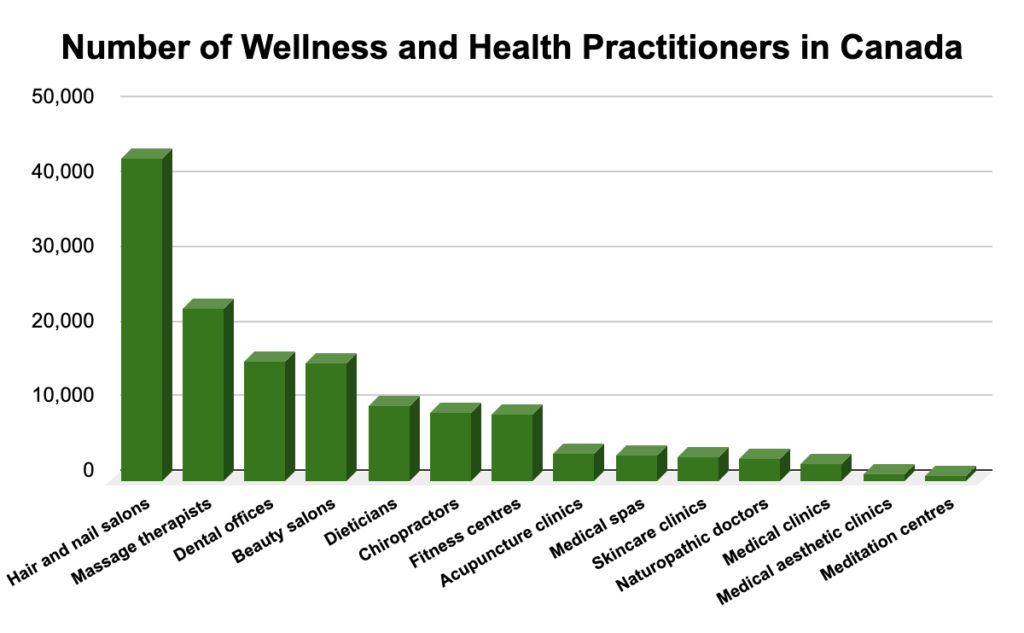

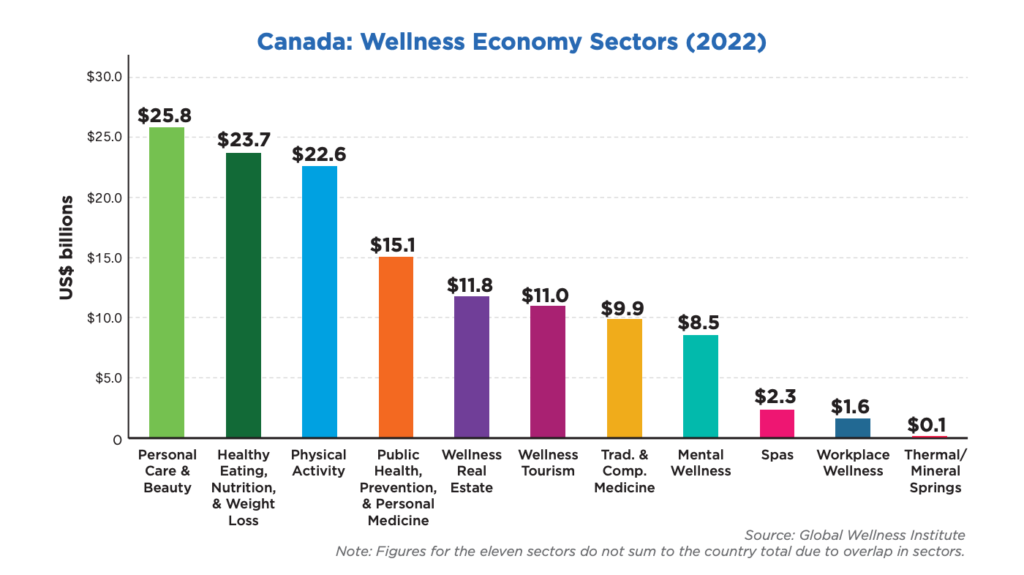

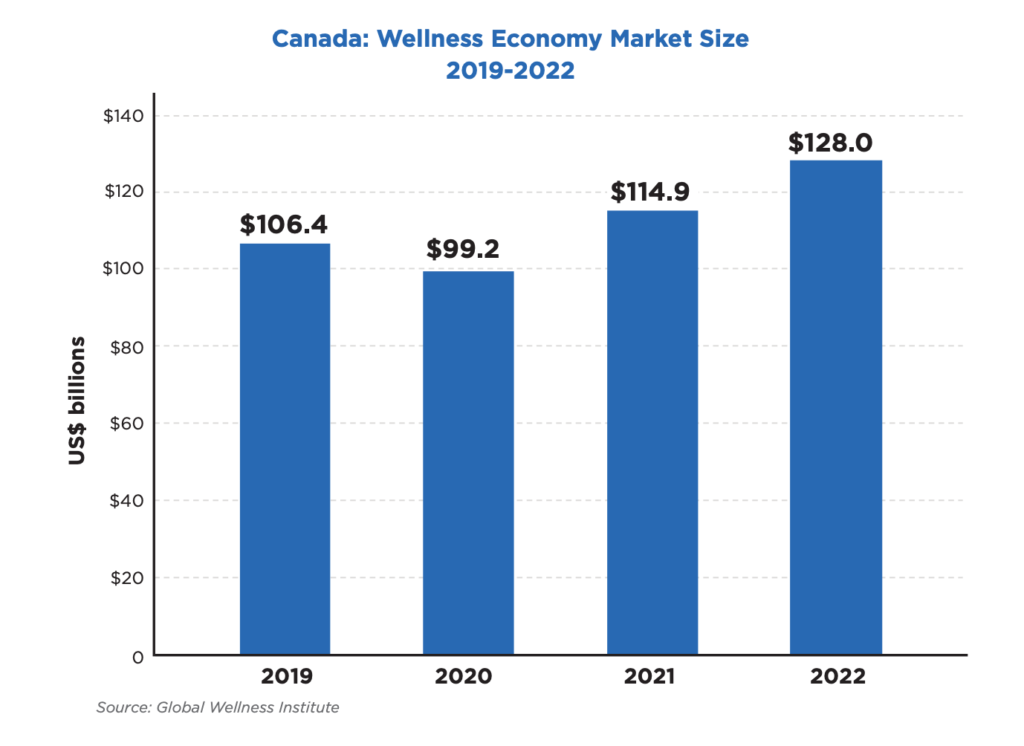

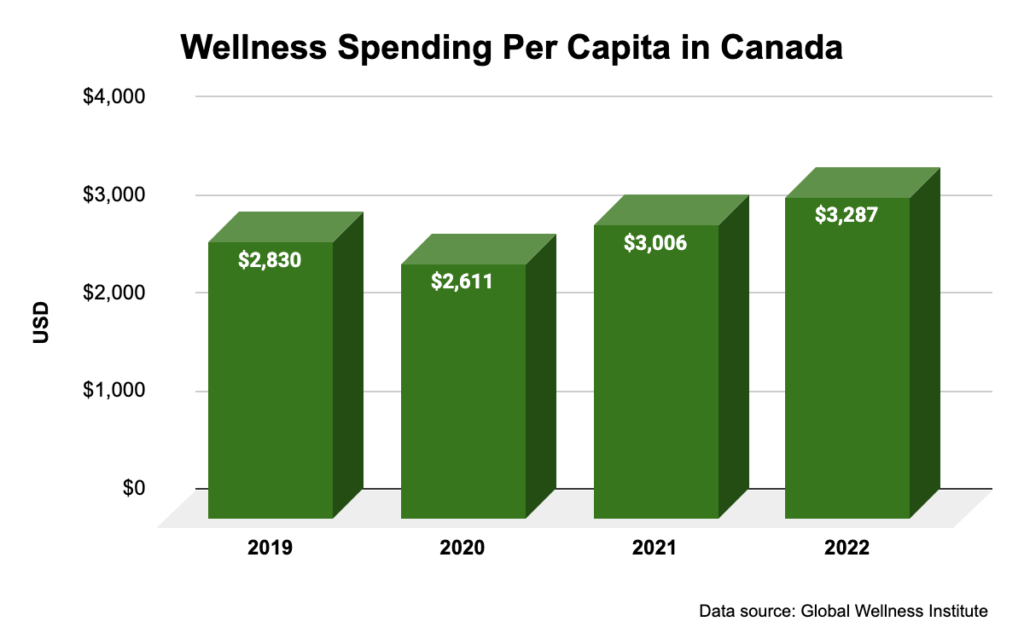

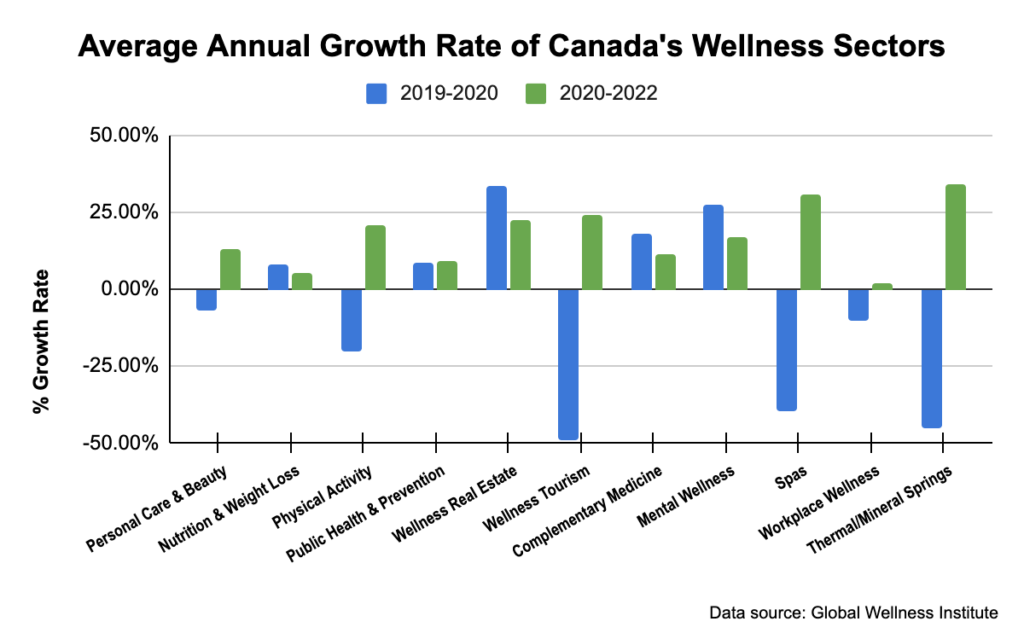

Canada’s wellness economy is the eighth largest in the world, so it’s not surprising that it’s home to tens of thousands of health, wellness, and dental practices. But just because these practices exist in a thriving – and growing – sector, doesn’t mean they don’t face many of the same challenges as companies in other areas. Those in the health and wellness industry still have to contend with broad economic challenges, soaring real estate costs, and an intensely competitive marketplace – which is why finding appropriate business financing options can be such an important factor in survival and long-term success. So if you’re in the health and wellness industry, here’s everything you need to know about the various financing options available to you in Canada.

