In today’s market, securing a business loan or another form of business financing is essential for not just maintaining but also elevating the operations of stores nationwide. This section offers a comprehensive overview of retail loans and emphasizes their role in supporting and advancing Canadian retail establishments.

Learn more about Bizfund and our financing solutions.

Business Loans and the Retail Industry

Business loans are financial instruments tailored to meet the capital needs of companies, including Canadian retailers. These loans usually come with defined repayment terms, interest rates, and sometimes require collateral. Retail loans enable stores to meet financial obligations and pursue growth opportunities, even in a high-volatility industry.

Importance of Business Loans for Canadian Retailers:

The significance of financing for Canadian retailers is multifaceted and crucial for their success and growth. This funding facilitates:

Financial Stability

Loans give retailers the financial cushion to handle economic uncertainty, keep operations running smoothly, and meet obligations.

Expansion and Growth

Funding can help retailers expand their business, open new locations, or diversify their products and services.

Inventory Management

Loans allow retailers to manage stock effectively, handle seasonal changes, and ensure customers can get what they want.

Technology Upgrades

Retail financing can fund upgrades like POS systems, eCommerce platforms, and analytics tools for smarter decision-making.

Competitive Advantage

Financing helps retailers invest in marketing, improve the customer experience, and stay ahead of industry trends.

Types of Business Loans for Retail Stores in Canada

Small Business Loans

These provide a lump sum of capital that is repaid over time with interest. Retailers often use them for inventory, hiring, marketing, or business expansion. Some loans may require collateral.

Business Lines of Credit

A revolving credit option where interest is only charged on the money you borrow. Perfect for seasonal expenses or short-term cash flow needs. Learn more about Bizfund business financing.

Equipment Financing

Used to buy equipment or machinery, with the equipment itself often serving as collateral. This spreads the cost over time and helps conserve working capital.

Merchant Cash Advance (MCA)

Provides a lump sum upfront in exchange for a percentage of daily sales. It’s fast and flexible, but usually comes with higher costs. Learn more about merchant cash advances in Canada.

Sources of Business Loans for the Retail Business

Canadian Banks

These institutions provide a variety of financial products and services, including loans to businesses. The loans are typically offered at competitive rates and with flexible repayment conditions. The application process involves submitting a loan application, along with supporting documents such as financial statements and business tax returns.

If approved, the bank will disburse the money to the retail store, which must then pay the loan back according to the agreed-upon terms. The application process for a business loan from a bank can be lengthy and requires extensive documentation. Banks may also have strict eligibility criteria, which can make it difficult for a retail store to qualify.

Credit Unions

Credit unions are financial cooperatives owned and operated by their members. Any company interested in obtaining a business loan from a credit union must first become a member of the union, if they are not already. The application process for a loan from a credit union involves meeting with a loan officer to discuss the financing needs of the retail business, their services are more personalized. Unions are also more willing to work with companies that have less established credit histories compared to an alternative lender.

Online Lenders

Online lenders are financial firms that offer loans to retail stores through online platforms. They often provide fast approval processes and access to funds, making them a convenient option, especially for managing working capital. However, online lenders may charge higher interest rates and fees compared to others. Retailers should also be cautious of fraudulent online lenders and ensure they are dealing with a reputable institution.

Merchant Cash Advance

A merchant cash advance (MCA) is a financing option where a business receives a lump sum of money upfront in exchange for a percentage of its daily sales, plus a fee. Unlike a traditional loan, where you pay interest, with an MCA, the repayment is based on a factor rate rather than an interest rate. This means that the total amount paid is determined upfront, allowing for easy budgeting. They’re often used by those who need capital quickly or have fluctuating sales volume, as the repayments are based on a percentage of daily sales. One of the types of retail loans that can provide fast access to funds, they are typically more expensive than traditional loans, so it’s essential to carefully consider the terms before proceeding. If you’re interested in applying for a merchant cash advance, click here for more information.

