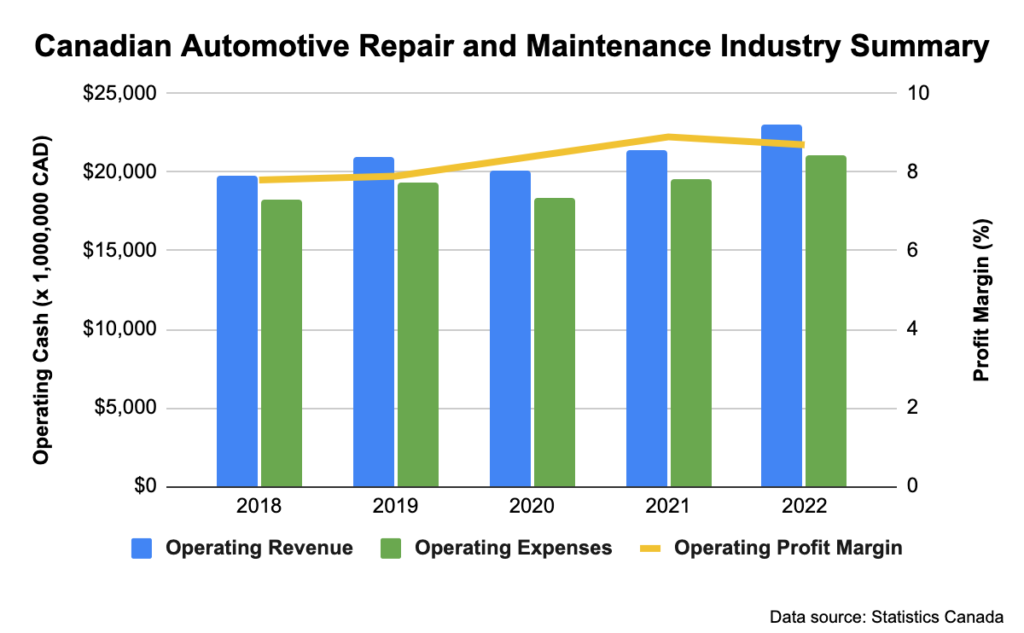

The Canadian automotive industry has experienced some turbulence over the past few years, and those operating maintenance and repair businesses have felt the effects firsthand. With more people opting to repair rather than replace, auto shops are bearing the brunt of consumer demand and struggling to keep up.

While increased demand for services may be good news, meeting that demand isn’t always easy, and those businesses not positioned with the right equipment, inventory, or accessibility risk falling behind. Fortunately, affording the necessities to keep your business thriving isn’t all on you; business financing provides the valuable funds you need to properly support your business. But there are many different types of financing available to auto shops, each with its pros and cons, so choosing the best solution isn’t easy. Here’s what you need to know:

Types of Business Financing Available to the Auto Industry

No matter the size of your auto business or your financial needs, there is a solution to help. Among the most common types of business financing available to those in the Canadian auto industry are:

Traditional Small Business Loan

Most people’s first thought when it comes to borrowing money is of a traditional installment loan. These loans provide a lump sum at the start of the loan agreement and must be paid back in regular installments over the life of the contract. There are usually some loan fees, but the main cost comes from the interest charged by the lender. The level of interest can vary, and usually relies on the financial profile of the borrower.

Installment loans can be valuable in that they provide potentially large sums of cash at what can be relatively low interest and in most cases, the cash can be used for a variety of needs. They’re popular for big one-off expenses, like heavy-duty equipment or real estate costs. However there are some drawbacks to business loans: they are among the hardest type of business financing to qualify for, almost always relying on a strong credit history, a thorough business plan and sometimes collateral too; they take longer to apply for and get than some other types of financing; and repayments are fixed, which may pose issues for businesses with seasonal cash flow.

