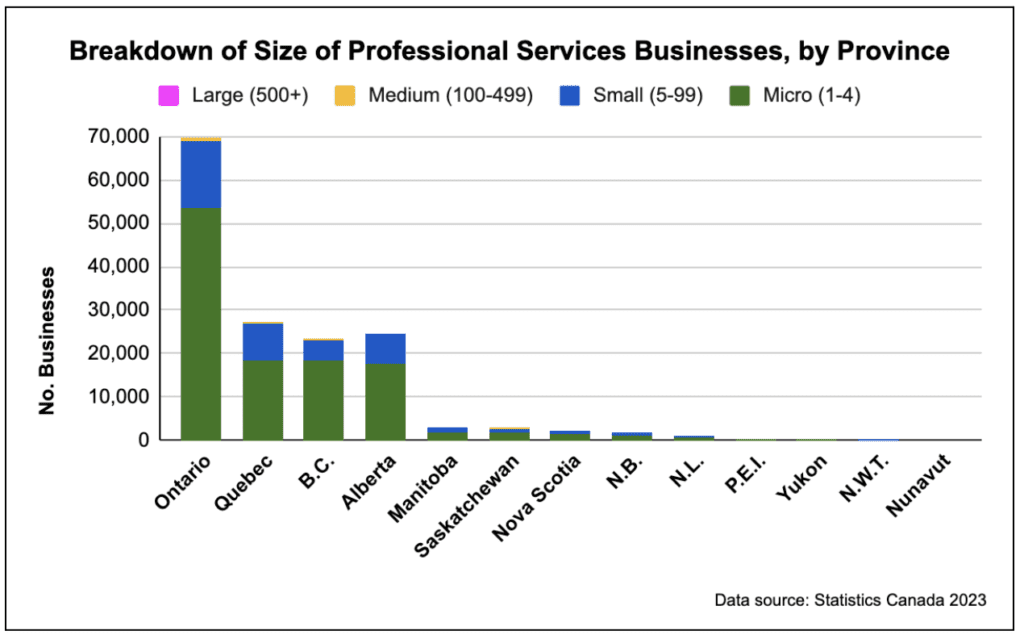

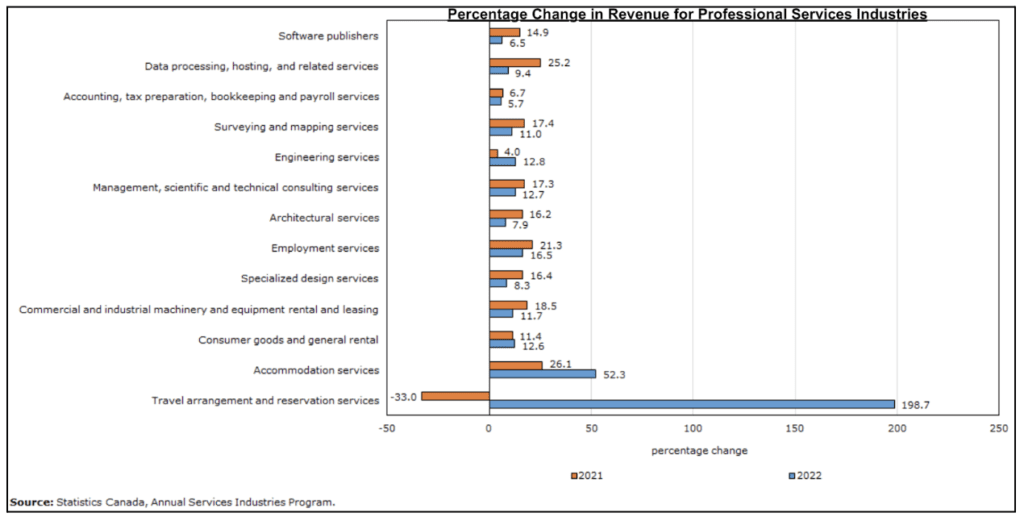

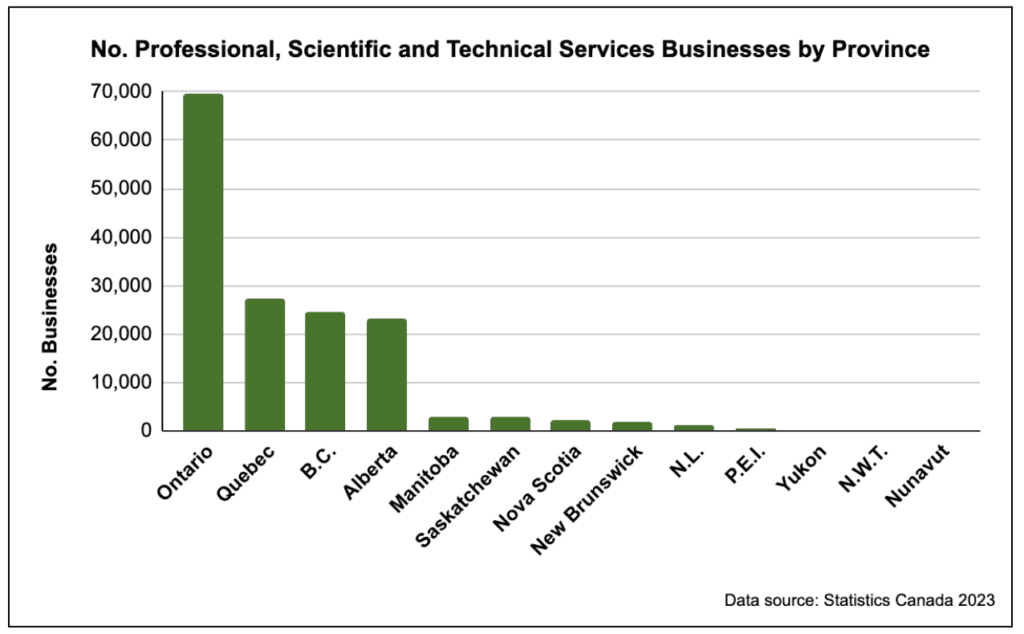

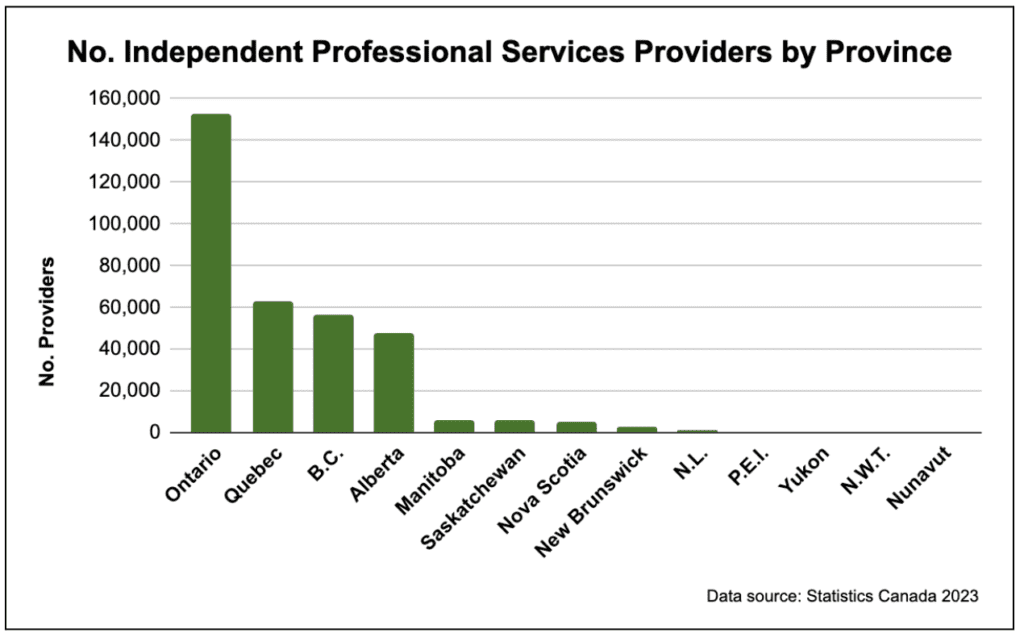

There are over 500,000 professional and technical services businesses (including independent operators) across Canada, employing 1.2 million people, and providing vital assistance to many millions more. But despite their indispensability, professional services face many challenges, including rising costs, labour retention, technological adoption and cash flow management. Any one of these could sink a company if it doesn’t have adequate resources, which is why access to affordable financing is so important, especially for small businesses.