Applying for Business Loans As a Retail Store…

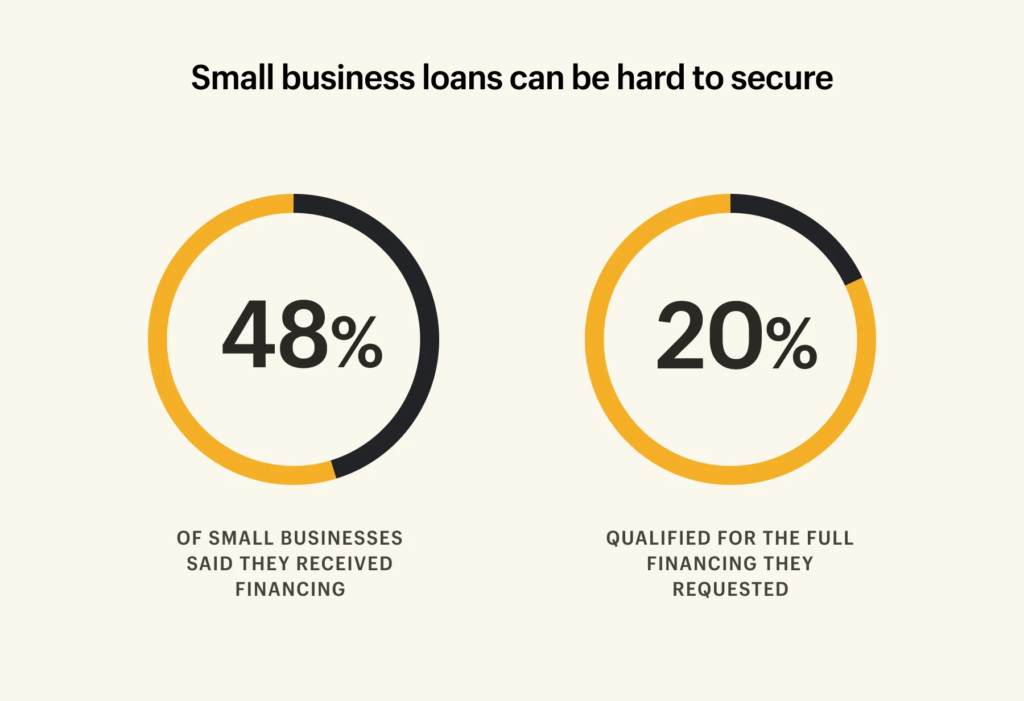

Last year, well over half (58%) of small companies in Canada needed retail business loans.

Documents You’ll Need:

- Business plan

- Financial statements (income, balance sheet, cash flow)

- Tax returns

- Bank statements

- Legal documents (licenses, permits, contracts)

Steps to Apply:

- Research lenders to find the best options

- Prepare all required documents

- Submit your application online or in person

- Meet with a loan officer if needed

- Wait for the lender to review and approve

Getting the Funds:

Once approved, the money is deposited directly into your account. You’ll repay it according to the agreed schedule, including any interest and fees.

Factors to Consider When Applying

Credit Score – A retail store’s credit score plays a significant role in its ability to qualify for a business loan. Creditors use credit history to assess the retail business’s financial reliability and determine the interest rate and terms of the loan. Retail store financing with a higher credit score generally indicates lower risk to the lender, making it easier to qualify for a loan with favorable terms.

Business Plan – A well-thought-out business proposal is essential when applying for a business loan. The plan should outline the retail store’s goals, target market, competition, marketing strategies, and financial projections. A strong business plan demonstrates to lenders that the retail store has a clear vision and a solid strategy for success.

Cash Flow Analysis – Lenders will also analyze the business’s liquidity to determine its ability to pay the loan. Retail stores should have a positive cash flow and be able to demonstrate that their sales can cover their operating expenses, including loan payments. An analysis helps lenders assess the retail store’s financial health and ability to manage debt.

Collateral – An asset that the retail store pledges to secure the loan. If the store defaults on the loan, the lender can seize the assets to recover its losses. Common types of collateral include real estate, inventory, equipment, or accounts receivable. Having sufficient capital can improve the retail store’s chances of qualifying for a loan and may result in lower interest rates.

Interest Rates and Fees – Retail stores should carefully consider the conditions associated with the loan. Different lenders may offer different rates and fee structures, so it’s important to compare options to find the one that best suits your store. High-interest rates and fees can significantly increase the cost of borrowing and affect the retail store’s ability to pay back the loan.

Repayment Terms – The terms of the loan, including the loan amount, interest rate, repayment schedule, and term length, are crucial factors to consider. Retail stores should choose repayment terms that align with their income and financial goals. Longer terms may result in lower monthly payments but could cost more in interest over the life of the loan. Shorter terms may have higher monthly payments but can save on interest in the long run.

Government Programs and Support for Canadian Retail Stores

The Canadian government offers a range of programs and support initiatives to help retail stores access capital and resources to start, grow, and succeed. These programs are designed to support entrepreneurship, job creation, and economic development across Canada, offering funding for both smaller and larger loans.