Uses and Benefits of Business Financing in the Health and Wellness Industry

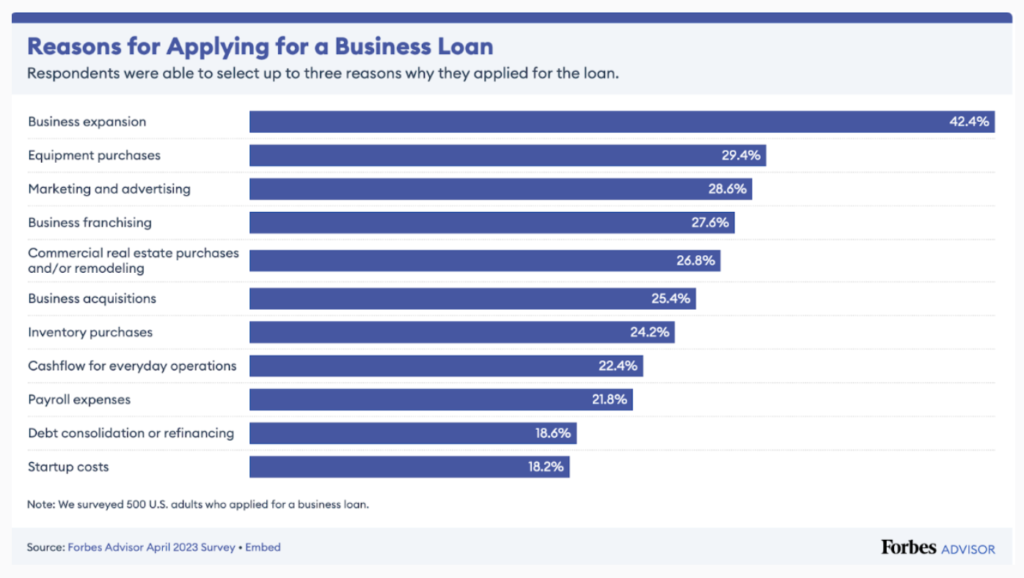

Let’s start by considering why your healthcare business might need to secure funding. Financing is available for a wide range of uses, including:

- Covering start-up costs

- Acquiring an existing business

- Equipment purchase or equipment repair

- Regulatory compliance

- Real estate purchase

- Rent or property taxes

- Real estate improvements

- Purchasing supplies and inventory

- Staffing costs, such as training and pay

- Refinancing or consolidating debt

- Advertising and marketing

- Operational costs and cash flow

- Implementation of new technology

- Small-business administration costs and fees

But business financing isn’t just about covering specific costs; it can also play a crucial role in your business’s long-term health, by providing:

- Financial stability – for any healthcare business to survive, it must be able to withstand economic uncertainty and unexpected challenges; appropriate financing helps ensure business operations continue during tough times

- More efficient inventory management – being able to optimize inventory turnover rates, for example, via a merchant cash advance, will improve operational efficiency and save money, but you need the finance on hand to do so

- Competitive edge – staying ahead of trends in the health services sector is an essential part of providing competitive services, but doing so requires funding that does not detract from your working capital

- Equity control – by obtaining financing rather than seeking investment, you, as the business owner, retain full ownership of your practice, and preserve your right to make business decisions as you see fit

- Improved credit rating – credit ratings for businesses depend on multiple factors, one of which is the proven ability to repay loans and lines of credit; by taking out a business loan and repaying it properly, you are demonstrating financial trustworthiness and are more likely to be able to access favourable products and rates for your business in the future

Types of Business Loans in the Health and Wellness Industry

With so many possible uses for business loans in the health and wellness industry, there’s a commensurate number of types of financing available:

Business Mortgage for Your Clinic

As with a personal mortgage, a business mortgage is a loan intended to help with the purchase of physical real estate, such as a dental practice or spa. This can mean funding for a new location, or funding the expansion or improvement of an existing location. Crucially, this type of loan is secured against the property in question, meaning that if you default on the loan, the property can be seized. A mortgage is one of the most cost-effective means of borrowing the large sums of money needed for real estate investment, with minimal fees; it does, however, rely on having good credit and a somewhat involved application process.

Medical Equipment Loans

Equipment is one of the biggest expenses in the health and wellness industry; regardless of whether you’re operating a spa, a medical facility, a dental practice, a fitness centre, or something else entirely, your practice centers around reliable, specialized equipment, which is often costly to purchase and maintain. As just one example, research indicates that most health spas spend between $700k and $1 million to get their business started, and necessary equipment ranges from $2,000 to $75,000 per item. Fortunately, there are a few different options when it comes to affording the specialized equipment needed for medical treatments. This includes:

- Equipment loans offered by the equipment manufacturer

- Rent-to-own or lease-to-own programs offered by the equipment manufacturer

- Equipment loans offered by third parties

- Equipment rental agreements

- Equipment leases

- Equipment repair programs

Each option has its own pros and cons, so business owners need to consider the lifespan of the equipment, its cost, its intended integration into their services, and any other factors that may impact their bottom line. But as with a mortgage, this is a targeted type of financing – it can only be used for the equipment in question, and is usually secured against that item. For more information on funding strategies for equipment, read our blog on the topic here.