BizFund specializes in a type of business financing that works particularly well for small, customer-driven businesses, but we don’t expect you to take our word for it. As a conscientious business owner, you need to be aware of all of your business financing options, so you can make an informed decision about what’s right for you. So here is everything you need to know about financing for professional services:

What Types of Professional Services Can Get Business Financing?

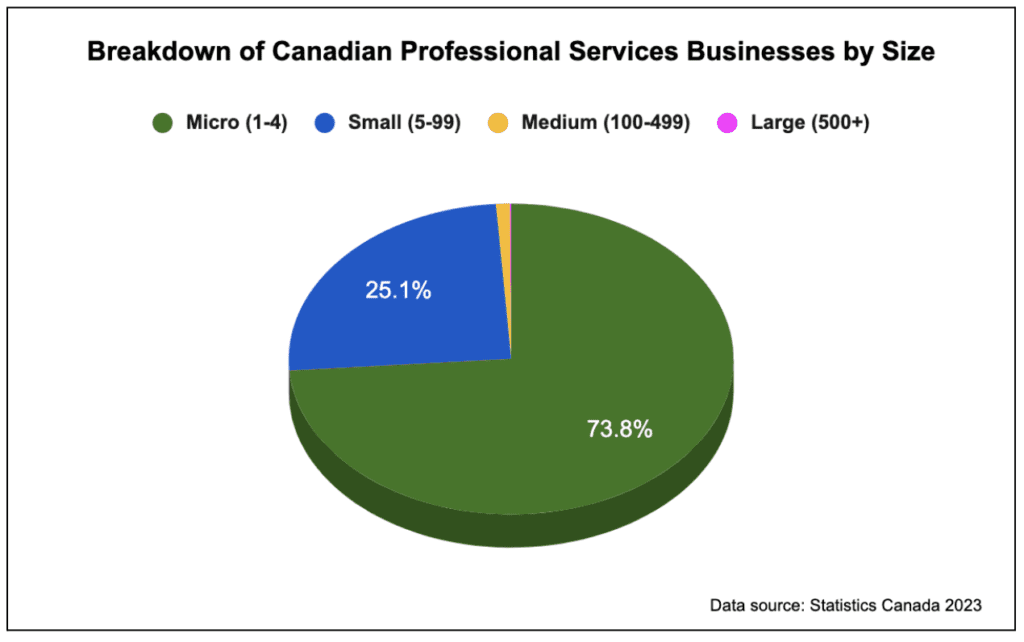

A variety of businesses fall under the classification of ‘professional services’ in Canada; the vast majority are very small (1-4 employees), and there are many independent sole operators as well. But the size and exact area of work does not really matter when it comes to financing, as companies of any size and in any sub-sector are potentially eligible for funding. This includes those in:

- Accounting

- Advertising

- Architecture

- Engineering

- Graphic design

- Healthcare and wellness

- HR consulting

- Financial planning

- Interior design

- IT

- Law

- Management consulting

- Marketing

- Public relations

- Scientific consulting

- Tax services

- Veterinary services

- Web development

How Can Professional Services Use Business Financing?

