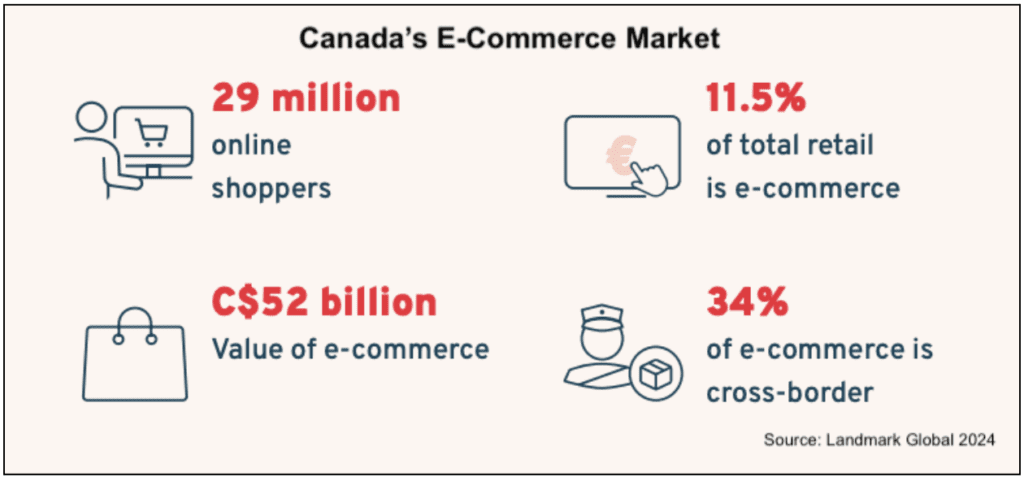

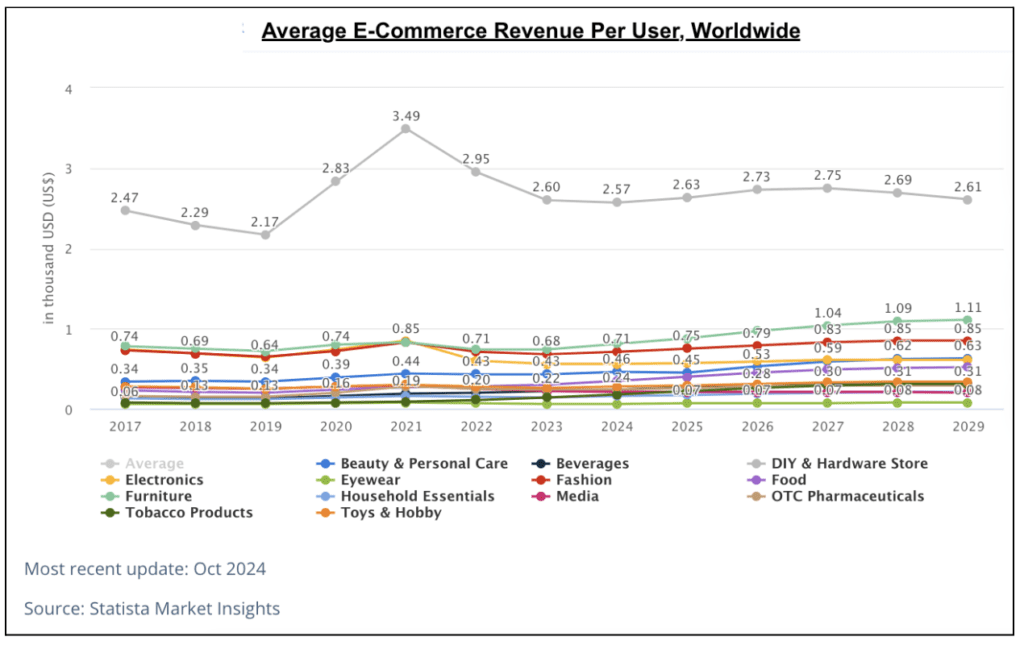

Canada’s e-commerce market has boomed in recent years, with 72.5% of Canadians choosing to shop online, and over 472,000 Canadian online stores. But just because a business sells online does not mean it has no overheads; on the contrary, e-commerce stores face many of the same challenges as brick-and-mortar stores, but need access to reliable business financing tailored to their specific needs. Here’s what you need to know:

