Grow your Canadian small business—fast—with flexible funding from Bizfund. Our Merchant Cash Advance (MCA) program helps you access $10,000 to $300,000 in as little as 24–48 hours, giving you the cash flow you need to seize opportunities, cover expenses, or invest in equipment—without the delays and red tape of traditional loans.

Why Choose a Bizfund Merchant Cash Advance?

- No collateral required—approval is based on your business’s projected sales.

- Simple, transparent pricing—no hidden fees or compounding interest. You’ll know your total cost upfront.

- Automatic, flexible repayments—pay back a fixed percentage of your daily, weekly, or monthly card sales, so you never pay more than you can afford.

- Fast funding—most businesses receive funds within 2 business days.

Apply now and discover why small businesses across Canada trust Bizfund for quick, reliable financing.

What is a Merchant Cash Advance?

A merchant cash advance (MCA) is technically not a loan; rather, it is a cash advance based on a business’s anticipated future sales. In this respect, MCAs work best for businesses with a known income stream, received directly from consumers.

How Does a Merchant Cash Advance Work?

Merchant cash advances are much simpler than some other types of business financing. Here’s how they work: let’s say you are a small business owner and need some extra funds or working capital, for whatever reason. The process goes as follows:

Step 1. Choose Your Financing

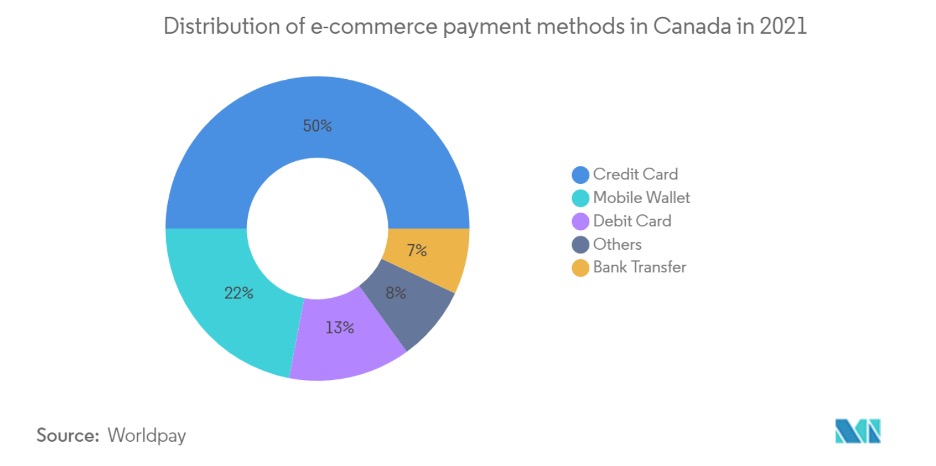

As a small business owner, you have several options. If you expect to be paid for your goods or services via credit card transactions over the next few months, you are in the ideal situation for business financing through an MCA. This applies to industries such as transportation and logistics, auto shops, and professional services.

Step 2. Apply and Receive Funds

Now you are in a position to compare merchant cash advance providers and find one that works for you. We go into this in more detail below, but for now, let’s just say you have found a good lender and have completed the application process.

The lender will look at your expected revenue from future sales, as well as your gross annual revenue, and calculate how much they are willing to advance you (advance amount), what percentage fee they will charge (factor rate) based on their perception of risk, and over what time-period you need to repay the money (repayment period). As you can see, this is slightly different from a business loan, where there is talk of loan amount, interest rate, and credit approval. Once this has been agreed upon and your application approved, your business receives its cash advance very quickly via direct deposit of a lump sum into your business bank account—making this a great small business financing program.

Step 3. Repayment

Repayments are then automatically deducted from your daily, weekly, or monthly credit card sales. This is done in concert between your lender and your credit card processor, meaning you do not have to do any calculations or manage repayments yourself. They happen automatically every time you receive a card payment. The repayment amount is calculated as a fixed percentage of sales, rather than as a set sum, so how quickly you pay off the advance depends on how many sales you make. Meaning you just focus on doing what you do best and growing the business, and the financing repayments take care of themselves in the background for extra peace of mind.