Business Term Loans

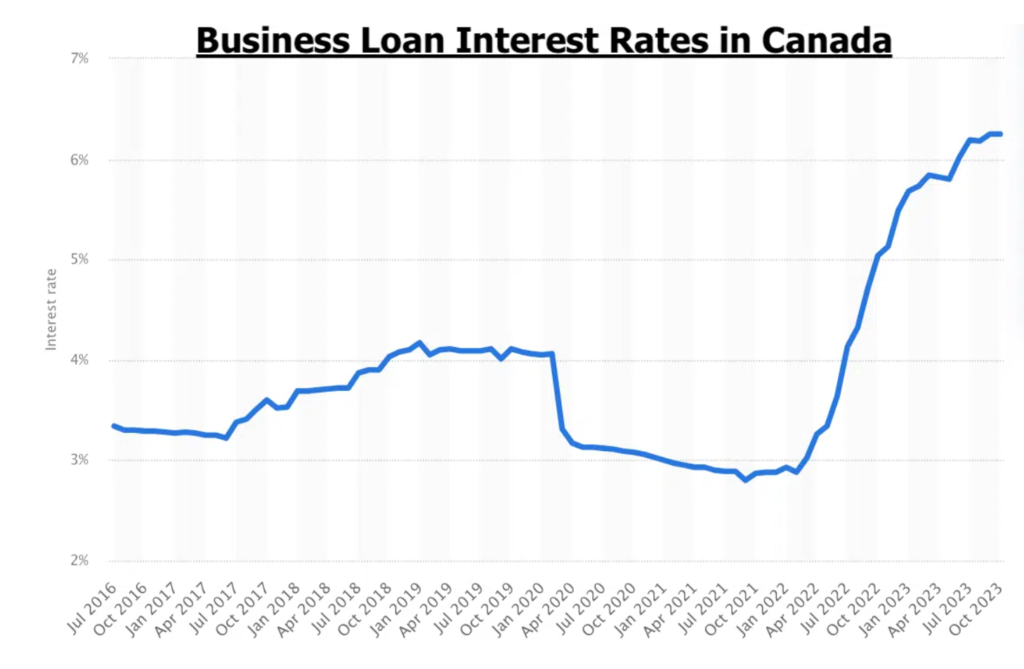

A more flexible funding option is a business term loan; this is a loan of a fixed lump sum that must be repaid at pre-agreed intervals over the life of the loan, and is subject to either a fixed or variable interest rate. They are often called ‘working capital loans’ to denote their all-purpose usage, and can be either secured or unsecured. They are available online as well as from most traditional banks and credit unions. Many do rely on credit approval, which is bad news for those with poor credit scores or a limited financial history.

Health and Wellness Merchant Cash Advance

A more specialized option for health companies like spas and dental practices is a merchant cash advance (or MCA). This is where a business receives a lump sum loan and repays it over time as a percentage of its sales. In this way, it acts much like a cash advance on future earnings. Unlike other types of loans, with an MCA, the repayment amount varies according to sales volume—so if you have a slow period, you pay less, and if you have a profitable period, you pay more—until the entire loan is repaid. Loan administration is streamlined by coordination with point-of-sale operators. MCAs are popular as they offer fast funding and cater to those experiencing fluctuating sales. To find out more about merchant cash advances, click here.

Business Line of Credit

Another flexible way to borrow money is a business line of credit. Here’s how it works: a business applies for a line of credit with a lender; if the application is approved, the lender will set a maximum amount of money the business can borrow. This is known as a credit limit. The business can then borrow as much money as it needs, up to that limit. The funds can be withdrawn at any time, in any amount(s), as long as the limit is not exceeded, and interest is only charged on what is borrowed. Funds can be repaid flexibly, and the credit line is reusable. In this way, a business line of credit is a long-term borrowing facility that enables health companies to access funds as and when they need them.

Business Credit Card

Last among the more mainstream borrowing options for those in the medical industry is a business credit card. A business credit card works just like a regular credit card, but it is designed for use by businesses; the credit limits are generally higher than with personal cards, and the perks associated with the card are designed with business needs in mind. There are a multitude of business credit cards available in Canada, but their primary utility is for small, short-term funding needs. For a larger loan amount or longer borrowing period, the interest associated with a credit card can become very costly.

