Securing a Loan in the Restaurant Business

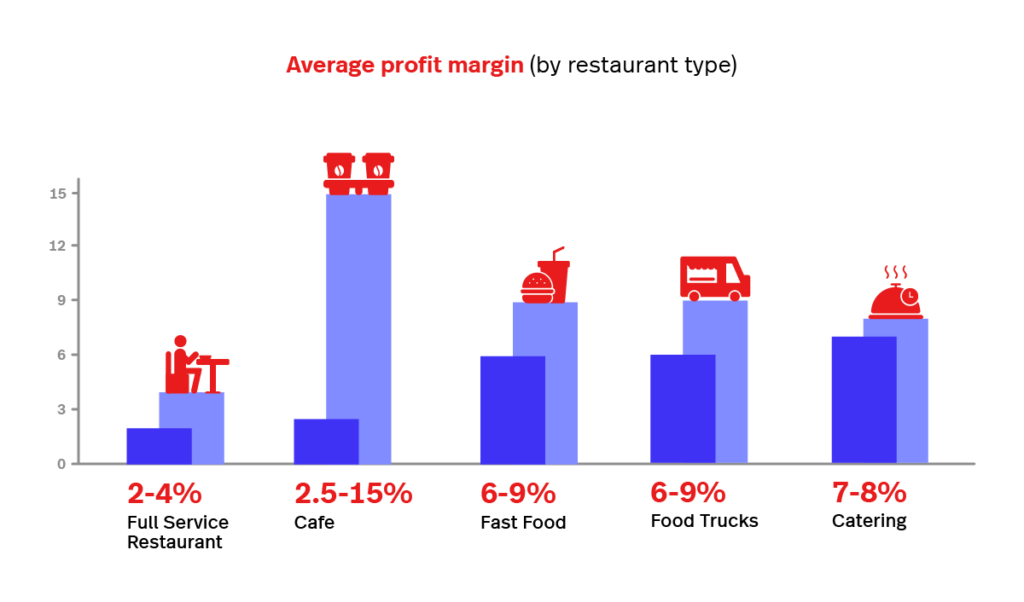

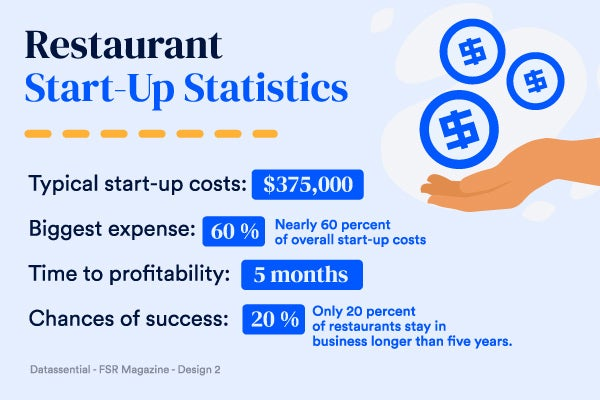

Obtaining financing can be a daunting task for many restaurant owners. The restaurant industry is known for its unique challenges, including high start-up costs, thin profit margins, and fluctuating cash flow. This makes it crucial for any business owner to utilize small business loans and other financing options that are available to them. For owners, access to financing is essential for several reasons. Firstly, it helps cover the high costs associated with starting or running a restaurant business, such as equipment purchases, lease payments, and payroll. Additionally, restaurant financing can help maintain cash flow, ensuring that the restaurant can operate smoothly even during slower periods.

Similar to obtaining financing for a retail store, in order for a restaurant owner to make advantageous decisions about their business, it is crucial to compare the interest rates, terms, and fees of the small business loan. This allows many business owners to find the loan that best suits their needs and helps them achieve their goals.

Before Restaurant Owners Apply for Financing

Before applying for financing, you must assess your restaurant business and its financial health. This involves analyzing your cash flow, profitability, and overall financial stability to determine how much financing you require and what type of loan or credit best suits your needs.

Gathering the necessary documents is an important step in preparing to apply for restaurant funding. This includes financial statements, tax returns, business proposals, and any other documentation that lenders may require to assess your creditworthiness. Understanding your credit score is also important, as it can impact and/or limit the financing options available to you.

Your credit score reflects your creditworthiness and is used by lenders to determine your eligibility for loans and the interest rates you may qualify for. A higher credit score generally indicates lower risk to lenders, which can result in better loan terms and lower interest rates.

Preparing thoroughly before applying for financing, improves your chances of securing the funding you need for your restaurant business.