Business Line of Credit

A line of credit for your business solves some of the issues posed by a business loan. A line of credit is a flexible borrowing tool that works much like a credit card; there will be a pre-set credit limit, determined by the lender and based on each borrower’s financial profile, and any amount up to that limit may be borrowed at any time. This means businesses have the flexibility to borrow as much or as little as they need, as and when they need. Interest is only charged on what’s borrowed, repayments are flexible, and when borrowed funds are paid off, the credit can be reused time and again. There is no set term, so the business retains borrowing capacity for as long as the line is kept open.

Business lines of credit are extremely flexible and popular, as 56% of small businesses in Canada have one. They can be used for any number of one-off or ongoing expenses, such as inventory or working capital, but the flexibility they offer especially suits costs that can’t be easily predicted, for example, renovations. But, as with traditional loans, they’re not the easiest to set up. Many lenders require a strong business credit history before they will approve a line of credit, and the interest you pay on borrowed funds is usually higher than with a business loan.

Equipment Financing

The heavy-duty equipment needed in an auto shop can be very expensive, which is why dedicated financing options exist for it. The benefit of equipment financing is that it is tailored to account for the needs of those investing in machinery and equipment; so, for example, the collateral required is automatically set to be the piece of equipment itself. This means you can qualify for financing more easily, interest rates can be low, and you can start using the equipment to improve your operations and bottom line right away.

Their specificity is also their drawback: equipment loans can only be used for relevant, qualifying pieces of equipment and are irrelevant for any other business expense. And whilst the majority of the cost of a piece of equipment can be financed, a deposit is often required, and this usually needs to be between 10-20%. You also need to make sure that the useful life of the piece of equipment is longer than the term of the loan; you don’t want to continue paying for something that’s become obsolete or has worn out.

Commercial Mortgage

Another type of specific business loan is a commercial mortgage. Physical premises can be expensive – both to buy and to renovate to the necessary safety and operational standards. Commercial mortgages are a type of installment loan, with large borrowing amounts and long terms, that help businesses afford the high costs of acquiring or improving a site. The drawbacks are the same as with traditional loans of other kinds – they’re hard to qualify for, and take some time to arrange.

Merchant Cash Advance

A much more accessible form of financing is a merchant cash advance (MCA). An MCA is technically not a loan at all – rather, it is a cash advance on expected future sales. The borrower receives a lump sum at the start of the agreement, but there are no fixed repayments, and no fixed term. Instead, the borrowed funds are repaid as a percentage of daily sales, and this percentage is agreed upon when the MCA is set up. Each time a credit card sale is processed, this fixed percentage is deducted and rerouted to the lender to help pay off the debt. These deductions are coordinated between the point-of-sale processor and the lender, meaning the borrower does not have to do any calculations, send any repayments, or worry about administration.

There’s also no interest rate with an MCA, and no loan fees. The cost is set in advance by something called the factor rate. This factor rate does not change depending on how long it takes to repay the debt, so unlike almost every other type of financing, it is not more expensive if you take longer to repay. And because repayments happen as a percentage of sales, they fluctuate in accordance with sales volume.

MCAs are perfect for businesses needing access to funds but without the income certainty necessary to meet fixed loan repayments. They are specifically set up to cater to the needs of businesses in consumer-facing, sales-oriented businesses; they do not require collateral, a long credit history, a certain credit score, or a business plan. They do, however, require you to process at least some of your sales via credit card, and the overall cost of borrowing may be higher than with a traditional business loan.

For more information on MCAs and how they work, see here.

Private Financing

Lastly, there are private financing options for businesses with unusual needs or who fail to meet the requirements of mainstream lenders. These options include:

- Angel investors

- Crowdfunding

- Peer-to-peer lending

All of these require you to do some research and potentially set up your business on a relevant portal or matching site that will connect you with potential investors. Finding private investment isn’t easy, but it can provide a route to funds for those with no other options or those seeking something outside the box.