Federal, Provincial, and Local Funding Programs for Health and Wellness Businesses

The Canadian government and business-assistance organizations across the country offer a range of programs to help companies access the funding they need to start, grow, and succeed. The most notable of these are:

Canada Small Business Financing Program

The Canada Small Business Financing Program (CSBFP) is a federal government initiative that helps companies access small business loans by sharing the risk of the loan with lenders. Under the CSBFP, the government guarantees a portion of the loan, making it easier for small companies to qualify for small business loans from participating financial institutions.

CBDC Loans

CBDC offers a few different funding and assistance programs aimed at helping business owners and entrepreneurs; some of these are location-specific (such as the PEI Program), while others are more general (such as the General Business Loan Program). For a full list of CBDC’s programs, see here.

Women-Focussed Programs

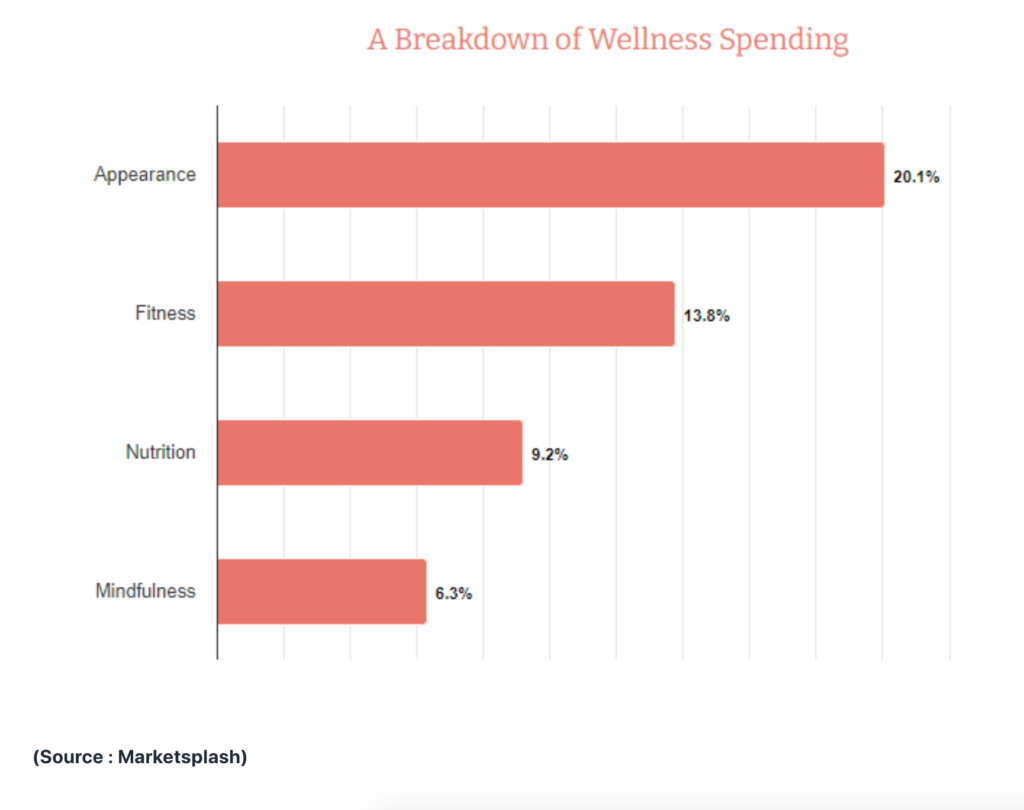

There is a higher proportion of female business owners in the health and wellness sector than in other sectors; over half of all spas and salons are owned by women. So it’s worth mentioning some of the funding programs aimed at female entrepreneurs:

Provincial Funding Programs

Lastly, individual provinces offer funding and assistance programs aimed at healthcare-related businesses and small businesses in their jurisdiction; key amongst these are:

- Accelerating Innovations Into Care in Alberta

- OBIO Capital Access Advisory Program in Ontario

- Innovate BC in British Columbia

- Multiple other programs in Ontario

- Multiple other financing support options in Alberta

Alternative Financing Options for the Health and Wellness Industry

Not every health and wellness business will want or qualify for traditional financing, and in this case, there are alternatives. Alternative loans are generally easier to qualify for and smaller than traditional loans, and are a great option for those with a limited financial history or needing fast approval. Popular alternative financing solutions include:

Angel Investors

Angel investors offer financial support as well as expertise and industry connections tailored to the wellness industry. Their hands-on involvement fosters long-term growth and success, and their endorsement can lend credibility to a fledgling business.