Canada Small Business Financing Program

The Canada Small Business Financing Program (CSBFP) is a federal government initiative that helps retail stores receive financing by sharing the risk with lenders. Under the CSBFP, the government guarantees a portion of the loan, making it easier for small retailers to qualify for loans from participating financial institutions.

Key features of the CSBFP include loans of up to $1 million for the purchase or improvement of real estate, equipment, or leasehold improvements. A maximum loan term of 10 years for real estate and leasehold improvements, and up to 5 years for equipment. Eligibility requirements include being a for-profit business with gross annual revenues of $10 million or less and using the loan proceeds for eligible purposes.

Canada Emergency Business Account (CEBA)

The Canada Emergency Business Account (CEBA) is a federal government program that provides interest-free loans to retail stores impacted by COVID-19. The program offers loans of up to $60,000 to help pay for operating costs, such as rent, utilities, and insurance. It makes sense for those who suffer from losses of sales due to seasonal changes.

Eligibility criteria include having an active business operating account, being an eligible business entity, and demonstrating financial hardship as a result of COVID-19.

Other Provincial and Federal Programs

In addition to the CSBFP, there are other government programs available to support the Canadian retail industry. The Canada Emergency Business Account (CEBA) provides interest-free loans to those impacted by COVID-19. Provincial support programs, such as the Ontario Small Business Support Grant and the Quebec Small Business Support Program, also offer business loans for retail stores. A smaller loan may be an option depending on their capital.

Some industry-specific programs, such as the Canada Retail Innovation Challenge, support retail stores in adopting innovative technologies and practices.

Retail stores interested in accessing government programs and support should research available options and contact their local government or business financing provider for more information.

Future Outlook

Looking ahead, the future of business loans for Canadian retail stores appears promising. According to statistics from the Canadian Federation of Independent Business (CFIB), the retail sector is expected to experience steady growth, with an estimated 3.5% increase in sales in 2024. This growth is attributed to the continued economic recovery and increased consumer confidence. Additionally, government initiatives such as the Canada Emergency Business Account (CEBA) have provided critical support to retail businesses during challenging times.

Retailers are well-positioned for growth and innovation, with opportunities to expand their operations and reach new customers. This may require investment in various aspects of the business, but it’s essential for them to stay informed about available financing options and adapt to evolving market conditions. According to a survey by the Business Development Bank of Canada (BDC), 78% of smaller businesses in Canada believe that staying informed about financial management is essential for their success. By staying informed and leveraging available financing options, they can position themselves for long-term success in the dynamic Canadian retail market.

What is an example of a retail loan?

A common example is a business line of credit. It lets retailers borrow up to a set limit, repay it, and borrow again as needed. This flexibility makes it perfect for managing inventory, operating expenses, and marketing during seasonal ups and downs.

What is a CEBA loan, and is it extended to 2024 in Canada?

The Canada Emergency Business Account (CEBA) provides interest-free loans to businesses affected by COVID-19. The program has been extended, but check the official website for the latest updates.

How long does it take to get approved for a business loan in Canada?

Approval depends on the lender and your application, but it can take anywhere from a few days to a few weeks.

What happens if I default on a business loan in Canada?

If a business defaults, the lender can take legal action and may seize collateral. It can also negatively affect your credit score.

Can I use a business loan to purchase inventory in Canada?

Yes. Many loans are designed specifically for inventory, helping retail stores manage stock efficiently.

Are there grants available for retail store owners in Canada?

Yes, grants can help with working capital and other business needs. It’s worth researching local and federal programs.

What is the difference between a business loan and a traditional loan?

Business loans, like retail store loans, are specifically for business purposes—expansion, inventory, or hiring staff. Traditional loans are often personal or general-purpose, with fixed repayment terms.

How can I improve my chances of getting approved for a business loan in Canada?

Keep a strong credit score, prepare a clear business plan, show steady cash flow, and consider offering collateral.

How do you finance the expansion of a company in Canada?

Options include a line of credit, a business loan, or equity financing. The best choice depends on your company’s needs.

What is the best source of financing for a retail loan in Canada?

Inventory financing is often ideal, especially for seasonal or fluctuating stock, as it allows businesses to use inventory as collateral.

Can you get a loan for e-Commerce?

Yes! Many lenders offer e-Commerce business loans for inventory, website upgrades, marketing, and expansion, with flexible terms for online retailers.