The transport industry is often called the backbone of our economy, and not without reason. 70% of all freight and 90% of all consumer products and food in Canada are shipped by truck. The Canadian trucking industry contributes $39 billion to the economy every year, and that doesn’t include other transport methods or logistics companies.

As a result, transportation companies support almost every other business in the country. But who do transport companies go to when they need support? Where can they turn when they need financial help facing the many unique challenges in their industry? Here we’re going to answer that question and discuss the specialized financial solutions available to those in the transport sector.

How Can Financing Help a Transportation Company?

First, let’s consider why a transportation business might need financing. No business can survive without adequate funds, and those in trucking and logistics are no different. Financing can help in a broad range of ways, such as providing the cash necessary to:

- Maintain financial stability

- Expand, grow, and innovate

- Adopt new technology

- Manage inventory

- Develop or maintain a competitive edge

But it’s not just big picture issues that financing is appropriate for. Funds released from business financing can pay for some very particular expenses, such as:

- Vehicle/equipment purchase/repair

- Vehicle maintenance

- Insurance

- Permits

- Licensing

- Payroll

- Fuel

- Inventory

- Property costs

Financing can be crucial for both long-term success and short-term survival. But choosing the right financing for the right circumstances is just as crucial.

What Are The Types of Financing Available To Transportation Companies?

Fortunately, there are a number of financing options for Canadian transport companies, but it is up to each business to understand them and choose the most appropriate. Let’s look at each in detail:

Business Loans

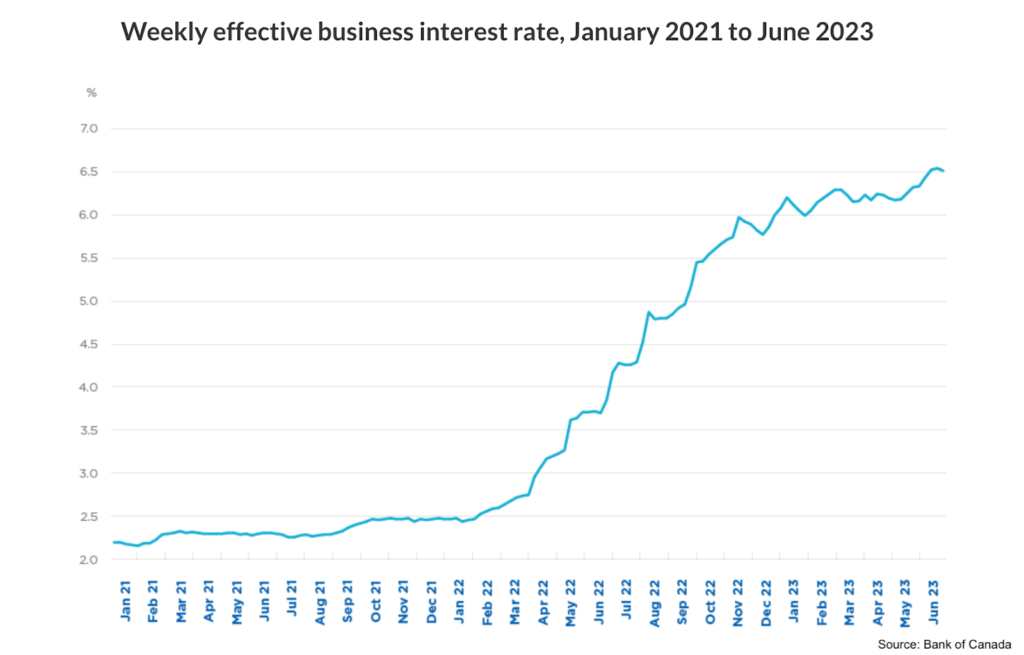

A traditional business loan is the most obvious and common form of business financing, not just in the trucking and transport industry but across all sectors. Business loans are simple instruments; you borrow a lump sum of money, and repay it at regular intervals (usually monthly) over a set period (most often somewhere between three months and five years). They often have fees and charge a rate of interest that can be either fixed or variable. They can be either secured against a business asset or unsecured.

There are a few big advantages of business loans: they can be for large amounts of money, their repayment periods can be quite long, and the interest rates charged on them can be quite low. This makes them ideal for long-term borrowing of large amounts.