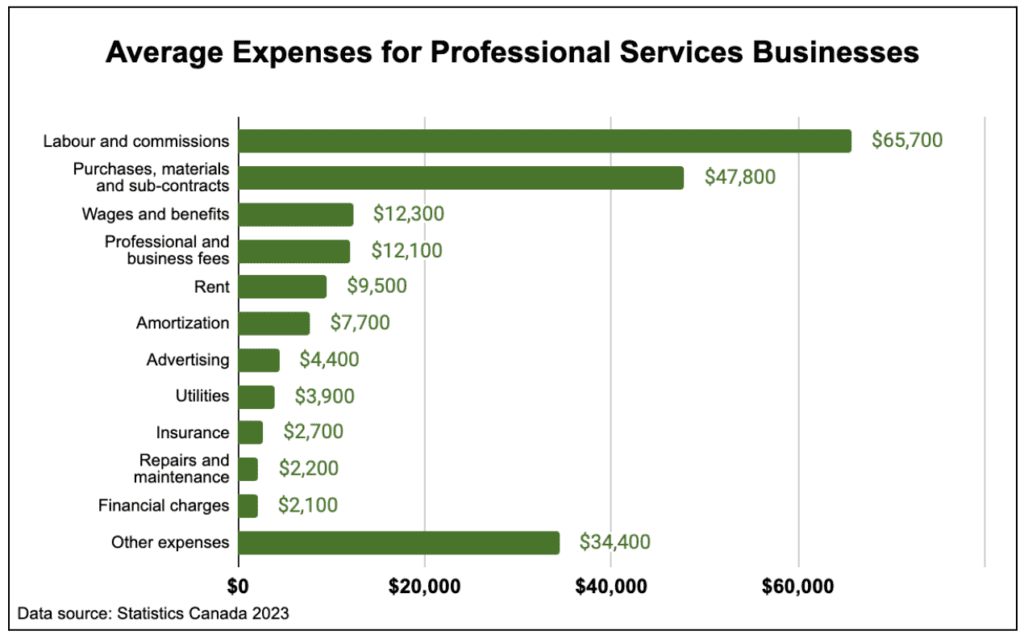

As the range of businesses eligible for financing implies, financing can be used for almost any business expense. This includes:

- Equipment and tools (physical and digital)

- Property costs (purchase or rental)

- Staffing costs (wages, training, benefits and commissions)

- Materials

- Sub-contracts

- Professional and business fees

- Advertising and marketing

It’s not just about known, specific costs though; financing can also help with long-term financial health, by providing:

