therefore not be used as an instrument for credit growth.

Paperwork Requirements

To be eligible for a merchant cash advance, you need to be able to provide:

- Photo ID

- Business number

- Proof of business's Canadian residence

- Business bank account details

- Several months of credit card receipts for the business

- Several months of bank statements and/or financial records (e.g. cash flow, tax returns, balance sheet) for the business

- A completed application form

The more information you provide, the better your chances of approval, and the more accurate your financing offer will be.

Other Requirements

In some cases, and depending on which lender you choose, you may also need to switch credit card processor.

Pros and Cons of Merchant Cash Advances

Pros

Pros

- Quick to obtain

- Flexible

- Scalable

- No collateral needed

- Credit history irrelevant

- No fees

- Simple repayment

Cons

Cons

- Can be more expensive than other loan types

- Relies on credit card payments only

- Some terminal types may not be covered

- Limited borrowing amounts

- Does not build credit

- Repayment amounts vary, making budgeting harder

How Do I Pick the Right Merchant Cash Advance?

There are a growing number of merchant cash advance providers in Canada; to find one that suits your business's needs, consider the following factors:

- Cost. Merchant cash advances are easier to compare than loans, because there is only one price - the factor rate. There are no hidden fees or application fees. But different lenders may offer different factor rates, making some options cheaper than others.

- Eligibility requirements. Merchant cash advance lenders can have varying requirements; for example, some may require 12 months of bank statements and cash flow information, while others may only need 6 months of bank statements. Some may require a certain volume in sales. Only complete the application process for a lender whose eligibility requirements you know you can meet.

- Borrowing amount. Different lenders may have different borrowing limits, so make sure you are looking at those which can provide the cash advance you need.

- Repayment period. Different lenders may offer different repayment periods; find one that works for your needs based on your expected credit card sales over the borrowing period.

There are enough options out there for most small business owners to find approval for a merchant cash advance.

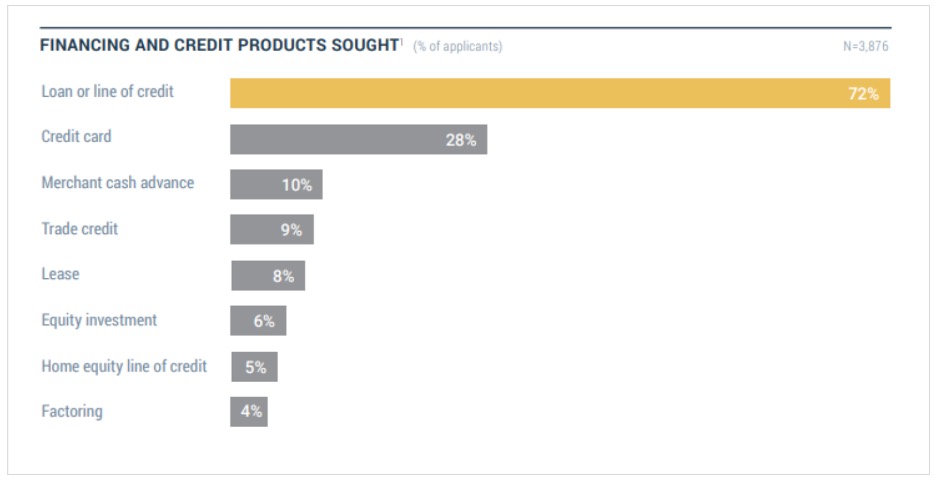

What Other Types of Business Financing Are Available?

Merchant cash advances are not right for every situation. If your business is primarily paid in cash, cheque or bank transfer, it will not qualify for one. Similarly, businesses without bank statements, or new businesses without credit card receipts to show, won't qualify.

Luckily there are alternative forms of business financing, including:

Business Cash Advance

A business cash advance is just like a merchant cash advance, with one crucial difference: any form of incoming payment is considered, not just payments made at a credit card terminal. As such, a business cash advance is an option for businesses that receive payments via cash, cheque, bank transfer, and so on. Basically all the other characteristics of a business cash advance are the same as with a merchant cash advance.

Small Business Loan

A small business loan is a traditional loan made to a business by a bank or other financial institution for a fixed period of time, repayable at a specific interest rate and subject to fees and other loan terms. With a small business loan you can receive larger amounts of money upfront than with a cash advance, but you will have to provide far more information and meet stricter requirements to qualify for the loan, and there is less flexibility overall.