Reasons Restaurants Apply for Financing

Restaurants often seek financing to support various aspects of their business, including expansion costs, equipment upgrades, increased labor force, and necessary working capital. These reasons highlight the importance of securing adequate funding to ensure the success and growth of a business.

Expansion and Growth Opportunities:

Securing financing from a bank or credit union can enable restaurants to expand their operations, whether opening new locations, renovating existing ones, or entering new markets. This expansion can lead to increased revenue and profitability, making it a key reason for seeking financing.

Equipment Purchases and Upgrades:

Restaurant equipment is essential for daily operations, and financing can help cover the costs of purchasing or upgrading equipment. This includes kitchen appliances, furniture, and technology systems that improve efficiency and reach more demographics. If any of your appliances are not in good working order, an equipment loan may be a good option.

Working Capital and Cash Flow Management:

Maintaining adequate working capital is key for restaurants to cover day-to-day expenses such as payroll, inventory, and utilities. Financing can provide the necessary restaurant funding to manage cash flow effectively and ensure the restaurant operates smoothly.

Marketing and Promotions:

Effective marketing is essential for enticing and retaining customers. Financing can be used to launch marketing campaigns, offer promotions, or revamp the restaurant’s branding to stay competitive in the market.

Menu Expansion and Innovation:

Introducing new menu items or revamping existing ones can gain new customers and keep regulars coming back. Loans can cover the costs of menu development, ingredients, and staff training.

Technology Integration:

Adopting technology, such as online ordering systems or point-of-sale (POS) systems, can improve operational efficiency and enhance the customer experience. A business loan can help cover the costs of implementing these technologies.

Regulatory Compliance:

Staying compliant with regulations, such as health and safety standards or licensing requirements, is essential for running a restaurant. Compliance-related expenses can be covered by funding.

Emergency Fund:

Having access to financing provides a safety net for unexpected emergencies, such as equipment breakdowns or natural disasters, ensuring that the restaurant can continue operating without major disruptions.

Financing plays a crucial role in the success and growth of restaurants, enabling them to seize opportunities, invest in essential upgrades, and manage day-to-day operations effectively.

Restaurant Financing Options

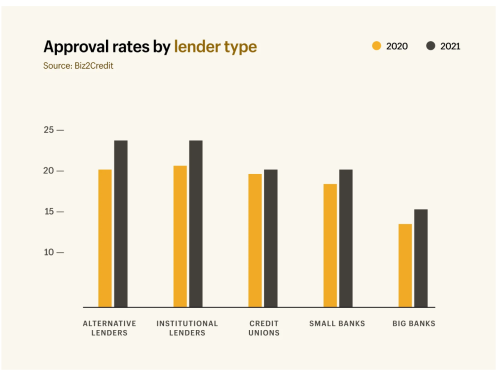

When considering financing for your restaurant in Canada, there are various options, including bank loans and alternative lenders. Each avenue offers unique benefits and considerations, underscoring the importance of understanding their specifics before committing. If you need help deciding which one is best for you, this is a great resource to begin.