However, getting a business loan is not a trivial task. Businesses need to have good credit, an operational history of at least a year, a solid business plan, assets to secure the loan against if pursuing a secured loan, and detailed financial statements proving that the business will be able to make all of its loan repayments. The application process is comprehensive, and it can take a few weeks for a business loan application to be processed and funds for approved loans to be released. In addition, funds released by a business loan must be used for the purposes outlined in the application, and there isn’t much flexibility when it comes to changing the terms of the loan once they have been agreed.

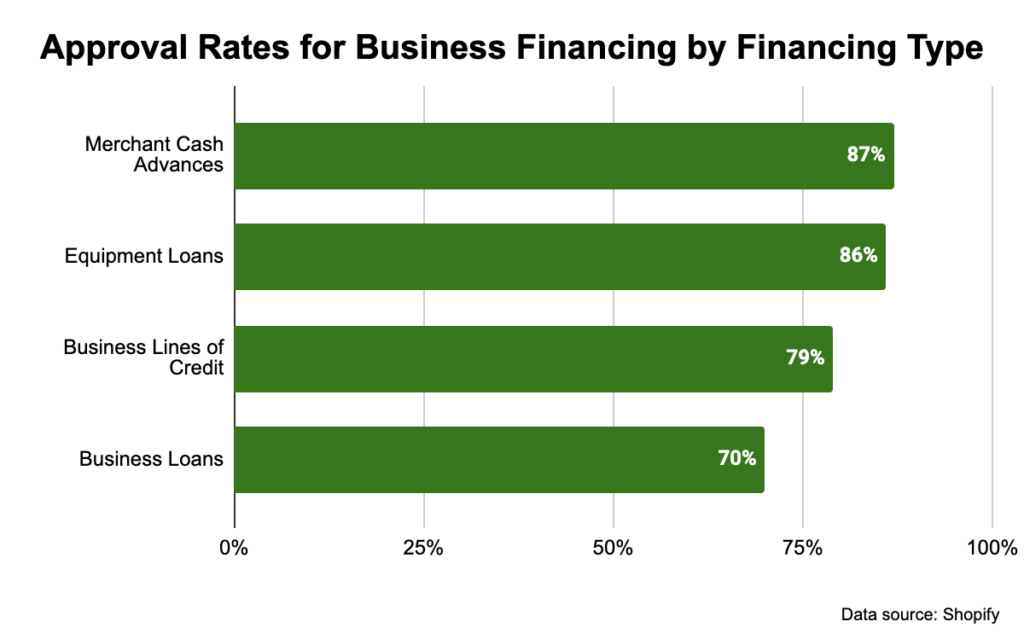

All of this means that business loans are the hardest to get and the most structured, but potentially the cheapest, form of business financing available in Canada. This makes them useful for large purchases, such as property, vehicles, and equipment, but less relevant for ongoing costs such as payroll and licensing.

Business Lines of Credit

A business line of credit offers flexibility that traditional loans don’t. Here’s how it works: a business applies with a lender, who reviews its history, revenues, and assets to set a credit limit—the maximum amount the business can borrow.

Like a credit card, you can use as much or as little as you need, up to the limit. Interest is only charged on the amount used. Once balances are repaid, the available credit resets and can be reused. Lines of credit can be secured or unsecured.

The key benefits are flexibility and reusability. Funds can be used for any purpose without notifying the lender each time. However, there are qualification requirements, including a good credit score, at least a year of operations, financial documentation, and proof of assets if secured.

Lines of credit typically cover smaller amounts than traditional loans, but they can be reused multiple times. Interest is generally higher than a business loan but lower than some alternative financing options. Prompt repayment is essential—like a credit card, unpaid interest can quickly compound.

Overall, a line of credit provides long-term flexibility for managing unexpected costs, such as vehicle repairs or emergency expenses. It’s less suited for large, predictable expenses or ongoing working capital unless the business can repay borrowed funds quickly.

Equipment Loans

Equipment loans are extremely common in the transport industry, and for good reason. The average cost of a new heavy-duty truck in Canada is over $220,000, and anyone operating a fleet knows that it’s not just the truck itself that needs paying for. All manner of other equipment may be necessary to operate a transport business smoothly. For this reason, there are various equipment financing options available, including loans, leases, and lease-to-own agreements. The right type of equipment financing for any given company will depend on its needs and budget, as all the options have their own advantages and disadvantages.