Step 4. Repeat

Once your cash advance has been paid off in full, the slate is wiped clean, and you’re able to apply to borrow more money via a merchant cash advance again in the future, either from the same lender or a different one. One benefit of using the same lender time and again is that as they get to know your business, the amount of funding you qualify for will grow, and you’ll pay a cheaper percentage. The application process also becomes easier over time.

Key Terminology

When looking at any merchant cash advance option, you’ll see the following common phrases:

Holdback

The holdback is the amount deducted from each credit card transaction to repay the advance. The lender calculates this as an agreed-upon percentage, not a fixed dollar amount. Holdbacks continue automatically until you repay the advance in full.

Typical holdback rates range from 10%-20%. For example, if your holdback rate is 10%, and you receive a $100 card payment, $10 goes to your lender and $90 goes to you.

Repayment Amount

The repayment amount is the total amount you need to repay the lender. This is effectively the sum of all of the holdback amounts over the life of the agreement.

Factor Rate

Merchant cash advances do not have interest rates in the way that other forms of funding do. Instead, a merchant cash advance has a fixed fee, calculated as a percentage of the amount borrowed. This fee is expressed as a factor rate. So, for example, a business may agree to pay a fee of $0.20 for every $1.00 borrowed. This equates to a factor rate of 1.2.

How Much Does a Merchant Cash Advance Cost?

As mentioned above, merchant cash advances are a little different from other types of business financing, so it’s worth understanding how they are priced and how this compares to other funding options.

Interest Rate vs. Factor Rate

As a business owner, when you compare different loans, you’ll primarily be comparing interest rates. You’ll also need to take into account loan fees, and then calculate how much each loan will set you back over the life of the loan. The longer you take to repay, the more you’ll pay in interest, as interest compounds.

But with a merchant cash advance, the fee for your funding is instead expressed as a factor rate, which is a percentage calculated at the start of the financing agreement, and remains fixed. The amount you pay for your financing does not change or compound, no matter how long your repayment takes.

Factor rates are generally somewhere between 1.07 and 1.35, depending on the size and stability of the business, the volume and value of transactions, and other lender-specific factors.

Merchant Cash Advance Calculator / Business Financing Calculator

To understand the price of a merchant cash advance, you simply need to multiply the amount you borrow by the factor rate.

For example, if you were to borrow $10,000 at a factor rate of 1.20, you would be required to repay: $10,000 x 1.2 = $12,000.

Merchant cash advances do not have any other fees to account for.

How Do I Obtain a Merchant Cash Advance?

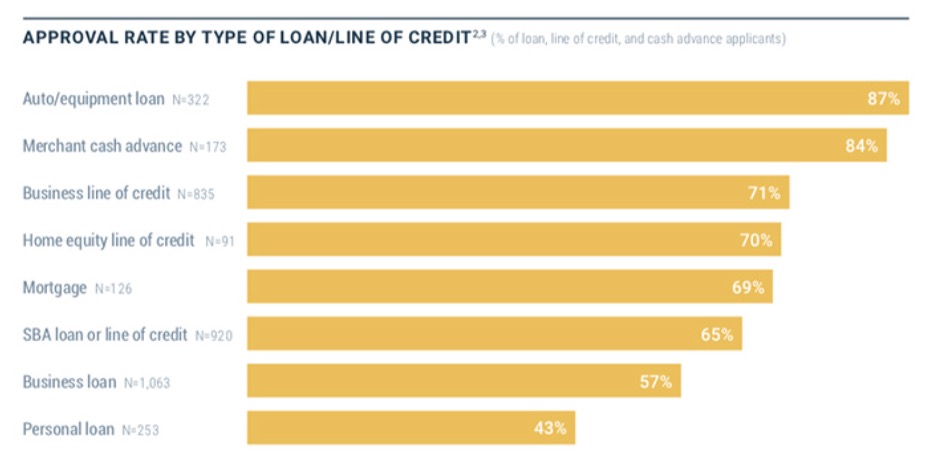

Only 22% of small business loan applications to banks are approved, and the average bank loan application requires 32 articles of information. These are just two of the reasons small businesses choose to apply for a merchant cash advance rather than a traditional loan—they are both easier to qualify for and easier to apply for. That doesn’t mean every business is eligible, though!