- Financial stability

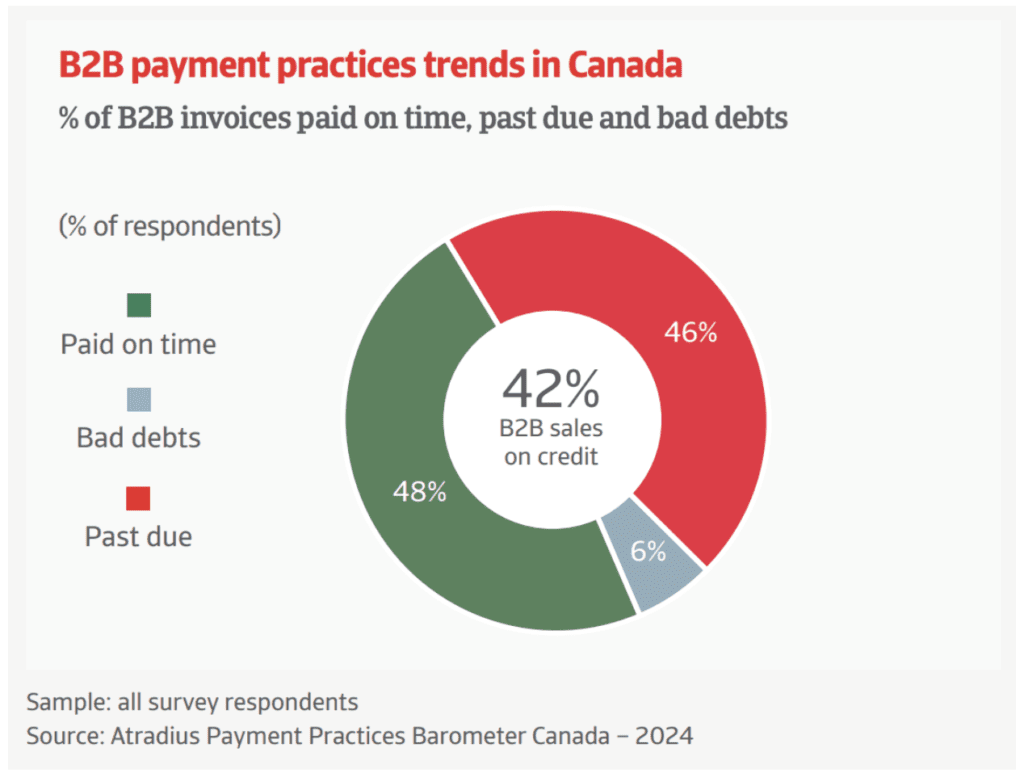

- Protection of working capital (especially in the instance of a delay in payment of invoices – 48% of invoices issued by small businesses are paid late)

- Equity control

- Competitive edge

- Improved credit rating

Regardless of whether financial help is needed for a short-term or a long-term need, there are financing solutions available to help. The different options all have different characteristics though; it’s important you understand these, to find what works best for your individual financial situation.

What Types of Business Financing Are There for Professional Services?

1. Small Business Loans

Size: $500 – $1 million (can be more in certain cases; loan amount dependent on applying business’s characteristics)

Structure: Funds are released as a lump sum at the start of the loan agreement; repayment size and frequency is set at the start of the agreement and must happen regularly (often bi-weekly or monthly) until the entire loan is repaid. Loan can be either secured or unsecured.

Term: 3 months – 7 years

Source: Banks, credit unions, online lenders, alternative lenders

Cost: Interest (variable or fixed) plus loan fees; unsecured loan interest rates start at about 7.5%

Eligibility: Usually rely on credit check, income and operational history of the business

Features: Can be used for any business expense; particularly good for large and long term expenses

2. Business Lines of Credit

Size: $1,000 – $500,000 (amount dependent on applying business’s characteristics)

Structure: At the start of the agreement, the borrower is approved for a line of credit up to a certain credit limit; they can then borrow as much or as little from the line, as and when they need to, and repay borrowed funds flexibly. Once funds are repaid, the amount of available credit resets, so the line is reusable over time. Lines of credit can be either secured or unsecured.

Term: Open-ended

Source: Banks, credit unions, online lenders

Cost: Interest charged on borrowed funds only, according to a fixed or variable rate; rates start at 7% for secured lines

Eligibility: Relies on credit check, income and business financial health assessment

Features: Reusable, open-ended, flexible; particularly useful for emergency expenses and/or occasional costs, and popular across industries

3. Invoice Factoring Loans

Size: $5,000 – $2 million (dependent on value of outstanding invoices)

Structure: Borrower enters into an agreement with a lender; as new invoices are issued to the borrower’s clients, the borrower receives an advance (typically between 70% and 90%) on the invoice’s value, from the lender. This essentially provides almost immediate access to sales funds, despite clients not paying invoices immediately. When an invoice is paid by a client, the advance from the lender is repaid from the proceeds.

Term: Open-ended

Source: Specialty lenders

Cost: A factoring fee, which is a certain percentage of every repaid amount (e.g. 3%), plus lender fees

Eligibility: Requires businesses to bill by invoice and to have expected, reliable future client payments

Features: Accessible, fast, but complicates the chasing of unpaid invoices with a business’s clients; popular in industries with high-value invoices, such as those seeking business financing for a transportation company

4. Merchant Cash Advances

Size: $2,500 – $300,000 (dependent on monthly credit card sales)

Structure: At the start of the agreement, the borrower receives a lump sum from the lender; as the borrower makes credit card sales, a small percentage (e.g. 10%) of each sale is rerouted to the lender as a form of repayment. This happens until the entire advanced amount is repaid.