The benefits of equipment-dedicated financing as a whole are consistent: it provides reliable, specialized funding for large one-off equipment expenses, and as the financing can often be secured against the equipment in question, it can also be comparatively affordable. But all equipment-dedicated financing has one big drawback: it is only for use on equipment. If you need funds for cash flow, payroll, licenses, bills or anything else related to your business, equipment financing won’t be suitable.

Merchant Cash Advances

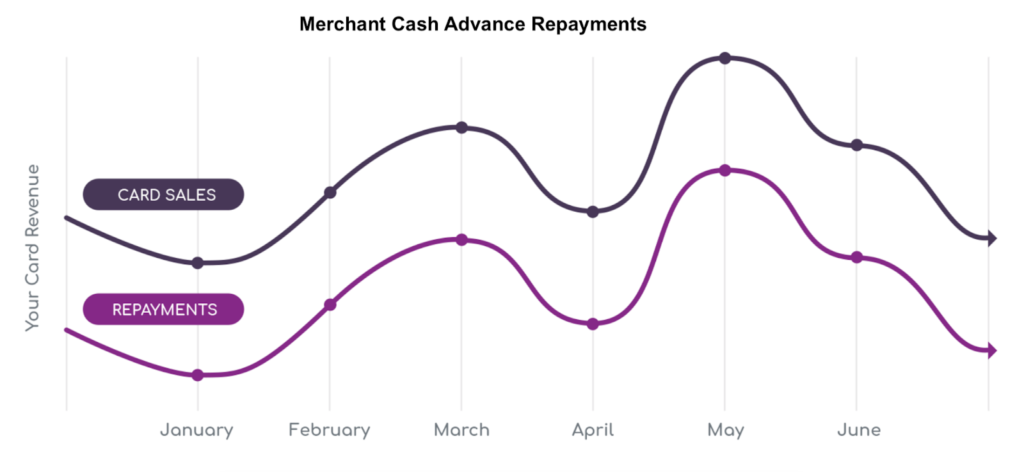

The last major type of financing for transport companies is a merchant cash advance (MCA). MCAs work differently from traditional loans: the cost of borrowing is set at the start and does not change, no matter how long it takes to repay.

Once approved for a merchant cash advance (MCA), a business receives a lump sum that can be used freely. The cost is set upfront using a factor rate instead of an interest rate—for example, a rate of 1.1 means borrowing $10,000 requires repayment of $11,000. This rate never changes.

Repayments are made as a percentage of credit card sales, called a holdback. High sales mean faster repayment; slower sales mean slower repayment. This flexibility makes MCAs ideal for businesses with seasonal revenue, fluctuating sales, or those needing unrestricted funds.

MCAs are easier to qualify for than traditional loans. They are usually unsecured, don’t require assets, and credit score is less important than consistent revenue. Even new businesses may be eligible, with applications processed in a day or two.

The trade-offs: borrowing limits are lower, costs are higher than traditional loans, and MCAs only work for businesses that accept card payments. They are best for short-term or emergency needs like cash flow, payroll, or inventory—not for large, long-term investments such as equipment or property.

If you’re interested in getting a cash advance for your business, talk to BizFund. We have over a decade of experience catering to small and medium-sized businesses for all their cash advance needs.

Summary of Most Common Business Financing Options

| Business Loan | Business Line of Credit | Equipment Financing | Merchant Cash Advance | |

| Receipt of funds | As a lump sum | As and when needed | Goes directly to the equipment supplier | As a lump sum |

| Repayment period | 3 months – 5 years | Open-ended | 3 months – 7 years | Open-ended |

| Repayment flexibility | No | Yes | No | Yes |

| Cost | Interest on the entire loan amount plus fees | Interest only on the amount used | Interest on the entire loan amount | One set cost, no interest |

| Restrictions on the use of funds | Must be used according to the business plan | None | For equipment only | None |