Uses for Business Financing in the Auto Industry

The most common uses for business financing in the auto industry are:

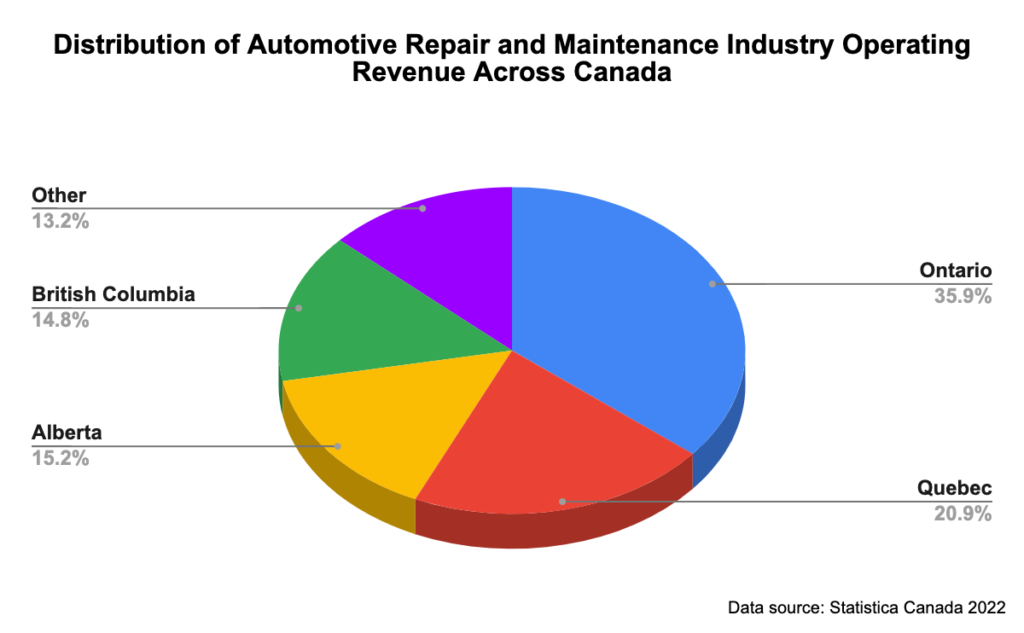

Expansion

It makes sense to capitalize on growing demand in the industry by expanding your operations; this may mean purchasing or renting new locations, expanding existing locations, or simply expanding operations within an existing garage – for example, by hiring more mechanics, or investing in a marketing campaign. All types of business expansion require an initial investment of capital before a corresponding increase in revenue can occur.

Renovation

Renovation may be part of an expansion effort, but it doesn’t have to be; many businesses renovate existing spaces simply because it’s time to do so, or because they are lacking the infrastructure needed to operate at maximum efficiency. Here’s a great example: many auto shops have felt the need to renovate their customer waiting areas over the past few years, as they have been increasingly in use and thus become an essential part of the overall customer experience.

