Last month, a client asked me which was better: a business line of credit or a loan. I said “yes.”

He didn’t find that helpful. But here’s the thing. Asking about business line of credit vs loan Canada without context is like asking whether a hammer or screwdriver is better. Depends what you’re trying to fix.

Most business owners don’t actually know how these two work differently. They just know they need money. So let’s clear this up with real examples, not banker speak.

The Basic Difference Nobody Explains Properly

A business loan is like buying a car. You get $50,000 today. You pay it back over three years. Same payment every month until it’s gone. Simple.

A line of credit is like a credit card for your business. Approved for $50,000? Great. Use nothing, pay nothing. Use $10,000 this month for inventory? Pay interest on just the $10,000. Pay it back and that $10,000 becomes available again.

One gives you money. The other gives you access to money. Massive difference.

Breaking Down the Real Costs

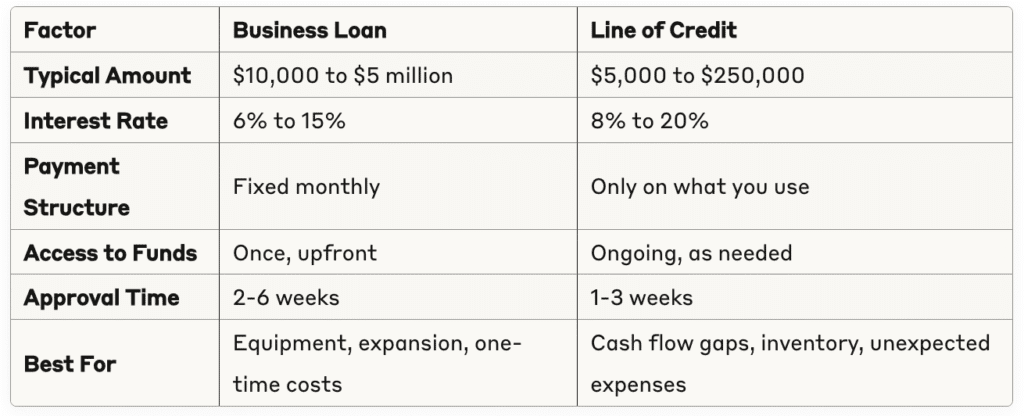

Here’s what the numbers actually look like:

But those numbers don’t tell the whole story.

When a Loan Actually Makes Sense

You’re buying a $75,000 delivery truck. You know the exact cost. You know how the truck will generate revenue. You want predictable payments you can budget around.

Business loan. Every time.

Why? Because you need all the money now. That truck dealer isn’t letting you pay in installments. Plus, loans typically have lower interest rates than lines of credit. You’re paying 7% instead of 12% because the bank knows exactly what you’re doing with the money.

Sandra owns a bakery in Ottawa. She needed two new ovens costing $45,000 total. Loan at 8% for four years. Monthly payment of $1,098 she can plan around. The ovens pay for themselves through increased capacity. Clean and simple.

When a Line of Credit Saves Your Business

Your biggest client pays 60 days late. Again. Your payroll is next week. You need $15,000 to cover it, but that client’s check will clear in two weeks.

This is line of credit territory.

You pull $15,000, pay your team, then pay it back two weeks later when the client’s payment hits. Total interest cost? About $75. Try doing that with a loan. You can’t.

Marcus runs a construction company. His line of credit is his safety net. Material costs spike unexpectedly? Covered. Client delays payment? He’s fine. Equipment breaks? Fixed immediately. He might not touch it for months, then suddenly needs $30,000. Then pays it back. Then needs $10,000 again.

A loan would’ve forced him to borrow money he didn’t need and pay interest on cash sitting in his account.

The Scenario Most People Don’t Consider

What if you can’t get either? Or what if both options kind of suck for your situation?

This is reality for tons of businesses. Your credit isn’t perfect. Your business is too new. Your revenue is inconsistent. Banks offer you terrible rates or just say no.

Enter alternative financing. A Merchant Cash Advance works differently than both loans and lines of credit. It’s based on your sales, not your creditworthiness. No fixed monthly payments. No unused funds sitting around. You get money now and pay it back as a percentage of daily sales.

Different tool for different situations. Like when Derek needed $25,000 for holiday inventory but his seasonal revenue made banks nervous. Traditional business line of credit vs loan Canada options didn’t fit his November-heavy sales pattern. An MCA did.

Making the Right Choice

Here’s your decision tree:

Get a loan when: You’re buying something specific. Equipment, real estate, a competitor’s business. You know the exact amount and want the lowest rate possible. Your revenue is steady enough for fixed payments.

Get a line of credit when: Your cash flow is unpredictable. You have seasonal swings or irregular client payments. You want emergency backup funding. You might need money but aren’t sure when or how much.

Consider alternatives when: Banks won’t approve you or their terms don’t match your business cycle. You need funding faster than traditional options provide. Your revenue is strong but your credit is weak.

What Actually Happens Next

Most people reading about business line of credit vs loan Canada options do nothing. They get overwhelmed by choices and stay stuck.

Don’t be most people.

Figure out what problem you’re solving. Buying equipment? Loan. Managing cash flow? Line of credit. Need flexibility traditional lenders won’t provide? Alternative financing.

Then apply. Not to one lender. To several. Banks, credit unions, online lenders. See what you actually qualify for, not what you assume you’ll get. The answers might surprise you.

That client who asked me which was better? He ended up with both. A loan for his expansion and a line of credit for working capital. Because sometimes the answer really is “yes.”