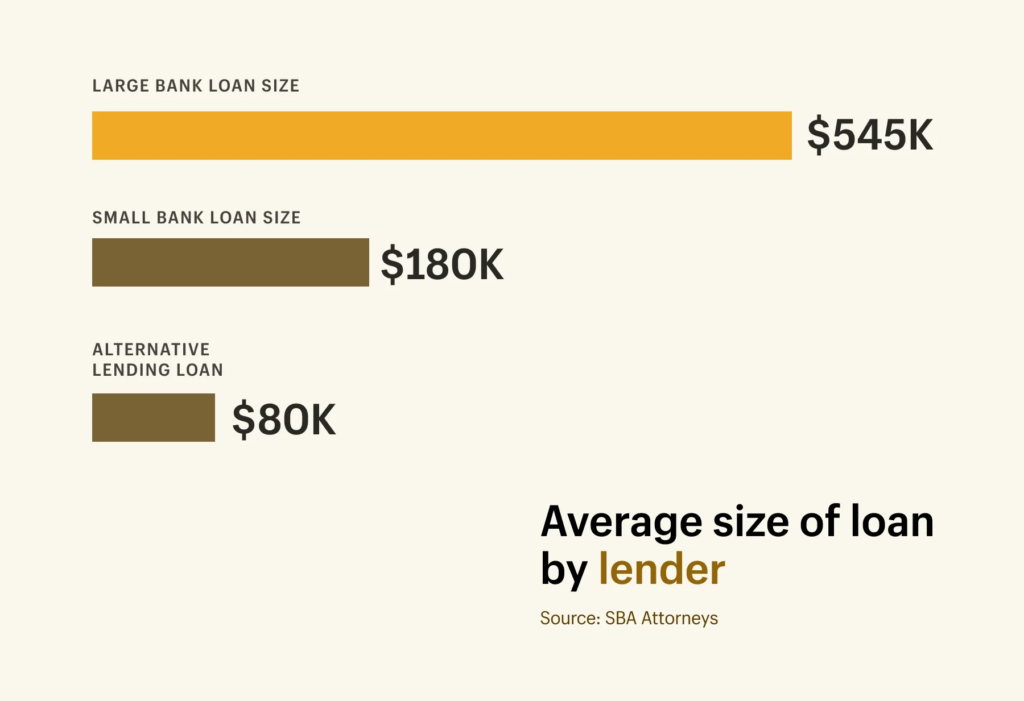

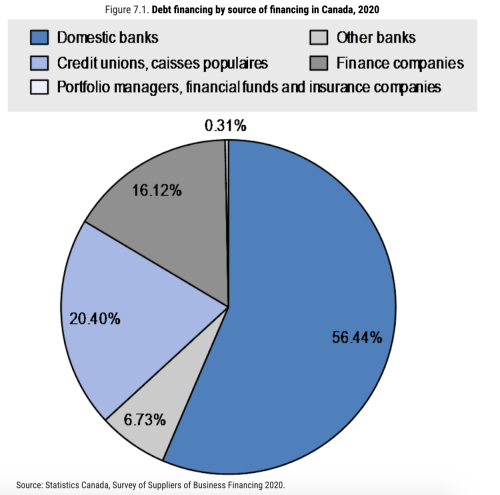

There are several types of restaurant funding options available to a business owner in Canada. A traditional option includes a bank loan, which is offered by both banks and credit unions, typically with fixed interest rates and repayment terms. Small Business Administration loans (SBA loans) are another option, offering competitive rates and terms for a new business.

Equipment financing and a line of credit are other common forms of restaurant financing available to a restaurant owner. Alternative lenders are also an option, offering more flexibility and faster approval times than traditional financial institutions. Merchant cash advances allow a lender to advance a lump sum of cash in exchange for a percentage of the restaurant’s future sales. Below are some financing options described in further depth.

Traditional Bank Loans

Offered by banks or credit unions, these types of restaurant loans or equipment loans typically have fixed interest rates and repayment terms. They require a strong credit history and a well-thought-out business proposal to qualify, making them a reliable but rigorous option for restaurant financing. According to the Canadian Federation of Independent Business (CFIB), approximately 30% of small businesses in Canada rely on traditional bank loans for financing.

When making a major purchase such as expensive equipment or significant renovations, traditional lenders are often the best type of business financing. This restaurant business loan usually offers a lower interest rate and longer repayment terms, making it suitable for large, one-time expenses.

Small Business Administration (SBA Loan):

SBA loans are designed for small businesses and offer competitive rates and terms. They can be used for various purposes, including restaurant financing options.

Equipment Financing for Restaurants

Specifically tailored for purchasing or leasing equipment, this business loan option allows you to spread the cost of the machinery over time. The equipment serves as collateral for the loan, making it a secure option for restaurant owners looking to upgrade their inventory. Equipment Leasing and Finance Association of Canada found that equipment financing accounts for over $500 million in annual equipment acquisitions in Canada.

Business Line of Credit

Similar to a credit card, a business line of credit provides you with a predetermined credit limit. You can borrow as needed and repay it over time, with the interest only charged on the amount borrowed. 56% of small businesses in Canada have a line of credit, making it one of the most popular financing options.

Commercial Real Estate Loan

For a restaurant owner, this type of business loan can be a game-changer, offering the opportunity to acquire or refinance properties essential for their business. Whether you’re in the market for a new restaurant location, an office space for administrative purposes, or a warehouse for storage, these loans provide the financial backing you need to make it a reality.

Acquiring commercial real estate is a pivotal moment for restaurants, allowing them to establish a physical presence, expand their footprint, or even generate additional revenue through property leasing. This particular restaurant business loan is imperative in empowering restaurant owners to capitalize on these opportunities and secure the perfect location for their business.

Online Lenders

Online lenders, including those offering cash advance services, serve as financial sources for restaurant businesses. As an alternative lender, they can offer a range of restaurant funding options with fast approval processes. While they can be more flexible than traditional banks, they may come with higher interest rate, making them a convenient but potentially expensive option.