Equipment Purchase or Upgrade

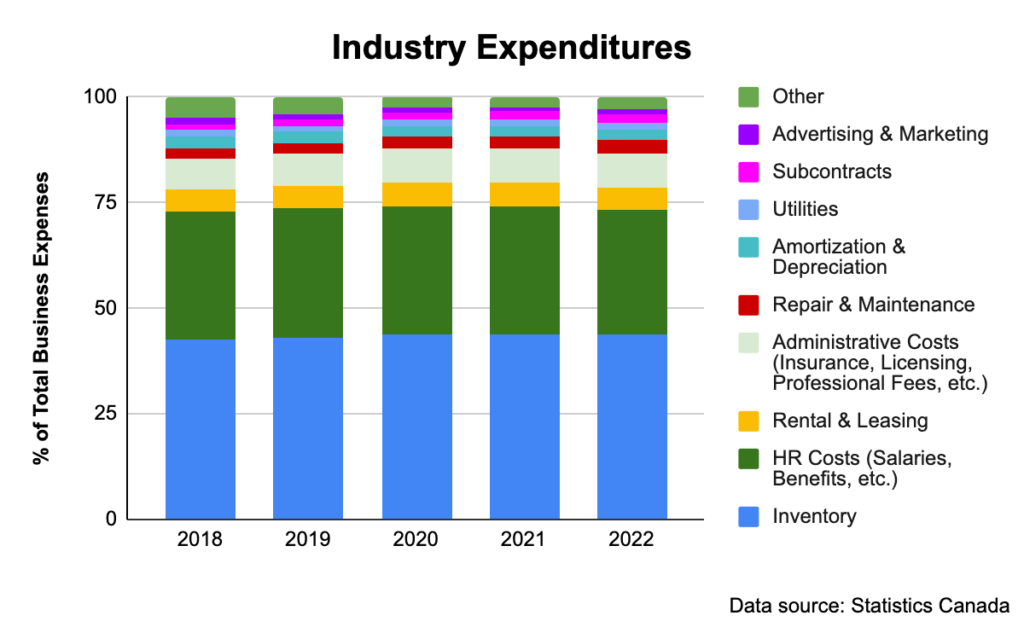

The right equipment is essential to a smooth-running auto shop, but many of the required items run into the thousands of dollars. And many of these items aren’t optional – for example, safety equipment for your workers is a must, both to protect them and business operations. Even smaller day-to-day tools quickly add up, as they are more easily misplaced and damaged. Equipment costs can therefore be considered ongoing and significant, and financing to help spread the financial burden over time is often imperative.

Insurance and Licenses

Business licenses, specific machinery operating licenses, liability insurance, property insurance, and workers’ compensation insurance – all of these are necessary to run a legitimate auto business.

Innovation and Technology

Technology is a growing part of the auto repair industry, as more and more cars route operations through computer systems. Diagnostics and repairs now frequently need corresponding technology, and your staff need to be trained appropriately. And investment in this capacity is not necessarily a one-off, as new systems are developed and released to the consumer auto market all the time, and a competitive auto shop must be able to keep up.

In addition, many consumers now expect to be able to interface with companies online, so customer-facing technology, such as an online booking system, may require an outlay too.

Inventory Management

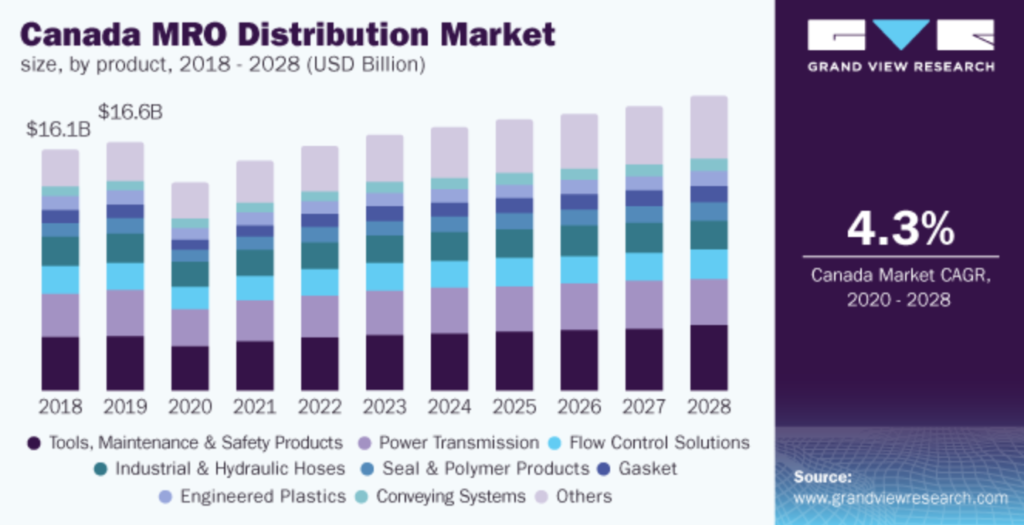

A busy garage must be suitably stocked with all manner of parts, lubricants, oils, batteries, tires, and a myriad of other basic supplies necessary to operate. Affording the appropriate inventory so that no delays occur in operations means finding the cash to do so upfront, and as many businesses lack the cash flow to do this, business financing tools offer a welcome bridge between expenditure and revenue.