Peer-to-Peer Lending

With peer-to-peer lending, a business borrows from multiple individuals or investors through an online platform. This option can offer competitive rates and flexible terms, but requires a strong credit profile and business plan to qualify.

Crowdfunding

Crowdfunding is another option reliant on multiple individuals investing, but it can work very well for businesses or entrepreneurs with an established brand or track record – for example, a practice or business looking to expand operations into a new area and thus provide its popular services to more people.

Where To Get Business Financing for Your Health and Wellness Business

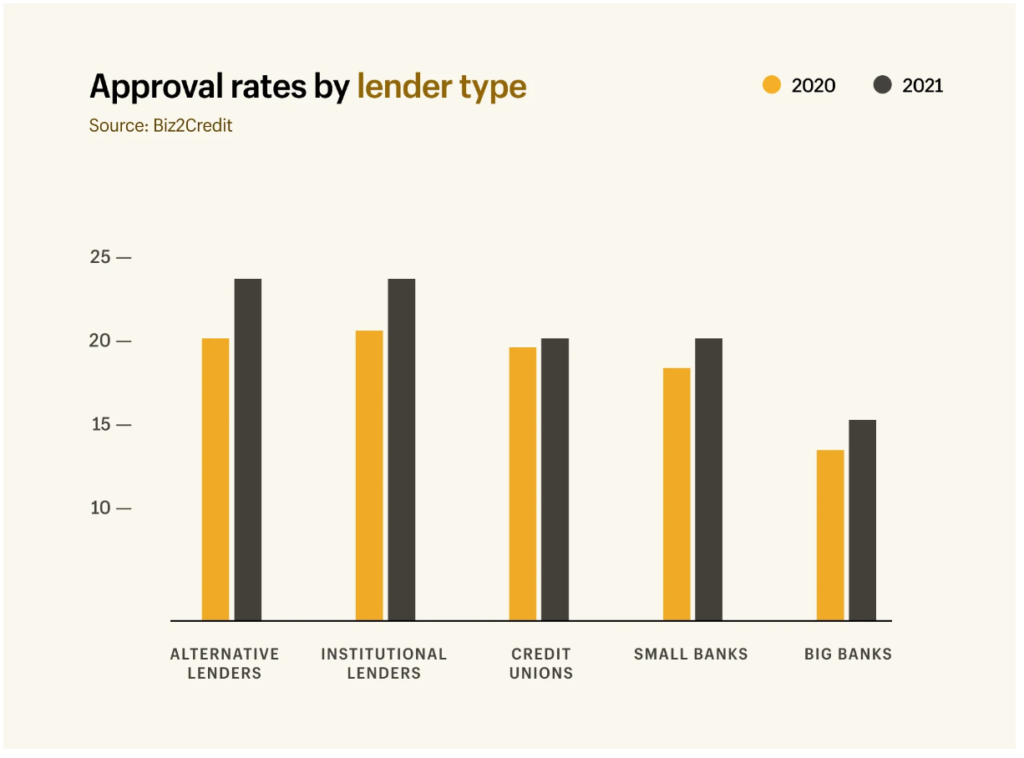

With so many types of funding to choose from, it’s not always clear who the lenders are and how they compare to each other. So let’s take a look at the lender options in Canada; they fall into three very broad categories:

Canadian Banks

These institutions provide a variety of financial products and services, including loans, to businesses. Their rates are usually competitive, but their application processes can be long and their eligibility requirements strict. For example, most banks will want to see at least 12 months of business records and tax returns before considering a loan application, and a credit score will be a big factor in approval. However, if you are well-established and already have a business bank account, it’s probably worth talking to your local branch.

Credit Unions

Credit unions are financial cooperatives, and any company interested in obtaining a business loan from a credit union must first become a member. The application process for a loan from a credit union is quite similar to that in a bank, and it will require a bit of paperwork, but a credit union’s services tend to be more personalized, and their loan eligibility requirements are less strict. Their rates are also competitive.