Uses for E-Commerce Business Financing

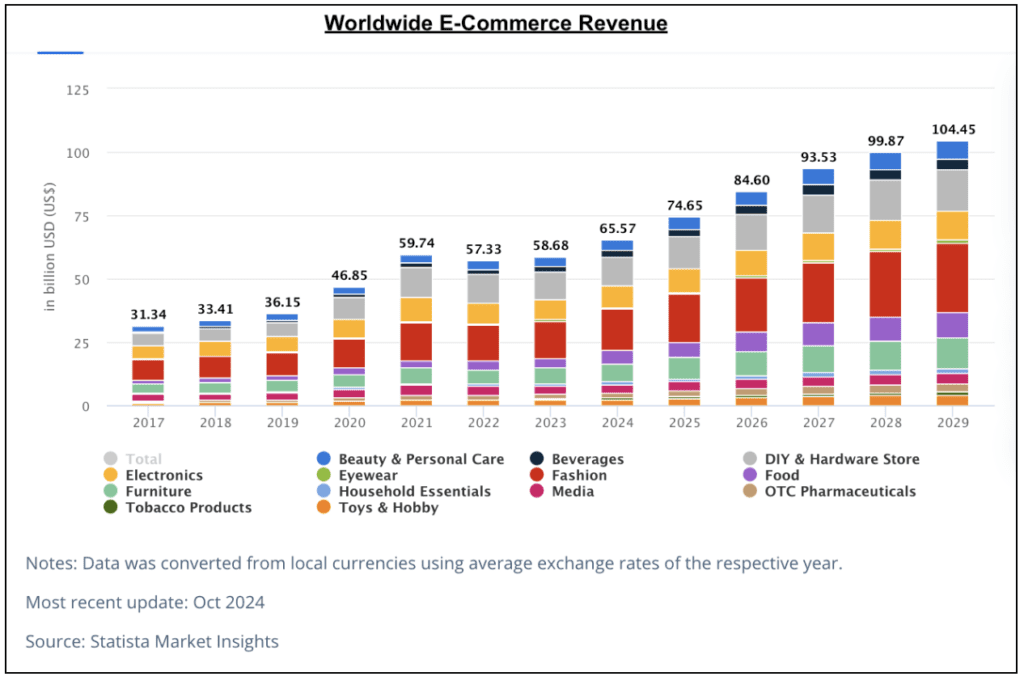

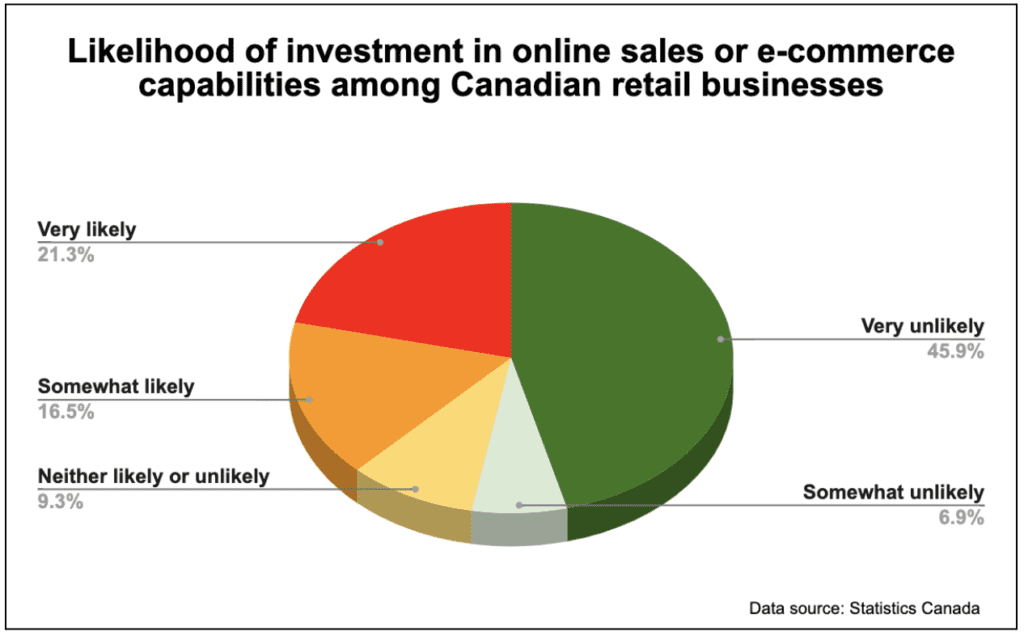

Worldwide, e-commerce is thriving; this may mean shopping online is increasingly popular, but it also means the number of e-commerce businesses competing for sales is higher. This competition requires Canadian e-commerce businesses to capture and retain customers while weathering economic and political uncertainty, without interruption to business operations.