Working Capital

Not all financing needs are one-off or even specific. Sometimes businesses need working capital to assist with day-to-day costs, such as rising personnel costs (salaries and benefits account for 30% of auto business expenses), unexpected costs like supply chain issues, seasonal fluctuations in customer demand, and more. Fortunately, multiple of the business financing solutions available to auto shops allow for flexibility of use to cater to just this dilemma.

Sources of Business Financing for the Auto Industry

Now that you know what types of financing are available to Canadian auto businesses, and how they can be used, the next question is: where should you go to get your loan or cash advance? There are a few major options:

Banks and Credit Unions

Most business owners will automatically turn to their bank or credit union when seeking a loan, and given the fact that there is usually a pre-existing relationship there, that can make sense. Banks and credit unions can provide large, competitive business loans, but that doesn’t necessarily make them the best choice for every auto business. They rely heavily on a business’s financial credentials; only those with good credit, an established business history (of at least two years), a detailed business plan, and collateral can qualify for a loan from a bank or credit union.

The application and approvals process for bank and credit union funding is not trivial either; applicants need to provide extensive paperwork and may have to wait several weeks for a decision on their submission. This is worth it if your business does not need funding quickly and meets the strict eligibility criteria, as borrowing costs are typically quite low. However, it can be problematic if you require flexible or fast funding, or if your business profile does not meet approval requirements.

Online Lenders

A more accessible option for various types of business loans is online lenders. Many online-only financial services companies offer business loans with more flexible qualification criteria than banks and credit unions, and easier application processes. They’re often faster, and an online lender may be able to process a loan application in just a day or two. But you’ll pay for this convenience and accessibility with slightly higher interest rates, especially if your business lacks an established history or has poor credit.

Equipment Manufacturers/Retailers

As mentioned above, equipment financing is a popular option for heavy-duty equipment in a working garage, and this is often provided by the equipment manufacturer or retailer directly. The benefit of obtaining your equipment financing here is that it’s all done for you, as part of the sales process when you purchase the equipment. Don’t let this convenience stop you from shopping around, as depending on your business’s circumstances, better terms may be available elsewhere.

Specialty Lenders

Lastly, there are numerous specialty lenders providing business financing across Canada. For example, merchant cash advances are available from both dedicated MCA lenders like BizFund, and more general-purpose financial services companies offering a range of financing types. A dedicated MCA lender, who works only with MCAs, can be thought of as a type of specialty lender. Similarly, mortgages can be available from both general-purpose lenders, like banks, and specialty lenders, like mortgage-only providers.

The benefit of working with a specialty lender is that they have the most in-depth expertise and probably better terms for that type of financing than anyone else in the market. The drawback is that not every specialty lender will work with every borrower, so you need to find one who will work with you.

Other Sources of Support for Your Auto Business

As well as the various financing options listed above, Canadian businesses have access to government-run programs that may suit their financial needs. The most significant of these is the Canada Small Business Financing Program (CSBFP), which is offered country-wide by the federal government with the express purpose of making it easier for small businesses to get loans. It does this by sharing the risk of small business loans with private lenders, like your bank. Because of the CSBFP, qualifying small businesses are more likely to be approved for a business loan or be able to access larger, longer, and cheaper loans.

These loans can be for up to $1 million; up to $500,000 can be used for leasehold improvements and equipment purchase, and up to $150,000 for working capital. There is also a possible maximum of $150,000 for a line of credit. Getting a CSBFP loan requires you to work with a qualified lender, and only for-profit businesses with gross annual revenues of less than $10 million can apply.

As well as the CSBFP, there are a multitude of country-wide and provincial programs aimed at small businesses and auto-related businesses specifically. These include:

- Training programs like:

- The Innovation in Automotive Training Fund from AIA Canada

- The Saskatchewan Job Grant

- The Alberta Job Grant

- The B.C. Employer Training Grant

- Wage subsidy, training, and mentorship programs like DEI Fund from APMA

- The Canada Digital Adoption Program from the Government of Canada

- The OVIN Regional Future Workforce Program in Ontario

- The Rural Economic Diversification and Infrastructure Program in B.C.