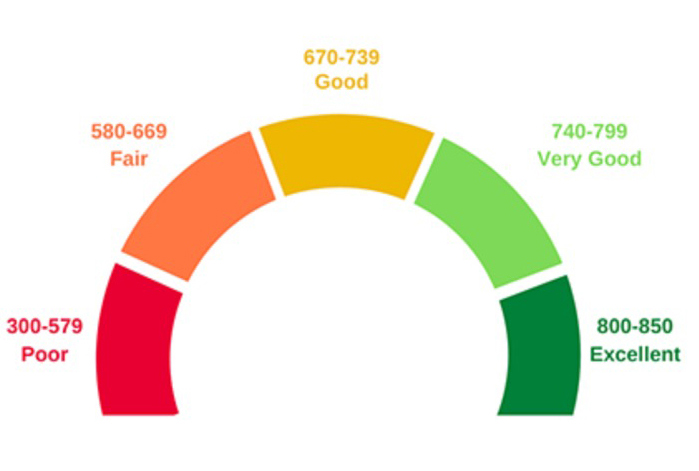

Credit Requirements

There are no strict credit score requirements with merchant cash advances, as approval is usually based on expected revenue from future sales. This means those with bad credit scores are more likely to obtain business funding with an MCA than with other financing types. However, as MCAs are unsecured, there are some instances where a lender may want to do a credit check, and low credit scores or serious issues with other lenders may impact approval.

In some cases, you might be able to secure an MCA without a traditional credit check, since lenders tend to place more weight on your business’s credit card transactions than your personal credit history. That said, many providers will still conduct at least a “soft” review of your credit rating to ensure your ability to repay. If there are significant concerns about your financial background, a lender may request a full credit check before making a decision.

It’s important to note that an MCA does not help a small business build a credit profile, as technically it’s not a loan, and repayments are not reported to credit bureaus. It can therefore not be used as an instrument for credit growth.

Paperwork Requirements

To be eligible for a merchant cash advance, you need to be able to provide:

- Photo ID

- Business number

- Proof of Canadian business residency

- Business bank account details

- Several months of credit card receipts for the business

- Several months of bank statements and/or financial records (e.g. cash flow, tax returns, balance sheet) for the business

- A completed application form

While merchant cash advance providers typically focus on your business’s card payment volume and history, you should expect to show some financial records as part of the process. Lenders use these documents to assess the health and stability of your business and to identify potential risk. For most established businesses, this means sharing recent bank statements along with credit card sales reports.

If your business is a startup or you have limited financial history under the business’s name, some lenders may ask for your personal tax returns or additional documentation to better understand your cash flow and financial situation.

The more information you provide, the better your chances of approval, and the more accurate your financing offer will be.

Other Requirements

In some cases, depending on which lender you choose, you may also need to switch credit card processors.

Pros and Cons of Merchant Cash Advances for Business Financing

Cash Advance Funding Pros

- Quick to obtain

- Flexible

- Scalable

- No collateral needed

- Credit history irrelevant

- No fees

- Simple repayment

Business Cashflow Cons

- Can be more expensive than other loan types

- Relies on credit card payments only

- Some terminal types may not be covered

- Limited borrowing amounts

- Does not build credit

- Repayment amounts vary, making budgeting harder

How Do I Pick the Right Merchant Cash Advance?