Business Credit Card

A more flexible form of business borrowing comes via business credit cards; business credit cards often have much higher credit limits than personal credit cards, and can allow businesses to quickly access flexible amounts of cash as and when needed. However, interest rates on credit card balances can become very expensive over time, so this option is best for those who expect to be able to pay off their business card quickly.

Business Line of Credit

A business line of credit works in a similar fashion to a credit card, with a set credit limit that allows a business to borrow flexible amounts of money, over time and as needed. A line of credit is more structured than a credit card, and can be cheaper as a result. Many banks offer them.

Secured and Unsecured

Loans, credit cards and lines of credit can all either be secured or unsecured. Secured means that the borrower uses an asset (inventory, equipment, property) as collateral against their funds, to reduce the risk to the lender and thereby lower the interest rate on the loan. In the event of a default, the lender can seize the asset used as collateral in lieu of payment.

Using security makes borrowing cheaper as it lowers the lender's risk, but this is not an option with MCAs. So if your business has assets and is considering different funding options, be aware that you may be able to get cheaper funds with a traditional loan.

Choosing the Best Financing Option for You

With all of the information we've talked about so far, you may be left wondering: how can I know which financing option is best for my business? There are a few questions you can ask yourself to narrow down your options and find the right solution:

1. What are the conditions of my business? This includes information such as: how long has it been operating, does it hold any assets, does it have a good credit score, what does its cash flow look like, and how does it accept payment from customers? These factors will affect what forms of funding your business qualifies for.

2. How much do I need to borrow? The amount you need will steer you towards a financing type, as a merchant cash advance or credit card is better for small amounts, while a business loan or line of credit are better for large amounts.

3. How much can I afford to pay? The cost of your borrowing, whether in fees, interest or by a factor rate, should be a key determinant in what type of financing you choose. Only consider options you can afford.

4. How quickly do I need the money? Loans take longer to get, while MCAs are fast. The urgency of your situation will have a big impact on what's realistic.

5. How much and what type of flexibility do I need? If you need to borrow a flexible amount of money, a credit card or line of credit is best for you. If you need to borrow a set amount, but need flexibility in how long you take to repay, a merchant cash advance is the best bet.

FAQ

What credit score do I need for a business loan?

Getting a loan with bad credit can be tricky; most banks will require a score of 650 or above for loan approval. Fortunately, funding from banks is not the only option; it is easier to get approval for funding based on expected future sales transactions via a cash advance, even if you have bad credit.

What is the best type of funding for a business?

The best type of funding for a company depends on that company's needs and situation; how much funding they need, how much they make in sales, what percentage of their revenue comes via card payments, whether there is a history of bad credit, and so on. The risk and benefit of each type of funding means that each business owner must assess their options individually to find the funding that they can reasonably apply for and be approved for, and that meets their unique needs.

Can I apply for a merchant cash advance online?

Yes; as long as you have the relevant paperwork (including bank account information, company information, data on sales via card payments, and so on) you can apply for, be approved and receive your funds via a lump sum, all totally online.

Do I need a business bank account to get a merchant cash advance?

Yes. A bank account is necessary to apply for and be approved for a merchant cash advance.

What can I use a merchant cash advance for?

Almost any legitimate business expense. This can include employee pay, payments to suppliers, buying new equipment or repairing old equipment, growth-related expenses, capital expenditures, and so on.

How much money can I borrow with a merchant cash advance?

This depends on how much you take in credit card sales, your working capital, and what the lender thinks you can reasonably afford. Most lenders have a lending limit of 1-2 times monthly card receipts.

Who can benefit from a merchant cash advance?

Merchant cash advances are a good source of funding for businesses that: need cash fast, process a lot of debit and credit card transactions, need a small amount of funding only, have limited credit history or low credit score, or have no collateral.

How do I repay a merchant cash advance?

Repayment of your merchant cash advance is calculated as a percentage of sales transactions completed by card payments, and is automatically deducted at time of sale by your credit card processor. This means the amount you repay fluctuates to match your card payment income. The flexibility of repaying as a percentage can work particularly well for businesses with variable or seasonal income.

How much should I pay for a merchant cash advance?

The percentage fee for a merchant cash advance is set at the start of agreement and depends on the lender's assessment of your income and ability to repay the advance. This percentage fee may be higher than the interest rate on a standard business loan, and will not change even if your business grows stronger over time.

How quickly can I get a merchant cash advance?

Very quickly; cash advance applications can be completed in a few minutes, and approval usually comes through within a few days.