Financing is one of the key ways to do this, but financing isn’t just for emergencies. It can also be used for all manner of e-commerce-related costs, such as:

- Branding

- Purchasing domain name(s)

- Logistics management (e.g., package tracking for customers, fulfillment centre connections, etc.)

- Data analytics

- Data management, including customer profile management

- Back-end and front-end web and mobile development and design

- Inventory management

- Platform security

- Custom software development

- Order/payment processing software

Regardless of whether you sell on an online marketplace, use a template-based storefront, or operate a custom-built platform, your business is likely to face mounting costs, both to maintain operations and to keep pace with developing sales technologies. Affordable and accessible financing is therefore crucial.

The same can be said for those in traditional retail, which is why appropriate business financing for retail stores is also important.

Types of Financing for E-Commerce Stores

There are multiple types of business financing in Canada; here are the major ones for e-commerce stores:

Small Business Loans

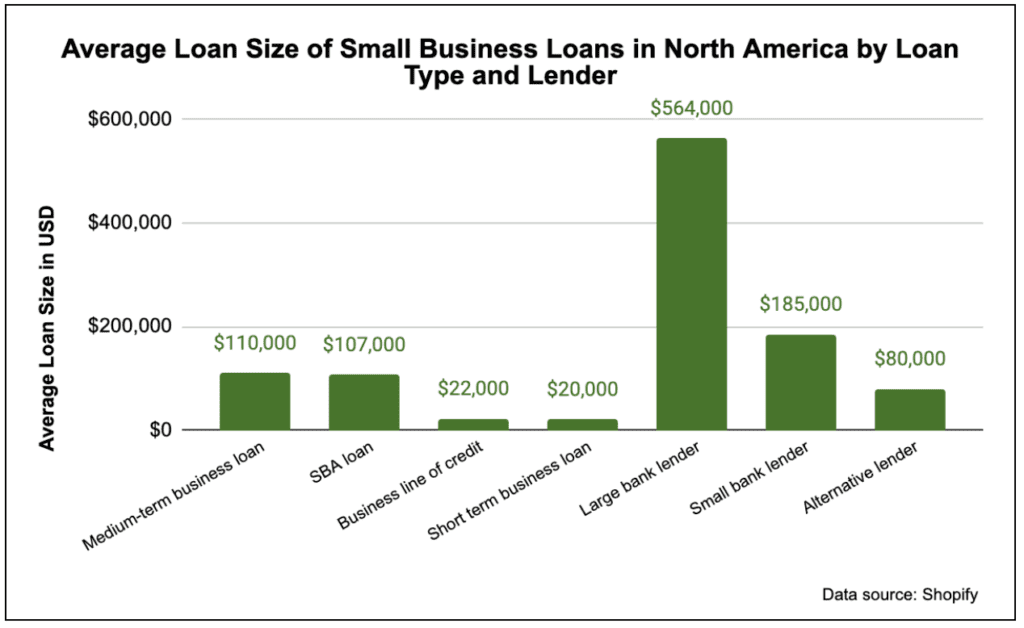

Small business loans are the most common form of financing for businesses across industries. Loans from just $5,000 to many millions are theoretically available, from a variety of lenders, on both a secured or an unsecured basis; in all cases a lump sum is released upon loan origination, which must be repaid over a set period (anything from a few months to five years), at pre-agreed intervals, until the entire borrowed amount (plus all interest and fees) is repaid. Interest can be charged according to a fixed or variable rate.

Small business loans, or installment loans, are very structured and are most often sought from banks and credit unions, though a growing number of online lenders offer them too. They can have strict eligibility criteria (for example, many banks have a minimum business credit score and a minimum income threshold for their installment loans), but they can provide some of the most competitive costs of any type of financing. There are usually no restrictions on how loan funds can be used, but it is common for lenders to require a business plan detailing the funds’ intended use before approving a loan.

If your e-commerce business is seeking affordable, all-purpose funds and has the income certainty necessary to make regular loan repayments over a prolonged period of time, then a small business loan might be a good fit.