There are a growing number of merchant cash advance providers in Canada; to find one that suits your business’s needs, consider the following factors:

- Cost. Merchant cash advances are easier to compare than loans because there is only one price – the factor rate. There are no hidden fees or application fees. However, different lenders may offer different factor rates, making some options cheaper than others.

- Eligibility requirements. Merchant cash advance lenders can have varying requirements; for example, some may require 12 months of bank statements and cash flow information, while others may only need 6 months of bank statements. Some may require a certain volume in sales. Only complete the application process for a lender whose eligibility requirements you know you can meet.

- Borrowing amount. Different lenders may have different borrowing limits, so make sure you are looking at those that can provide the cash advance you need.

- Repayment period. Different lenders may offer different repayment periods; find one that works for your needs based on your expected credit card sales over the borrowing period.

There are enough options out there for most small business owners to find approval for a merchant cash advance.

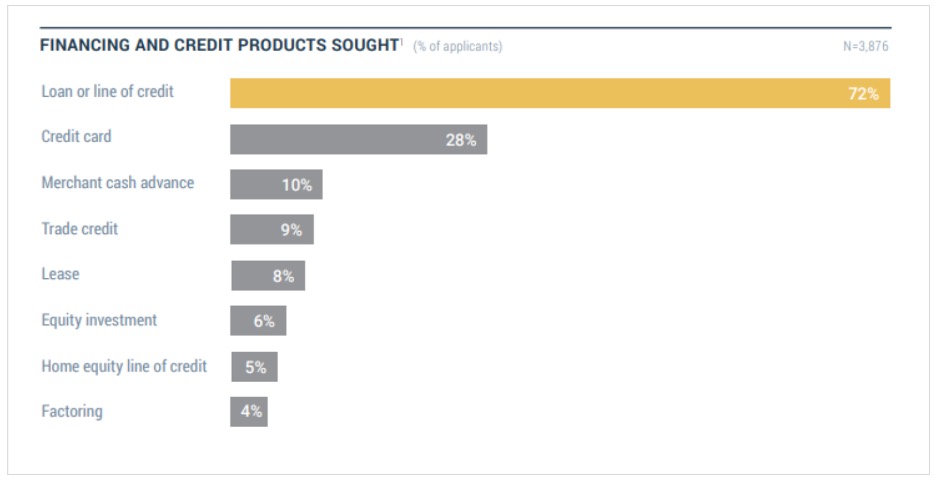

Other Business Financing Options

Merchant cash advances are not right for every situation. If your business is primarily paid in cash, by cheque, or via bank transfer, it will not qualify for one. Similarly, businesses without bank statements or new businesses without credit card receipts to show won’t qualify.

Luckily, there are alternative forms of business financing, including:

Business Cash Advance

A business cash advance is just like a merchant cash advance, with one crucial difference: any form of incoming payment is considered, not just payments made at a credit card terminal. As such, a business cash advance is an option for businesses that receive payments via cash, cheque, bank transfer, and so on. All the other characteristics of a business cash advance are the same as with a merchant cash advance.

Small Business Loan

A small business loan is a traditional loan made to a business by a bank or other financial institution for a fixed time period, repayable at a specific interest rate and subject to fees and other loan terms. With a small business loan, you can receive larger amounts of money upfront than with a cash advance, but you will have to provide far more information and meet stricter requirements to qualify for the loan, and there is less flexibility overall.

Business Credit Card

A more flexible form of business borrowing comes via business credit cards; business credit cards often have much higher credit limits than personal credit cards, and can allow businesses to quickly access flexible amounts of cash as and when needed. However, interest rates on credit card balances can become very expensive over time, so this option is best for those who expect to be able to pay off their business’s card quickly.

Business Line of Credit

A business line of credit works in a similar fashion to a credit card, with a set credit limit that allows a business to borrow flexible amounts of money, over time and as needed. A line of credit is more structured than a credit card and can be cheaper as a result. Many banks offer them.