Term: Open-ended; repayment rate changes according to sales volume

Source: Specialty lenders

Cost: A single fee, known as the factor rate, sets the cost of borrowing at the start of the agreement, and does not change regardless of how long it takes to repay the funds; there are no other costs

Eligibility: Relies on a business making credit card sales regularlyFeatures: Accessible, fast, and repayments adapt to changing sales environments without increasing the overall cost of borrowing; particularly useful as a form of business financing for retail stores and auto shops

5. Equipment Financing

Size: $5,000 – $750,000 (dependent on equipment and borrower)

Structure: Funds are released when the borrower makes a specific equipment purchase; funds are often routed directly to the equipment supplier to cover the purchase cost. The borrower then makes regular repayments over a set term, until the loan is repaid in full. The equipment being financed is wholly owned by the borrower throughout the term of the loan, but the equipment is used as loan collateral.

Term: 3 months – 7 years

Source: Online lenders, specialty lenders, equipment manufacturers

Cost: Interest rate (fixed or variable) plus loan fees; interest rates start at around 5%

Eligibility: Relies on a credit check and a business financial health assessment

Features: Allows businesses to purchase specific business equipment for immediate use, while spreading the cost of the equipment over time; particularly popular as a form of business financing for restaurants

6. Commercial Mortgages

Size: $10,000 – $20 million (dependent on property and borrower)

Structure: A large, secured loan that must be used for appropriate property costs (purchase, renovation, expansion, etc.). Funds are released as a lump sum and must be repaid in set installments, over time, until the entire amount is repaid.

Term: 6 months – 10 years (amortization periods can be up to 25 years)

Source: Banks, credit unions, online lenders

Cost: Interest (fixed or variable) plus loan fees; interest rates generally start at 5%

Eligibility: Relies on a credit check and a thorough business financial health assessment, including analysis of the age of the business, and a valuation of the property in question

Features: The best financing option for established businesses looking to spend a lot of money on real estate; not useful for any other purpose and not accessible by businesses failing to meet strict eligibility criteria

7. Business Credit Cards

Size: $1,000 – $1 million (dependent on card and borrower)

Structure: As with a personal credit card, the borrower is approved for a certain credit limit, which can be accessed as and when the borrower likes, as they use the card. Borrowed funds must be repaid in order to reset the available amount of credit on the card.

Term: Open-ended

Source: Banks, credit unions, credit card companies

Cost: Interest (fixed or variable) charged on borrowed funds, plus annual fees; the average business credit card interest rate in Canada is 20%

Eligibility: Varies depending on provider

Features: Allows for very flexible borrowing, but interest charges are high so unsuitable for long term borrowing

8. Private Loans

Size: Any

Structure: Any

Term: Any

Source: Private individuals, private companies, private investment vehicles

Cost: Varies

Eligibility: Varies

Features: Private loans are the most open form of financing, as almost any financial agreement can be made with a private lender, depending on what your business needs and what the lender wants. Private loans are generally much harder to source than other types of financing, and most commonly rely on the business owner relinquishing some of their equity in the business.

Can Professional Services Get Any Financing Assistance From the Government?

The Canadian government is keen to promote small businesses across provinces, and so provides a few programs that do just this. The most important of these is the Canada Small Business Financing Program, which helps qualifying businesses obtain loans and lines of credit from traditional lenders. Up to $150,000 is available (as a term loan or line of credit) for working capital and intangible expenses, and up to $500,000 (as a term loan) is available for leasehold improvements and equipment purchase. There is a maximum borrowing amount of $1,000,000 for any single business. Entities must be registered in Canada and have gross annual revenues of less than $10 million.