Online Lenders

Online lenders offer loans and other financial solutions to businesses through online platforms. They often provide faster approvals, making them a convenient option, especially for managing working capital. However, online lenders may charge higher interest rates and fees compared to more traditional lenders. But the sheer volume of options online means that business owners can quickly and easily compare and contrast a wide variety of funding types to find those with low rates and good reviews. This can save time and money. Online tends to be more of the flexible financing solutions, such as MCAs, compared to the more traditional products offered by a bank or credit union.

Securing Business Financing for Your Health and Wellness Business

As mentioned above, different lenders have different eligibility requirements when it comes to business loans, with some being stricter than others. There are a few key metrics that most lenders will take into consideration when deciding on whether to approve a traditionally-structured business loan, and the funding amount you qualify for:

- Credit Score – A business’s credit score plays a significant role in its ability to qualify for a business loan. Creditors use credit history to assess financial reliability and to determine the interest rate and terms of any loan.

- Time in Business – In general, lenders will be more reluctant to lend to start-ups or businesses with less than a year of experience.

- Revenue – Many lenders will have a minimum monthly or yearly sales revenue to be eligible for a loan.

- Collateral – Any asset held by the business can help secure a loan, thus making it less risky for the lender and more likely to be approved. Common types of collateral include real estate, inventory, equipment, or accounts receivable. It can also help a new business if the owner provides a personal guarantee or offers personal assets as collateral.

In terms of application, different lenders have different processes, with some being quick and easy and entirely online, and others requiring quite a bit of paperwork. It’ll help you to secure financing quickly if you try to gather as much of the following as possible:

- All business legal information, such as incorporation/ownership documents, licenses, permits, etc.

- Bank statements

- Financial statements for the past 1-3 years

- Financial projections

- Debt schedules

- Rental and/or lease agreements

- Tax returns

- Detailed business plan

- Documentation detailing the intended use of the loan

- Marketing plans, if applicable

All of the above apply to larger and more traditional loans, which is why many businesses, including those with time constraints or a limited history, opt for smaller, less onerous, and more adaptive funding routes for their short-term needs, such as a merchant cash advance or credit card. These can be obtained with significantly less paperwork and fewer eligibility requirements than listed above. For more information, consider talking to a business financing specialist.

Types of Wellness and Health Businesses Eligible for Financing

The type of wellness and healthcare business eligible for financing is not restricted; all types can apply, including:

- Pharmacies

- Dental practices

- Optometry practices

- Medical clinics

- Gyms and fitness centres

- Med spas

- Massage clinics

- Spas

- Salons

- Private medical clinics

- Health food stores

- Chiropractors

There are similar types of financing available for those in other markets; to find out about funding options in the retail sector, see here; for more information on financing in the restaurant sector, see here.

FAQ

How long does it take to get approved for a business loan in Canada?

Approval times can vary depending on the lender and your application. It might take anywhere from a few business days to several weeks. If you need funding quickly, online lenders are usually faster than traditional banks, though they may charge slightly higher fees.

What types of business funding are available in Canada, and how do I choose the right one?

There are many options depending on your business needs:

- Business mortgages – great for buying or expanding real estate.

- Loans, leases, and term loans – ideal for equipment or improving services.

- Cash advances and lines of credit – helpful for daily working capital.

- Business credit cards – useful for smaller expenses.

Choosing the right funding depends on your situation. Established practices may get lower interest rates from local banks, while businesses needing fast cash might benefit from online lenders who can provide funding in just a few days. Always consider repayment terms, fees, and what best fits your business goals.

What happens if I default on a business loan in Canada?

If you can’t make repayments, the lender may take legal action to recover the money. This could include seizing collateral, like business assets, and it could hurt your credit score. The best approach is to communicate with your lender as soon as possible if you run into trouble.

Can I get a loan to purchase an existing practice

Yes. Buying an existing business can be a smart move because you get:

- An established customer base

- Trained staff

- Existing equipment and infrastructure

These advantages can reduce risks and help you start generating revenue more quickly than if you were starting from scratch.

Can I get business funding for home improvements?

If you run your practice from home, you may be able to get funding for workspace improvements. Just make sure the upgrades clearly support your business, not personal use.

How can I improve my chances of getting approved for a business loan in Canada?

Here are a few tips:

- Offer collateral to secure the loan

- Keep a strong credit score

- Prepare a detailed business plan

- Show steady cash flow and profitability