Secured and Unsecured

Loans, credit cards, and lines of credit can all be either secured or unsecured. Secured means that the borrower uses an asset (inventory, equipment, property) as collateral against their funds, to reduce the risk to the lender and thereby lower the interest rate on the loan. In the event of a default, the lender can seize the asset used as collateral instead of payment.

Using security makes borrowing cheaper as it lowers the lender’s risk, but this is not an option with MCAs. If your business has assets and is considering different funding options, be aware that you may be able to get cheaper funds with a traditional loan.

Choosing the Best Financing Option for You

With all of the information we’ve talked about so far, you may be left wondering: how can I know which financing option is best for my business? There are a few questions you can ask yourself to narrow down your options and find the right solution:

1. What are the conditions of my business? This includes information such as how long the business has been operating, whether it holds any assets, if it has a good credit score, what its cash flow looks like, and how it accepts payments from customers. These factors will affect which forms of funding your business qualifies for.

2. How much do I need to borrow? The amount you need will steer you towards a financing type, as a merchant cash advance or credit card is better for small amounts, while a business loan or line of credit is better for large amounts.

3. How much can I afford to pay? The cost of your borrowing, whether in fees, interest, or by a factor rate, should be a key determinant in what type of financing you choose. Only consider options you can afford.

4. How quickly do I need the money? Loans take longer to get, while MCAs are fast. The urgency of your situation will have a big impact on what’s realistic.

5. How much and what type of flexibility do I need? If you need to borrow a flexible amount of money, a credit card or which line of credit is best for you. If you need to borrow a set amount, but need flexibility in how long you take to repay, a merchant cash advance is the best bet.

FAQ

What credit score do I need for a business loan?

Most banks require a credit score of 650 or higher to approve a business loan. If your credit is lower, options like merchant cash advances or funding based on future sales may still be available.

What is the best type of funding for a business?

The right funding depends on your company’s sales, revenue type, credit history, and funding needs. Each option has risks and benefits, so it’s important to choose the one that matches your business situation.

Can I apply for a merchant cash advance online?

Yes. You can apply, get approved, and receive funds online if you provide necessary documents like bank account details, business information, and sales data.

Do I need a business bank account to get a merchant cash advance?

Yes. A business bank account is required to apply and receive a merchant cash advance.

What can I use a merchant cash advance for?

Funds can be used for employee wages, supplier payments, equipment purchases, repairs, or other legitimate business expenses.

How much money can I borrow with a merchant cash advance?

Borrowing limits usually range from 1–2 times your monthly card sales. The exact amount depends on your sales volume and the lender’s assessment.

Who can benefit from a merchant cash advance?

Businesses that need fast cash, have frequent card transactions, limited credit history, or low collateral often find cash advances helpful.

How is a merchant cash advance repaid?

Repayments are a percentage of your card sales and are automatically deducted, so amounts vary with your income. This works well for seasonal or fluctuating revenue.

How much does a merchant cash advance cost?

Fees are set at the start of the agreement based on your ability to repay. They may be higher than standard loan interest rates and remain fixed throughout the term.

What happens if I default on a merchant cash advance?

If you default on a merchant cash advance, the lender can take steps to recover the funds you owe. This might include pursuing legal action, which could result in judgments against your business or personal assets, especially if you signed a personal guarantee. In some cases, they could seize any collateral you’ve pledged.

Defaulting may also hurt your credit score, limit your ability to get financing in the future, and potentially lead to significant financial strain for your business. As with any financial product, it’s wise to fully understand your obligations before accepting a merchant cash advance and to reach out to the lender early if you think you’ll have trouble making payments.

How quickly can I get a merchant cash advance?

Applications take minutes, and approvals usually come within a few days. Funds are often deposited quickly after approval.

Ready to Get Started?

- Apply now for a free, no-obligation quote—no credit impact.

- Prefer to talk? Call us at 1 (416) 224-2404 or email info@bizfund.ca.

- Not sure if an MCA is right for you? Contact us for a personalized consultation.

Get fast, flexible funding to grow your Canadian business. Apply today—funds can be yours within 48 hours.