| Secured or unsecured | Both | Both | Both | Unsecured only |

| Qualification criteria | Strict | Moderately strict | Moderate | Lenient |

| Speed | 1-3 weeks | 1-3 weeks | 3-7 days | 1-2 days |

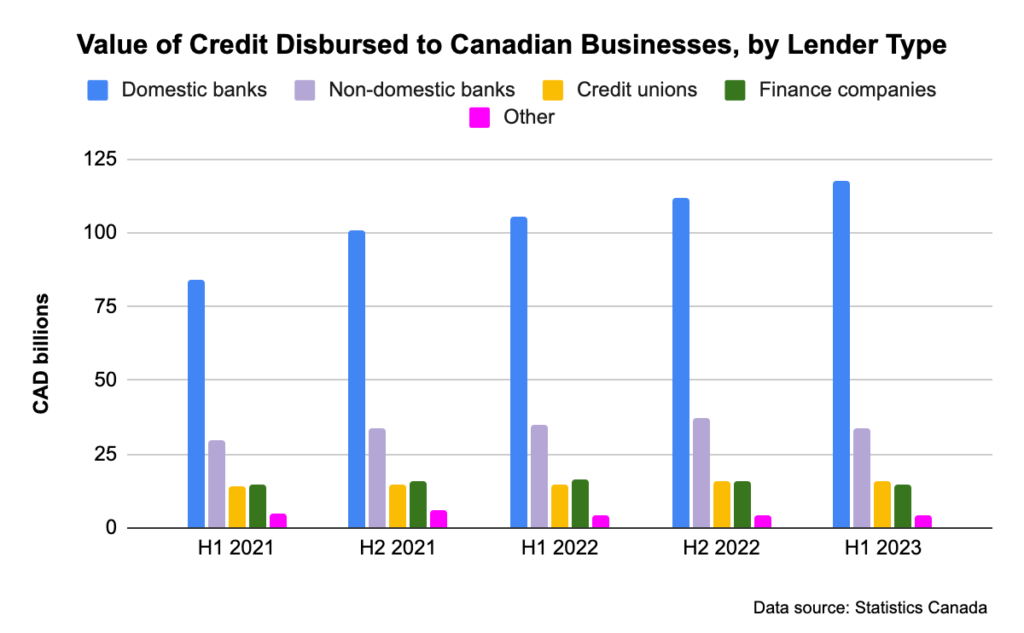

Who Provides Business Financing to Canadian Transportation Companies?