There is also the Business Development Bank of Canada (BDC) which provides a variety of small business loans to entrepreneurs and small businesses across Canada. With competitive rates and extra support services for Canadian business owners, the BDC is a very helpful resource for both fledgling and established businesses.

How Can Professional Services Get Business Financing?

Choosing which type of financing is most suitable for your business is the hard part; actually applying for business financing is surprisingly easy, thanks to the online application systems and streamlined, secure applicant portals provided by most lenders.

The type of financing and the lender you choose will dictate exactly what the application system looks like, and what will be required from you, but in general you can expect to need:

Business information, including name, contact information, operating address, etc.

Any business incorporation, registration, ownership and licensing documents (especially for licensed professional services)

Business owner information

Business bank statements for at least the past 3 months

Beyond these basics, many lenders will also want to see:

Business financial statements for the past 2 years, including cash flow statements, balance sheets, and tax returns

Up-to-date asset and liability statements, and existing contracts

Detailed business plan including intended use of the funds and financial projections

It’s imperative you check a lender’s documentation requirements before you begin an application with them, as failing to include requested documents will severely delay your application’s processing, and is likely to lead to loan refusal.

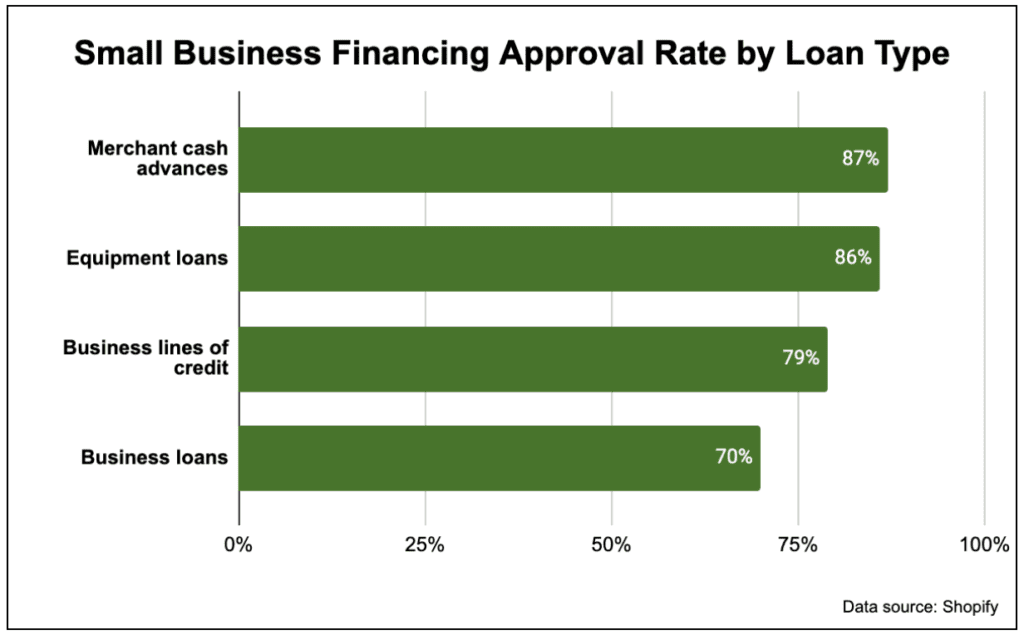

If your business is new or lacks some of the financial documents listed above, then don’t lose hope; not all types of financing rely on past business performance, credit score or assets, and by choosing a more accessible type of financing (such as a merchant cash advance) you will significantly increase your business’s chances of success.

Once you have all of the relevant paperwork needed for your chosen financing’s application, you can go ahead and complete the application process. Some lenders need just a day or two to process applications, while others need several weeks, so how long it takes to hear back will vary. If you receive financing approval, you must formally accept the terms of the financing being offered to you before funds can be dispersed. Once this is done, it is customary for funds to be transferred quickly, directly into your business’s bank account.

To find out more about flexible, affordable and accessible business financing, talk to BizFund. We specialize in helping Canadian business owners just like you.