Alternative Loans When Traditional Will Not Work

Merchant Cash Advances

Unlike a term loan, which typically requires collateral such as personal assets, a merchant cash advance adjusts repayment to the business’s daily sales, making it a viable option for those with variable income or bad credit. They provide a flexible solution for businesses looking to manage their financial liquidity and future payments.

The merchant cash advance is one of the best alternative loans for a business owner who may not qualify for traditional lenders. It is a quick way to access cash, the only downfall may be the higher interest rate.

Crowdfunding

This option enables individuals to raise funds from a wide range of contributors, typically utilizing online platforms, It can be a good option for new small business concepts or community-focused projects and has become a popular alternative to the traditional restaurant loan.

One major downside is the risk of not meeting your restaurant funding goal, which could result in not receiving any funds at all. Additionally, managing a crowdfunding campaign can be time-consuming and requires a significant effort in marketing and promotion. Crowdfunding campaigns are typically conducted in a public forum, which means that sensitive business information may be exposed to competitors.

Angel Investors

Angel investors offer crucial financial support along with invaluable expertise and industry connections tailored to the restaurant industry. Their hands-on involvement provides personalized mentorship and guidance, fostering long-term growth and success. Moreover, their endorsement lends credibility, enhancing the restaurant’s reputation and attracting further investment opportunities.

Government Grants and Loans

Various government agencies in Canada offer grants and small business loans. These options often have specific eligibility criteria and application processes but can be a good source of non-repayable funding for restaurant owners. Working with a reputable financial institution can help guide you through the complexities of these funding opportunities.

Peer-to-Peer Lending

With peer-to-peer lending, you borrow from individuals or investors through online platforms. This option can offer competitive rates and flexible terms but requires a strong credit profile and business plan to qualify, making it a viable but selective option for Canadian restaurant owners.

Exploring these restaurant financing options can help you find the right solution for your restaurant’s financial needs.

Assessing Restaurant Financing and Loans in Canada

Choosing the right type of funding is crucial for restaurants as it directly influences their ability to manage cash flow, invest in growth opportunities, and endure unexpected challenges effectively, ultimately shaping their success in a competitive industry.

How Quickly Funds Will Be Available

Understanding how quickly you can access funds is crucial. Consider the urgency of your financial needs, whether it’s for an expansion plan or immediate equipment replacement. Some lenders offer quick approval and funding processes, while others may have longer timelines. Knowing the funding speed helps you align your restaurant funding with your business requirements.

Evaluate Overall Repayment Costs

Calculating the total cost of borrowing a restaurant business loan is essential. Consider the principal amount, interest rates (fixed or variable), and additional fees (e.g., origination fees, prepayment penalties). This comprehensive assessment helps you determine the affordability of the financing option and compare different choices effectively.

Compare Loan Terms

The repayment term significantly impacts your financial obligations. Opting for shorter repayment periods usually entails higher monthly installments but leads to lower total interest payments. Conversely, longer terms typically translate to lower monthly payments but result in higher overall interest costs. Choose a term that aligns with your financial capabilities and business growth plans.

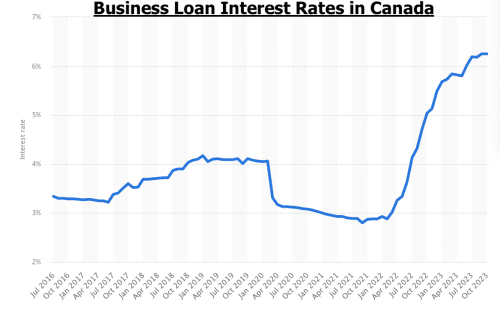

Look At Fixed vs. Variable Rates

Understanding the impact of interest rates on your business loan is crucial. Fixed rates offer stability and predictability, while variable rates may start lower but can fluctuate, potentially increasing your borrowing costs. Consider your risk tolerance and financial stability when deciding between fixed and variable rates.

Determine Collateral Requirements

For restaurant business loans, collateral requirements must be considered. Some lenders may request collateral to secure the loan, affecting the terms and loan amount. This step is especially critical for restaurants seeking a small business loan with low-profit margins, as they might have limited assets for collateral. By carefully assessing these requirements, owners can ensure they meet the lender’s criteria and protect their business assets.

Review Lender’s Credibility

Conduct thorough research to assess the lender’s reputation. Seek feedback from other borrowers and review online resources to evaluate the lender’s track record, credibility, and reliability. Look for a lender with competitive rates, transparent lending practices, and a positive customer service reputation. Partnering with a reputable lender ensures a beneficial financing partnership, reducing the risk of unfavorable experiences, and can help attract customers.