Business Lines of Credit

A business line of credit offers a more flexible solution. Instead of receiving a fixed lump sum at the start of the agreement, a line of credit provides a revolving credit facility that can be accessed and utilized as and when is convenient to you, up until the credit limit is reached. This means your business can borrow as much or as little as it needs, whenever is appropriate, and interest is only charged on what’s borrowed. When borrowed funds are repaid, the amount of available credit resets, and so the facility is reusable over time, much like a credit card.

The majority of Canadian businesses have a line of credit, but as with installment loans, the criteria to get one can be strict. A lender needs to be sure that the borrowing business will be able to pay back any amount, up to the credit limit, and so it is common for businesses to be assessed on their credit score, income and other debts before being approved.

Businesses wanting to secure access to funds in case of future emergencies or looking for help managing inconsistent inventory needs may find a line of credit especially useful. And it’s not just for those in e-commerce; those seeking business financing for their auto shop, for example, may benefit from a line of credit for many of the same reasons.

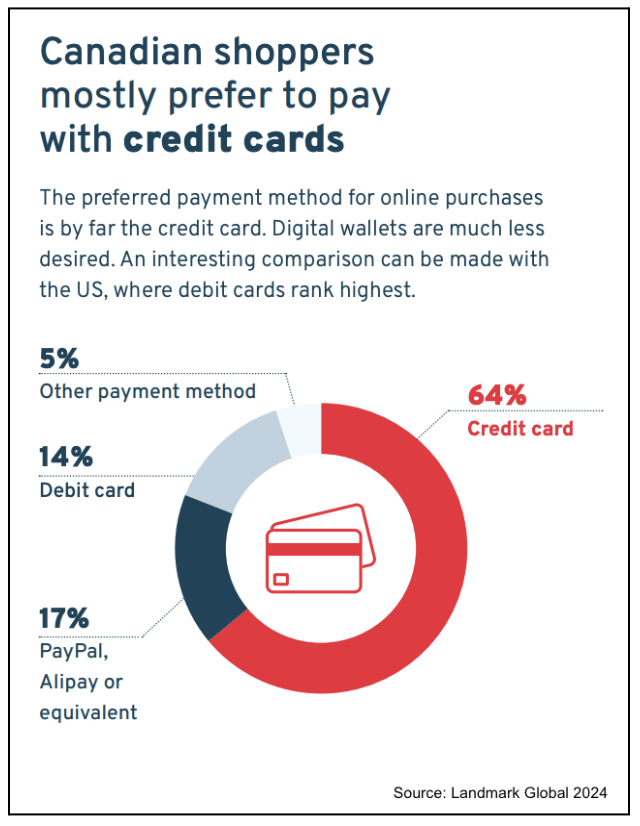

Merchant Cash Advances

A merchant cash advance (MCA) offers both flexibility and accessibility. As with an installment loan, an MCA provides a lump sum at the start of the agreement, which can be used however the borrowing business needs; but unlike an installment loan, repayments are not fixed at a set dollar amount every month, and the amount of interest due does not increase the longer it takes to repay the money – in fact, there is no interest at all. Instead, the cost of the financing is set at the start and known as the ‘factor rate’.

This factor rate designates exactly how much it will cost to borrow money via an MCA (for example, a factor rate of 1.2 means it costs $0.20 for every $1 borrowed), and does not change regardless of how long it takes to repay the loan. Repayments are taken as a small percentage of every credit card sale your business makes, and adapts to your business’s changing circumstances. This allows businesses with fluctuating income to borrow much-needed funds and repay them in a way that matches their business model.

As repayment is conditional on future sales, credit score, and business history are much less important for MCA lenders than they are for lenders of traditional loans and lines of credit. This makes them easier to qualify for and more accessible for small businesses, new businesses, and those with seasonal income. They are particularly appropriate for businesses that accept multiple credit card payments from customers, such as those in e-commerce, or hospitality. Many seeking business financing for bars and restaurants turn to MCAs.

You can find out if an MCA is appropriate for your e-commerce business by contacting BizFund.

Government Funding

There are a number of government programs to help small businesses start and grow in Canada. Among the biggest of these programs are:

1. Canada Small Business Financing Program (CSBFP)

This is a federal government program aimed at making it easier for small businesses with annual revenues of $10 million or less, in any industry, to borrow funds from major banks. This is achieved by the government guaranteeing a portion of the loans extended under the program. Up to $150,000 is available via CSBFP loans and lines of credit for working capital costs and intangible assets; more is available for equipment and real estate costs.