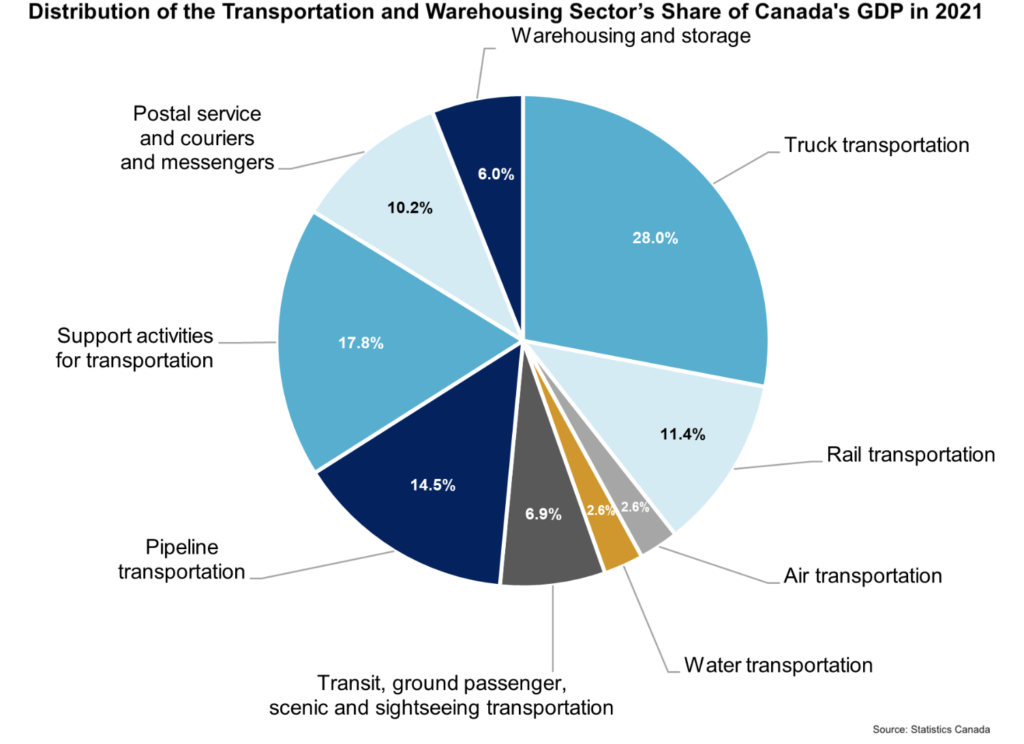

The Canadian transportation market is worth $39.55 billion and directly employs over 300,000 people. With such a large industry, there are plenty of lenders ready to help transport companies with their financing needs. These lenders typically fall into a few categories:

- Banks

- Credit unions

- Online lenders

- Specialty financing providers

- Private lenders

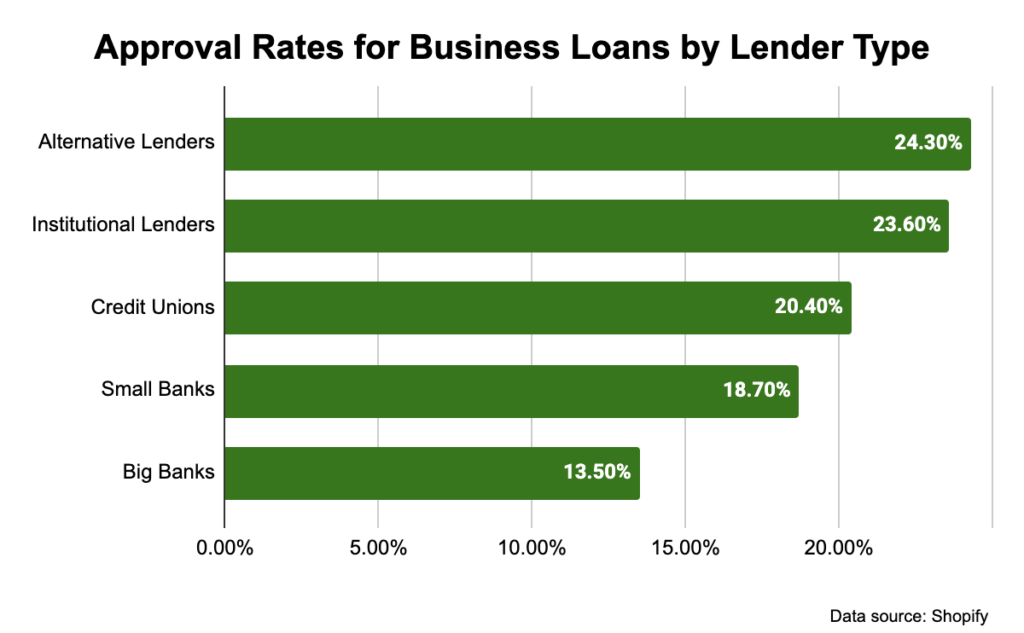

Each type of lender has its pros and cons. For instance, banks and credit unions often offer the best interest rates for traditional business loans, but they may not provide merchant cash advances. Credit unions might take a week or two to process a loan, while online lenders can usually approve one in just a few days.

To choose the right lender, start by asking yourself a few key questions:

- What type of financing fits your needs? Think about how much you need, what the funds are for, how quickly you need them, and how you plan to repay the loan.

- Which lenders offer that type of financing?

- Which lenders can you qualify with?

- Which lender gives the best overall deal? Look at the cost to borrow, the lender’s reputation, the clarity of their terms, customer reviews, and the support they offer.

Answering these questions will help you narrow down your options and pick a lender that’s right for your transportation business.

The Canada Small Business Financing Program

There’s one more important option for transportation companies in Canada: the Canada Small Business Financing Program (CSBFP). This federal program helps Canadian businesses with annual revenues under $10 million access loans of up to $1 million. The loans themselves don’t come directly from the government. Instead, the program makes it easier to get financing from traditional banks and credit unions by sharing the risk with them.

The CSBFP has helped many transport companies across Canada secure funding they might not have been able to access otherwise. If, after reviewing your options, you think a business loan is the right choice for your company, the CSBFP could be a valuable resource.