In addition to these steps, consider leveraging existing relationships with providers, such as POS providers, who may offer secure access to funding options tailored to your business needs. By carefully researching these factors and finding the best restaurant financing option, you can make informed decisions that support your restaurant’s growth and success in the competitive Canadian market.

Managing Your Restaurant Loan

Small business loan management requires careful planning and strategic decision-making to ensure financial stability and growth.

Budgeting is essential for managing your restaurant’s finances and ensuring that you can meet your loan or line of credit obligations. It allows you to allocate funds to different expenses, such as rent, utilities, payroll, and loan repayments. With a detailed budget, you can track your expenses and identify areas where you can reduce costs or redistribute resources to meet your financial goals.

Financial planning is another critical aspect of loan management. It involves creating a comprehensive plan that outlines your restaurant’s financial goals and strategies for achieving them. Financial projections are an essential part of this process, as they help you forecast your restaurant’s revenue and expenses over a specific period. By comparing your actual financial performance to your projections, you can identify any discrepancies and make adjustments to your plan as needed.

When you set credit limit, you control your spending and avoid overspending on non-essential expenses. With limits in place, you can ensure that you only use credit when necessary and that you can afford to repay any borrowed funds.

Monitoring your monthly sales is crucial for understanding your financial performance and making informed decisions. By tracking your sales figures, you can identify trends and patterns that can help you optimize your business operations and increase revenue. This data can also help you forecast future sales and adjust your budget and financial plan accordingly.

When your restaurant pays expenses on time, it’s ensuring you are maintaining a good credit score, and avoiding late fees and penalties. Establish a repayment schedule that aligns with your restaurant’s capital and revenue projections. Consider making additional payments when possible to reduce the principal amount and lower the total interest paid over the life of the loan.

Optimizing your existing location is another strategy for effective restaurant funding management. Evaluate your location’s strengths and weaknesses and make necessary changes to enhance its appeal to attract customers. This may include upgrading your facilities, improving your menu offerings, or enhancing your customer service.

Regular review of your financial performance is crucial to adjust your strategies as needed to achieve your financial goals.

FREQUENTLY ASKED QUESTIONS

Can I get a loan to buy an existing restaurant?

Yes, and buying an existing restaurant offers several advantages. An established customer base means immediate revenue generation, reducing the time it takes to build a clientele from scratch. Trained staff can lead to a smoother transition, maintaining service quality and customer satisfaction. Additionally, existing equipment and infrastructure save on upfront costs and time, as you won’t need to purchase new equipment or renovate the space. Overall, these factors can contribute to a quicker return on investment and reduced operational risks compared to starting a new restaurant. Accessing a small business loan to purchase an existing restaurant can further facilitate this process by providing the necessary capital.

What happens if my restaurant struggles financially and I can’t repay the loan?

If this happens, it’s crucial to communicate openly and promptly with your lender. Lenders understand that everyone faces challenges, and many are willing to work with you to find a solution regarding your restaurant business loan. They may offer options such as restructuring the loan to lower monthly payments or extending the repayment term to reduce immediate financial pressure. Some lenders may also provide temporary payment deferrals or interest-only payments until your restaurant’s financial situation improves. By proactively addressing the issue and seeking assistance from your lender, you can survive through financial challenges more effectively and protect your restaurant’s long-term financial health.

Are there specialized loans for marketing and promoting my restaurant?

Yes, there is restaurant funding available for marketing and promoting your restaurant. Some lenders, including those offering small business loans, offer alternative business financing options specifically for marketing purposes, helping you fund advertising campaigns, promotions, and other marketing strategies.

Can I qualify for a loan after declaring bankruptcy?

Qualifying for business financing after declaring bankruptcy can be challenging, but it’s not impossible. Some lenders specialize in providing loans to individuals and businesses with a history of bankruptcy. If you do not qualify for a bank loan, a merchant cash advance may be a good option for you but, you may face higher interest rates and stricter eligibility criteria.

Is it better to finance a new location or renovate an existing one?

The decision between financing a new location or renovating an existing one depends on various factors such as cost, location, and market demand. Renovating an existing location may be more cost-effective, but financing a new location could offer opportunities for growth and expansion.

What are the typical interest rates for restaurant business loans in Canada?

The rates for restaurant loans in Canada vary depending on the lender, the type of loan, and the borrower’s creditworthiness. Generally, interest rates for business loans can range from 4% to 30% or more, with lower rates for secured loans and higher rates for unsecured loans.

To find the financing option best suited to your restaurant’s specific needs and goals, visit BizFund. Their experienced team can help you find the right funding solution to support your restaurant’s growth and success.