2. Business Development Bank of Canada (BDC)

The BDC has multiple programs aimed at helping Canadian businesses, but most notable for the e-commerce sector is its Technology Financing program. This program provides access to financing specifically for digital infrastructure costs, including website costs, cybersecurity costs, and hardware costs.

3. Export Development Canada (EDC)

The EDC’s Working Capital Guarantee Program is relevant for e-commerce businesses expanding their operations beyond Canada’s borders; the program helps companies maximize their working capital while making the tricky transition to international trade.

Other Funding

The above list is not exhaustive; there are other types of business financing that are less common among e-commerce stores but are still available and may be applicable, depending on your specific business model. These include:

- Commercial mortgages

- Equipment loans

- Business credit cards

- Private loans, including:

- Crowdfunding

- Angel investors

- Peer-to-peer lending

- Shopify Capital Loans

And of course, businesses in other industries may benefit from some of the types of financing mentioned above, although the decision of which financing is best will depend on nuances within each industry. For example, those seeking business financing for a transportation company and those seeking business financing for a healthcare business may have similar options, but will face very different needs and challenges, which dictate how the options stack up against each other.

Tips for Choosing Financing for Your E-Commerce Store

As you can see, there’s a lot of choice for e-commerce business owners looking for business financing, but to protect your business’s finances over the long term, you need to select your financing carefully. Here’s how you can make this important decision:

1. Compare Loan Types and Terms

The first thing you need to do is understand what type of financing will best answer your business’s needs. Consider:

- The amount to be borrowed and the preferred format (lump sum or pre-approved credit)

- The purpose of the funds

- The repayment amount the business can afford and the preferred repayment method

- Whether fixed or flexible repayments are better suited to the budget

- Whether the business has any assets that can be used as collateral for the loan

All of the above will influence which type(s) of financing suit your purposes; once you know this, you can then consider individual products to find the best option for your situation. Specific loan terms you should scrutinize include:

- Interest rate

- Interest rate type – fixed or variable

- Loan fees

- Loan penalties

- Repayment schedule

- Loan term

2. Compare Lenders

The variety of lenders of business financing may seem never-ending, but they all fall into one of just a few categories:

- Banks

- Credit unions

- Online lenders

- Specialty financing providers

- Private lenders

Each type of lender has its pros and cons, and each individual lender has their own terms and conditions. In addition, not every lender offers every type of financing. Therefore, you need to analyze how each available option aligns with your business priorities.

Ask yourself:

- How quickly does your business need funding? Different lenders have different processing speeds for loan applications, so if urgency is a concern, then slower-moving lenders can be ruled out.

- What additional services, if any, do you want to be able to access via your financing provider? What level of customer service may you need?

- How do you want to apply for your financing – online, or in-person? How do you need to be able to manage your loan on an ongoing basis? Different lenders have different platforms, with varying levels of functionality, and this must be taken into account if you want to ensure you can apply for and manage your financing effectively.

- Is the lender credible? Do they have transparent terms and reliable business practices, and an established history of satisfied customers in your sector? Are they regulated by any authority? Long-term financial stability can only be safeguarded if you work with a reputable lender.

