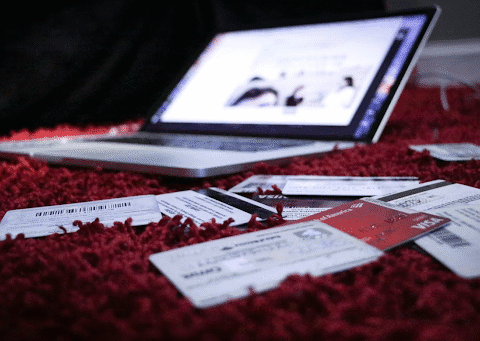

According to statistics, about 309,000 businesses in Canada missed at least one debt repayment, indicating that companies are under high debt pressure. Although this may paint a bleak picture of taking on debt to help your...

According to the Canadian Federation of Independent Business, around 34% of businesses in the country fail within the first five years of operation. This is in part because of bad choices, like poor supplier relationships, and...

Seasonal business cash flow can be tricky, with about 70% of businesses struggling with inventory management during seasonal transitions. Although specific figures aren’t available on how many Canadian businesses operate seasonally, the number is likely significant,...

Your business credit matters more than you may realize. If you have a good business credit score in Canada, you’ll find it easier to secure loans and lines of credit when the time comes for expansion....

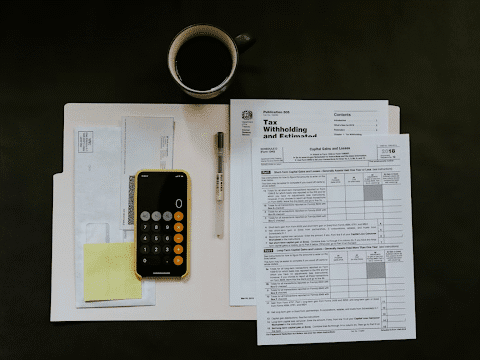

Recent announcements are pointing toward the 2026 tax season, offering small businesses exciting opportunities. It's believed there will be changes to CPP/EI rates, updated mileage allowances, and continued home office deduction options. However, to capitalize on...

During economic downturns, when credit becomes tighter and trust erodes, many small businesses come to an uncomfortable reality: their survival is limited by how quickly they can pivot their financing model. Historical evidence demonstrates that the...