- Small business loans from BDC

To find other business benefits relevant to you, check the government’s search engine here.

Choosing the Right Business Financing for Your Auto Business

Selecting the right tool for your business financing is essential to ensuring the smooth running of your business. Here’s a quick rundown of what you need to look out for when assessing any given option’s suitability:

Borrowing Amount

Each type of financing, as well as each lender, has their own borrowing caps; you need to find both a loan and a lender who can provide you with the funds you need.

Loan Cost

Fees and interest must both be considered when considering the cost of borrowing. Don’t overlook compounding interest over the loan term (for everything but MCAs). Longer loans with lower interest may end up costing more than shorter loans with higher interest. It’s important to find a solution that you can afford.

Eligibility Criteria

You need to be realistic about what types of financing and which lenders you are likely to qualify for. Understand your business’s financial position before shopping around, and check out eligibility criteria before applying with any lender.

Application Process

Both how you apply for funding and what’s needed to apply may influence your decision about which lender and type of financing you go for. Check the documentation required during the application process to see if you have what’s needed.

Speed

A lengthy, drawn-out application and approvals process may not matter if you’re not in a rush, but if you need funds quickly, then certain types of funding and certain lenders are better. Consider how soon you need funds when considering your options.

Reputability

Lastly, it’ll best serve your business’s interests if you choose to work with a lender that’s got a solid reputation, is experienced in the product you’re looking at, and that can offer transparency of terms and excellent customer service.

How To Apply for a Business Loan

Applying for a business loan is not as hard as you might think, though the exact procedure and requirements can vary from lender to lender. Generally, you need to gather some basic information and then complete an application form.

The basic information you may need includes:

- Business owner information, including ID and proof of address

- Business legal information (e.g., business license, permits, incorporation documents, etc.)

- Business bank statements

- Business financial statements (e.g., balance sheet, cash flow statements, etc.)

- Business/personal tax records (if requested)

- Business plan (if requested)

- Breakdown of existing financial contracts (e.g., leases, etc.) (if requested)

A lack of some of these items is a major reason many auto businesses turn to flexible financial solutions, like MCAs, over traditional installment loans.

FAQ

How much can I borrow with business financing?

That depends on the type of financing you use, the lender you apply with, and your business. Small amounts of just a few thousand dollars are available with some forms of financing, while others open the possibility of borrowing hundreds of thousands. That’s why it’s so important to know exactly what you need before you start shopping around for financing.

How long does it take to get a business loan?

Again, that depends on the type of financing and the lender. Some banks may take several weeks to process a loan application; others can process applications in just a business day. Determine how urgent your financial situation is before you choose a lender and financing type.

Can I use my business loan to hire more mechanics?

Yes. Most types of business financing do not put restrictions on how the funds can be used, and personnel costs, including wages, benefits, and training, are all valid business expenses that can be covered by business loans, lines of credit, cash advances, and online loans.

Can I use a loan to purchase used equipment?

Yes. Not only can most general-purpose loans be used to acquire used equipment, but there are also many equipment loans for used equipment. This is especially helpful in an industry where new equipment costs are high, and there is a large used market.

Is leasing or financing garage equipment better?

That depends on your situation and the equipment in question – for example, expected lifespan, warranty, maintenance costs, and so on.

Do I need to have collateral to get a business loan?

Only if you’re applying for a secured loan. Commercial mortgages, vehicle loans, equipment loans, and other types of large loans usually require collateral, but note that the property/vehicle/equipment being financed often acts as the collateral itself.

What happens to my business loan if sales drop off?

Most types of business financing have fixed repayment schedules, meaning that even if your sales fall, you have to meet your repayments in full and on time to avoid defaulting on your debt. However, some types of financing, for example, merchant cash advances, have flexible repayment methodologies that allow for fluctuating sales volumes. This makes budgeting through unpredictable periods much easier and less stressful.