3. Compare Accessibility

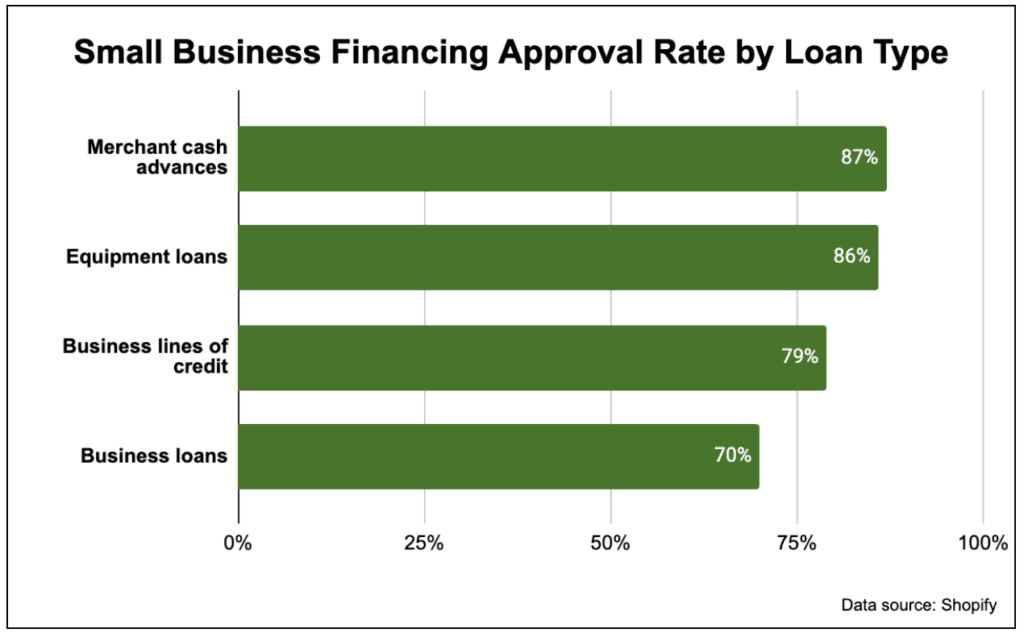

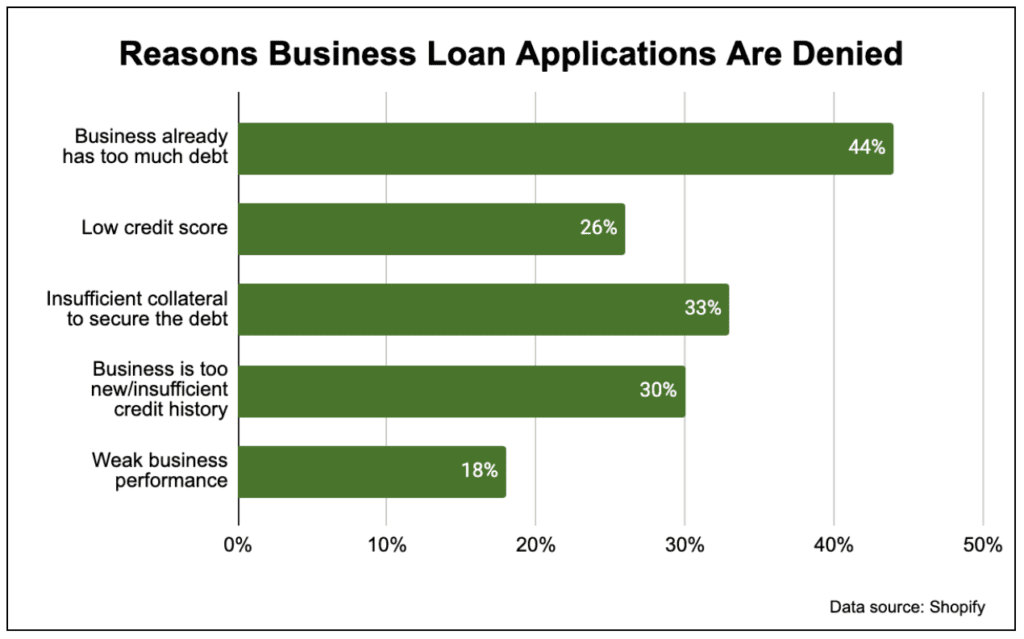

Lastly, there’s a major factor that all loan applicants need to be aware of when choosing financing: borrower eligibility.

Every lender has specific criteria that applicants must meet in order to gain approval for financing from them. These criteria may relate to one or multiple of the following:

- Business credit score

- Monthly revenue

- Operational age of the business

- Collateral

- Existing debt levels

- Business owner’s credit score

Your business’s financial position and the lenders from which it is likely to gain approval need to be an integral part of your financing decision. There is simply no point in applying for financing that your business does not qualify for.

Applying for Financing for Your E-Commerce Store

As different lenders have different application systems and requirements, there is no single list of items that you’ll need when applying for business financing. But at a minimum, you can expect to be asked for:

- Business legal information, such as incorporation/ownership documents

- Business owner information

- Bank statements showing the store’s cash flow and financial health

It is also possible you will be asked for any of the following:

- Current and historical financial statements (income statements, balance sheets, and cash flow statements)

- Personal and business tax returns for the past few years

- Financial projections

- Debt schedules

- Statement of assets

- Detailed business plan

To find out more about flexible, affordable and accessible business financing, talk to BizFund. We specialize in helping Canadian business owners just like you.